Electronic Components Sales Market Analysis and Forecast (April 2023)

Table Of Contents

Prologue

1 Macroeconomics in April

1.1 The Trend of the Global Manufacturing Industry is Weakening, and Uncertainties are Increasing

1.2 The Electronic Information Manufacturing Industry Continued to Shrink and Fell into a Downturn

1.3 Semiconductor Sales Fell Sharply, and the Index Fell Back

2 Chip Delivery Trend in April

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in April

4 Semiconductor Supply Chain in April

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Service Machine

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

(1)The Dawn is Emerging, and MLCC is on the Eve of an Upward Turning Point in the Prosperity

(2)The Market Turned Around, and the Downward Trend of Analog IC Prices Slowed Down

5.2 Risk

(1)Less Than Expected, the Progress of MCU Inventory Depletion is Still to be Digested

(2)Sudden Abandonment, Intel Stopped Producing Bitcoin Mining Chips

6 Summarize

Disclaimer

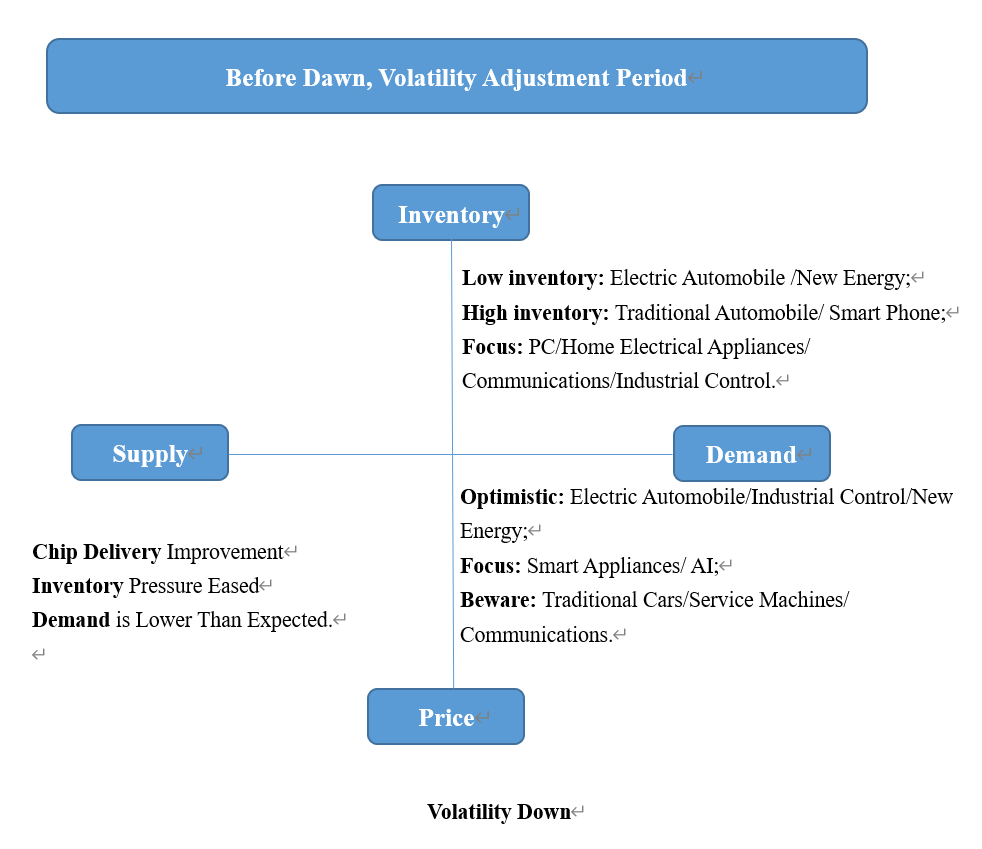

Prologue

1 Macroeconomics in April

1.1 The Trend of the Global Manufacturing Industry is Weakening, and Uncertainties are Increasing

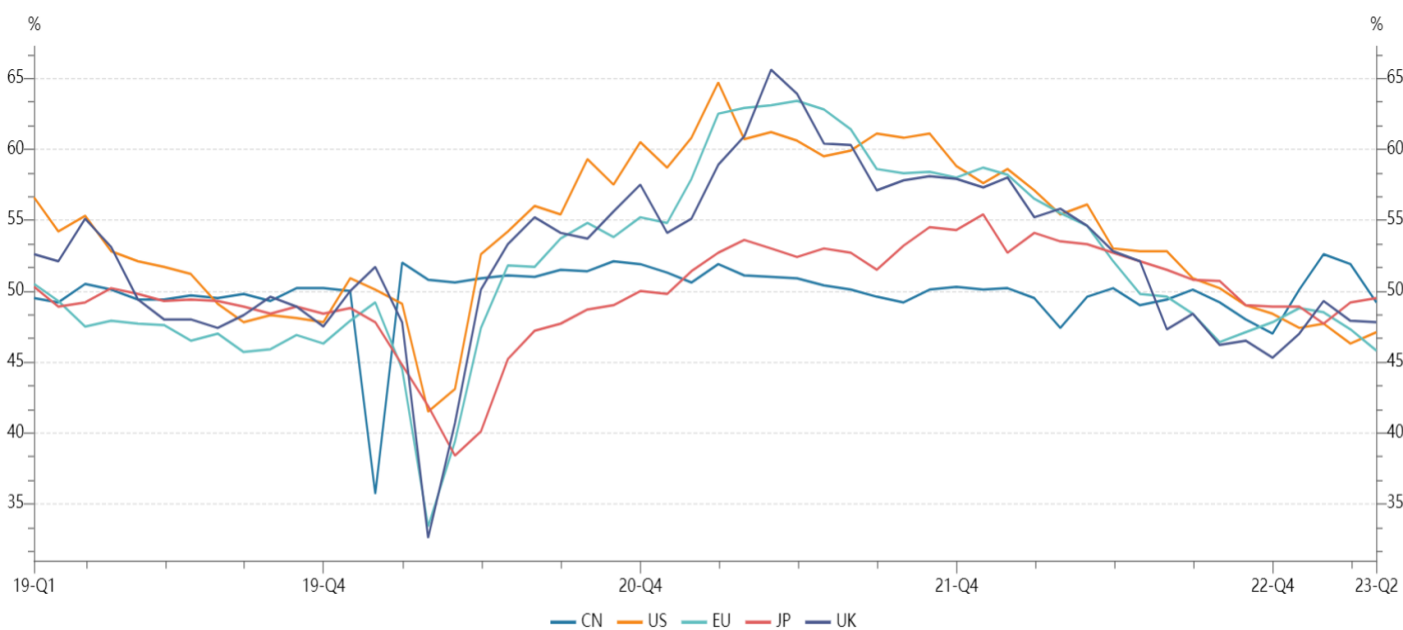

In April, the global economic index fell, and major economies including China, the United States, the European Union, the United Kingdom, and Japan were all below the critical point, and the momentum of economic recovery still needs to be consolidated.

Chart 1: Manufacturing PMI of the world's major economies in April

Source: NBSPRC

To sum up, the shrinking speed of the overall manufacturing industry is accelerating, and the global economic outlook continues to be unstable.

1.2 The Electronic Information Manufacturing Industry Continued to Shrink and Fell into a Downturn

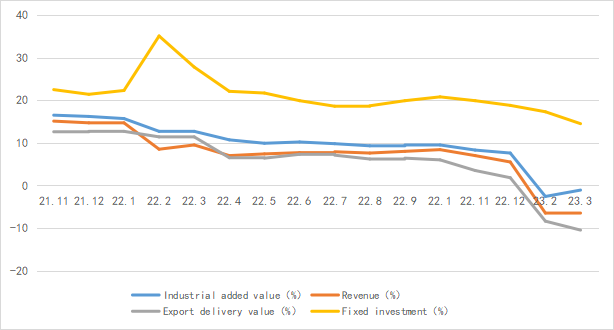

In Q1 2023, the production decline of the electronic information manufacturing industry narrowed, exports continued to decline, efficiency improved, and investment continued to grow.

Chart 2: Operation of electronic information manufacturing industry in Q1 2023

Source: MIIT

1.3 Semiconductor Sales Fell Sharply, and the Index Fell Back

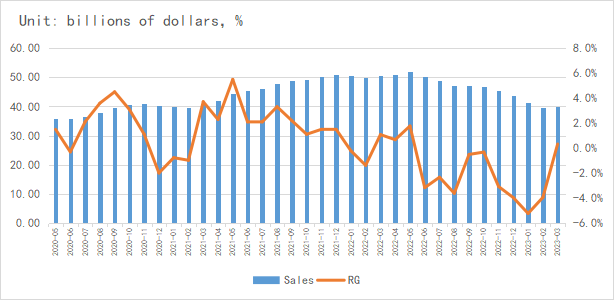

In Q1 2023, global semiconductor sales were US$119.5 billion, down 8.7% quarter-on-quarter and 21.3% year-on-year. From a regional perspective, mainland China fell by 34.1% year-on-year, making it the worst performing region.

Chart 3: Sales and Growth Rate of the Global Semiconductor Industry in Q1 2023

Source: SIA、Chip Insights

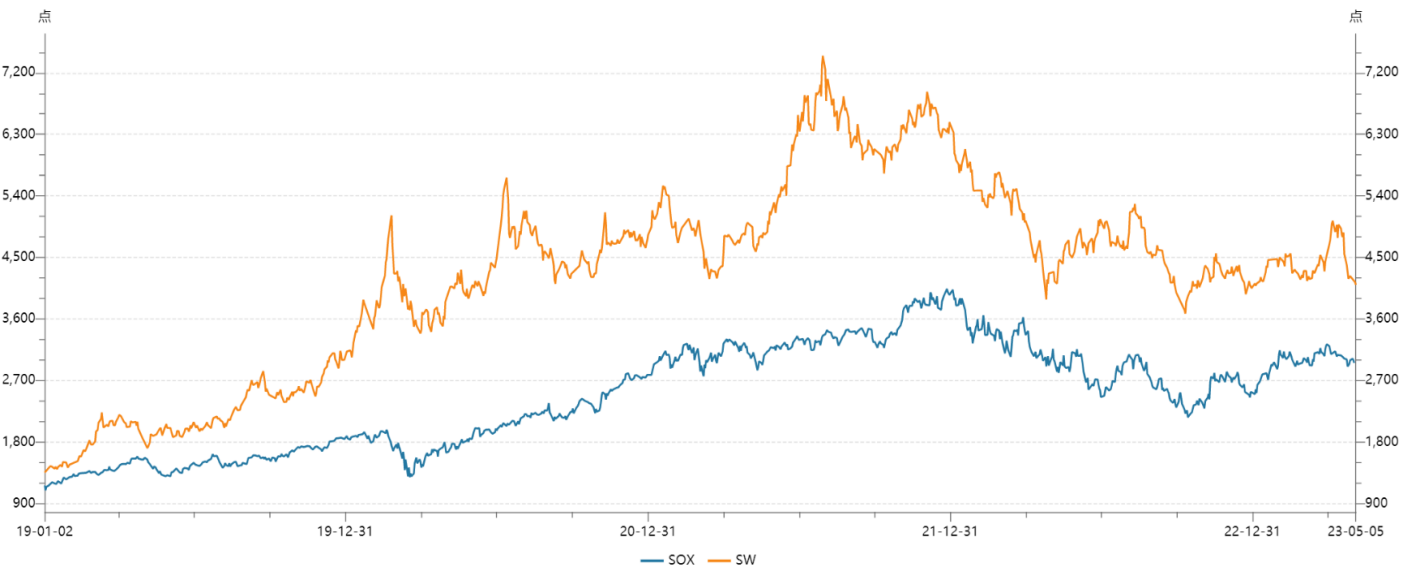

From the perspective of capital market indexes, the Philadelphia Semiconductor Index (SOX) fell by 6.4% in April, and the China Semiconductor (SW) industry index fell by 10.0%. Affected by market demand, investor confidence fell.

Chart 4: Trend of Philadelphia and SWS Index in April

Source: Wind

For more information, please refer to the attached report.