Electronic Components Sales Market Analysis and Forecast (May 2025)

Table Of Contents

Prologue

1 Macroeconomics in May

1.1 The Global Manufacturing Industry Remains Hovering at a Low Level

1.2 The Electronic Information Manufacturing Industry Is in Good Shape

1.3 Strong Growth in Semiconductor Sales

2 Chip Delivery Trend in May

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in May

4 Semiconductor Supply Chain in May

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT 24 4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in May

1.1 The Global Manufacturing Industry Remains Hovering at a Low Level

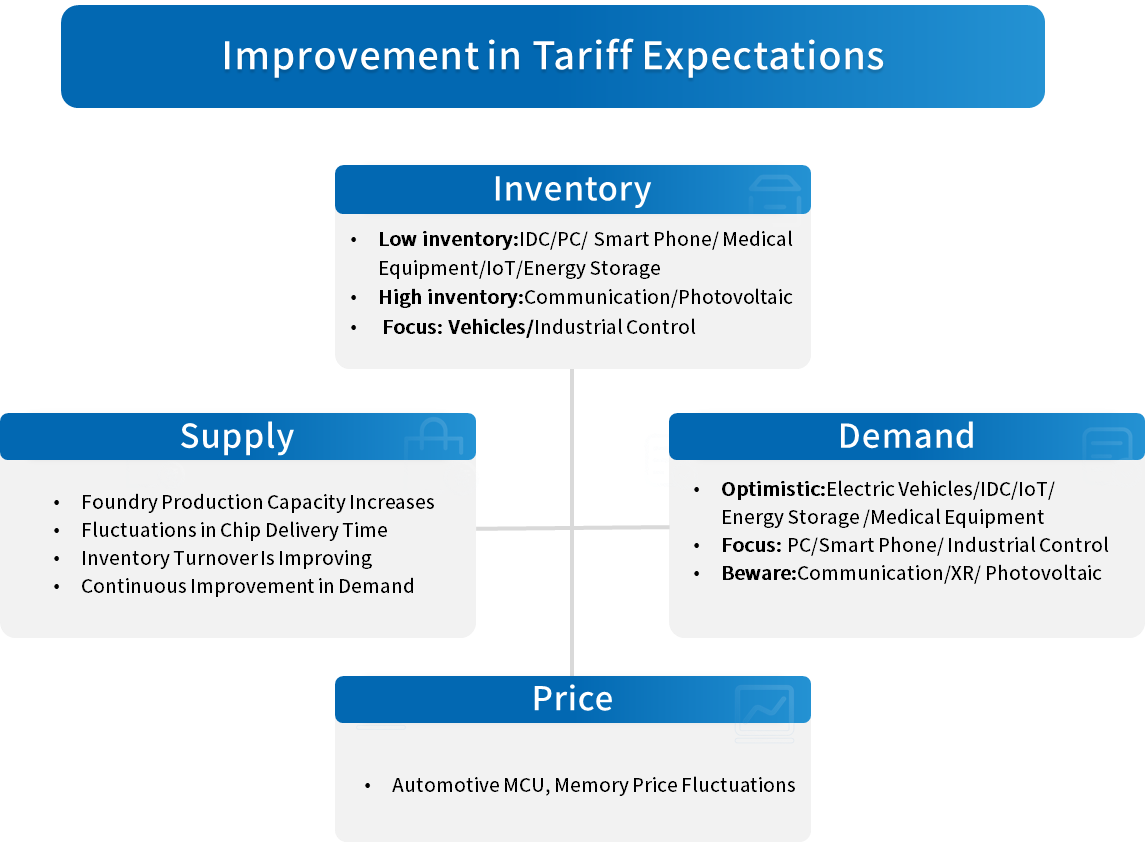

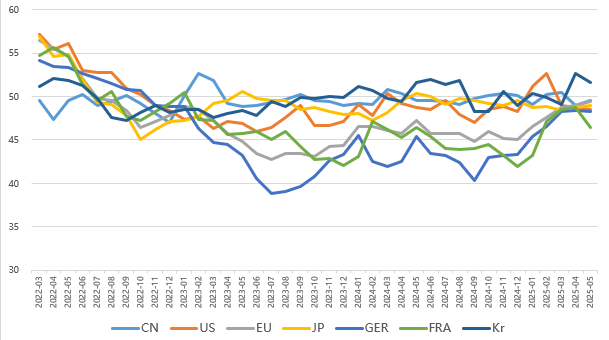

In May, the global manufacturing index rose slightly, while the global economy hovered at a low level. Except for South Korea, China, the United States, Japan, and the European Union represented by Germany and France all remained below the boom-bust balance line. Tariffs still disrupt the global economy, increasing uncertainties in the global economic recovery.

The Organization for Economic Co-operation and Development (OECD) has lowered its forecast for world economic growth this year from 3.1% to 2.9%. The United Nations predicts that this year's economic growth rate will slow from 2.8% in January to 2.4%.

Chart 1: Manufacturing PMI of the world's major economies in May

Source: NBSPRC

1.2 The Electronic Information Manufacturing Industry Is in Good Shape

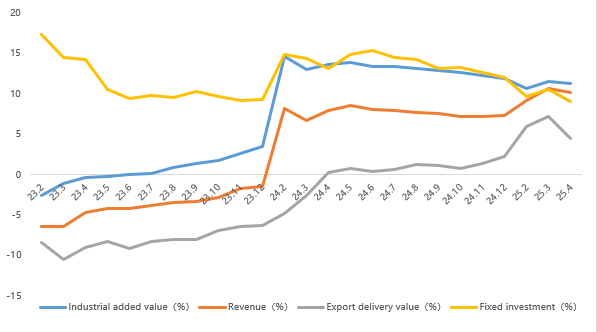

From January to April 2025, China's electronic information manufacturing sector saw steady production growth, slight fluctuations in exports, a gradual recovery in profitability, and stable investment expansion. The industry as a whole maintained a positive development momentum.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

1.3 Strong Growth in Semiconductor Sales

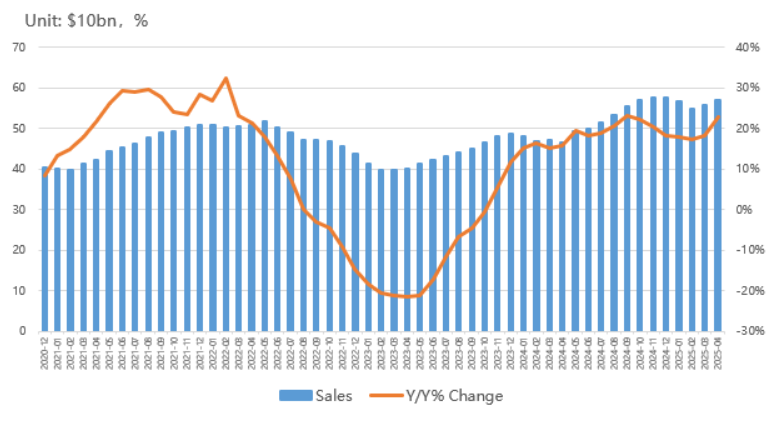

According to the latest data from SIA, global semiconductor market sales reached $56.96 billion in April 2025, a year-on-year increase of 22.7%, with year-on-year growth exceeding 17% for 12 consecutive months. Month-on-month sales grew by 2.5%, the first increase since 2025.

In terms of regional markets, the American market grew strongly, with a year-on-year increase of 44.4%.mainland China and Japan saw year-on-year growth of 14.4% and 4.3% respectively. The Asia-Pacific region grew by 23.1% year-on-year, and European sales also rose slightly by 0.1%.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

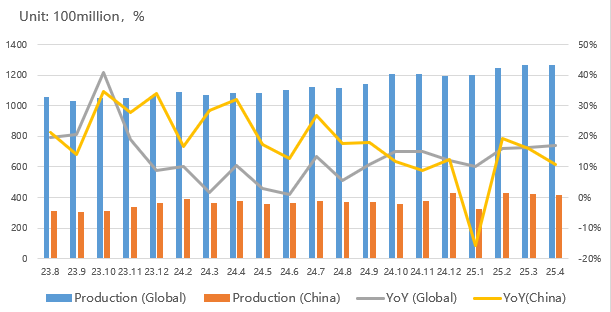

In terms of integrated circuit (IC) production, global IC output reached approximately 126.6 billion units in April, a year-on-year increase of 17.0%. China's output exceeded 41.67 billion units, declining month-on-month but still maintaining growth.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

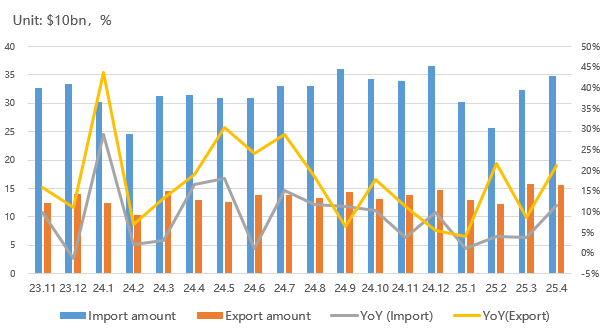

In terms of imports and exports, China's IC imports and exports remained highly robust in April. Notably, export growth soared to 21.3% year-on-year, reflecting a positive trend.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

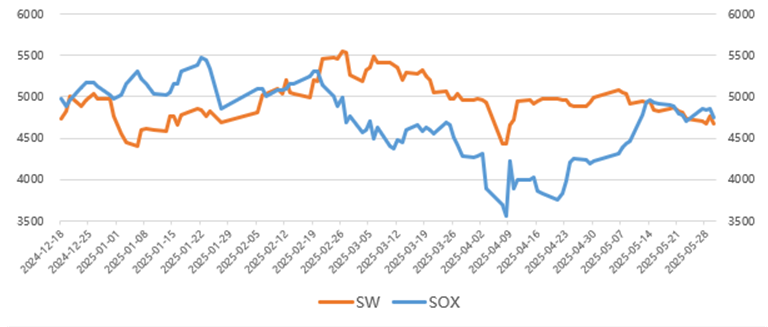

From the perspective of capital market indices, the Philadelphia Semiconductor Index (SOX) rose by 10.4% in May, while China's Semiconductor (SW) industry index fell by 7.9%. Domestic semiconductor capital markets were clearly impacted by tariffs.

Chart 6: Trend of SOX and SW Index in May

Source: Wind,Chip Insights

For more information, please refer to the attached report.