Electronic Components Sales Market Analysis and Forecast (Q4 2025)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Sees Fluctuating Decline

(2)Sluggish Investment in the Electronic Information Manufacturing Industry

(3)End-market Application Demand Continues to Rise

1.2 Semiconductor Market Analysis

(1)Semiconductor Production and Sales Remain Robust

(2)Semiconductor Trade Continues to Grow

(3)Semiconductor Indices Edge Up with Fluctuations

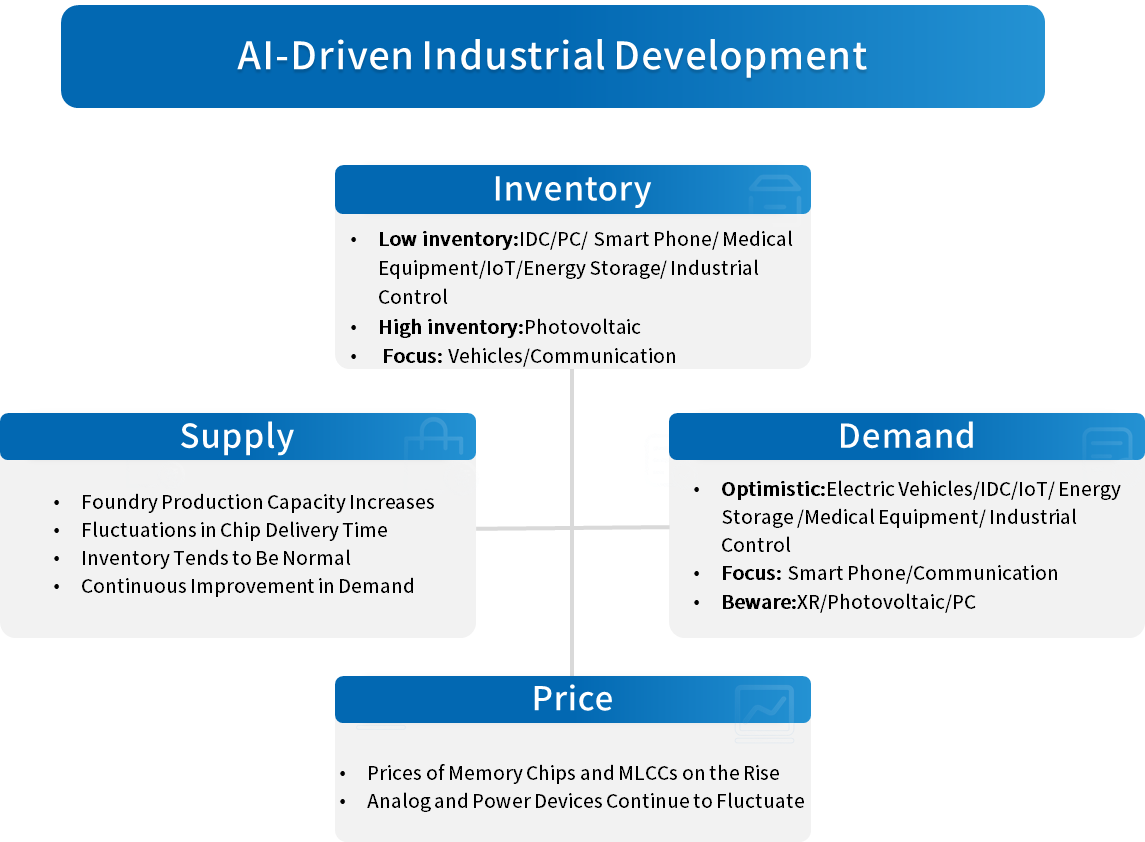

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Equipment/Silicon Wafer: Orders in the Chinese Market Remain Robust

(2)Fabless/IDM: Memory Chip Orders Continue to Rise

(3)Foundry: Market Sentiment is Recovering Steadily

(4)OSAT: Industrial and Automotive Sectors Resume Growth

2.2 Distributor: Robust Orders for AI-related Products

2.3 System Integration: Sustained Losses for Automotive Tier 1 Suppliers

2.4 Terminal Application

(1)Consumer Electronics: Monitor the Impact of Memory Chip Price Hikes

(2)New Energy Vehicles: Intense Market Competition

(3)Industrial Control: Orders Recover Steadily

(4)Photovoltaic: Demand Hits Bottom and Rebounds

(5)Energy Storage: Demand Continues to Rise

(6)Data Center: Positive Outlook for China Market Demand

(7)Communication: Profits Fluctuate

(8)Medical Equipment: Market Growth Expected

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Sees Fluctuating Decline

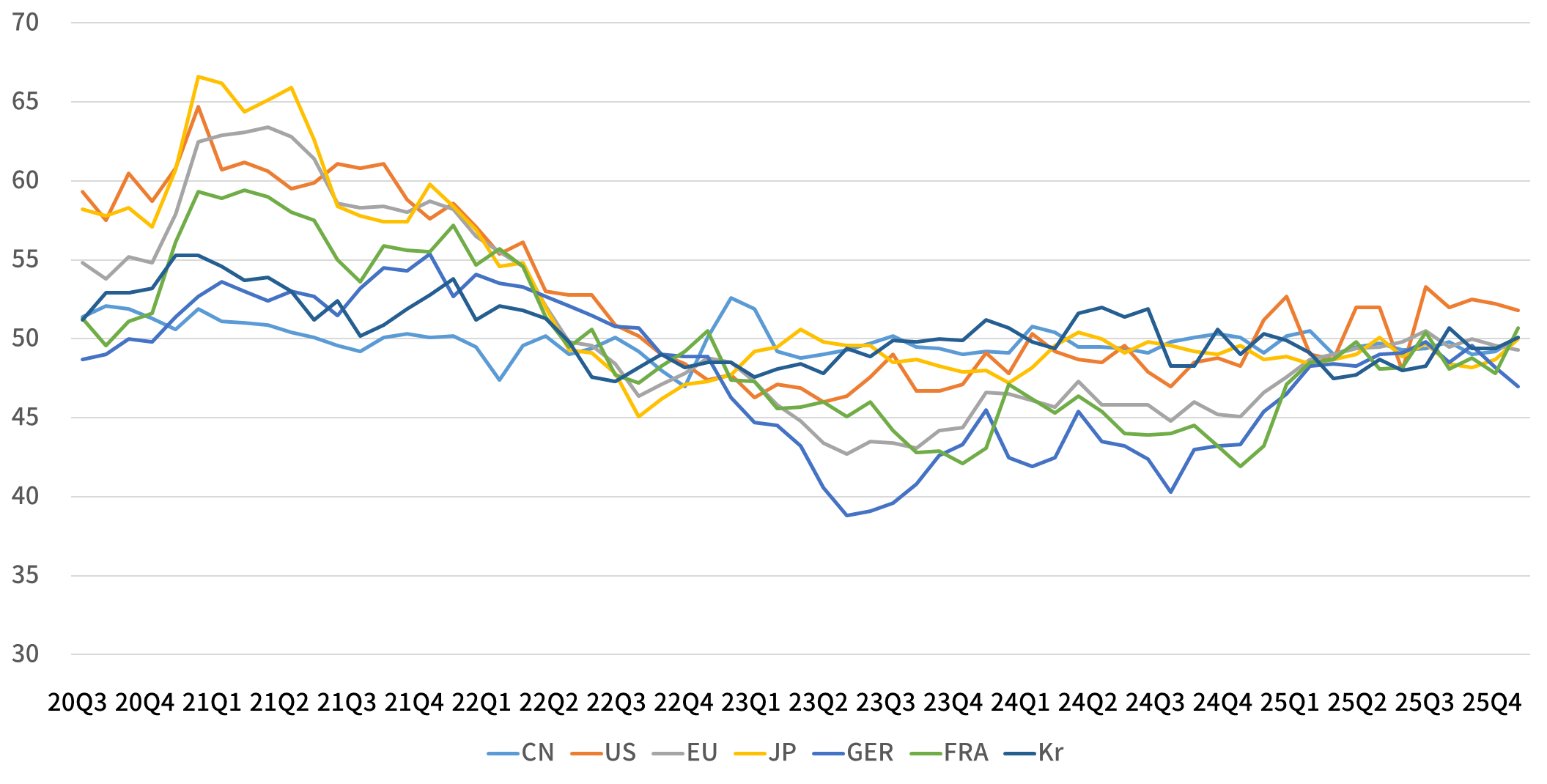

In Q4 2025, the global manufacturing sector remained in a downward trajectory, maintaining a pattern of weak recovery. Regionally, the manufacturing industries in Asia, represented by China, Japan and South Korea, accelerated their expansion. those in the Americas, led by the United States, continued to edge down weakly. and the manufacturing sectors in Europe, exemplified by Germany and France, stayed in a state of tepid recovery. Overall, the recovery momentum of the global manufacturing industry still needs to be strengthened.

Looking back at the full-year performance of 2025, the overall recovery of the global manufacturing sector was slightly better than that of 2024. However, the average index level remained below 50%, indicating that under the multiple impacts such as the influence of tariff policies and geopolitical conflicts, the global economic recovery maintained a steady yet weak momentum.

Looking ahead to 2026, the global economy may still face uncertainties and keep the trend of weak recovery. At present, major international economic institutions generally predict that the world economic growth rate will slow down in 2026.

Chart 1: Manufacturing pmis of major global economies in Q4

Source: NBSPRC

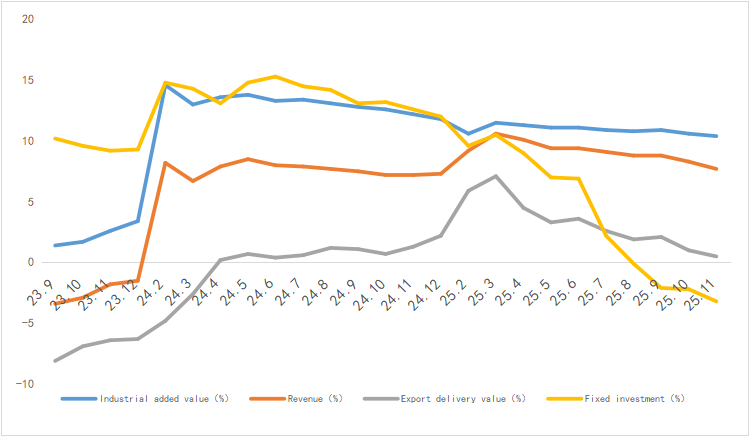

(2)Sluggish Investment in the Electronic Information Manufacturing Industry

From January to November 2025, China’s electronic information manufacturing industry maintained fast production growth, with exports registering a slight decline, benefits rising steadily, and investment continuing to slide. Overall, the industry maintained a sound development momentum.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

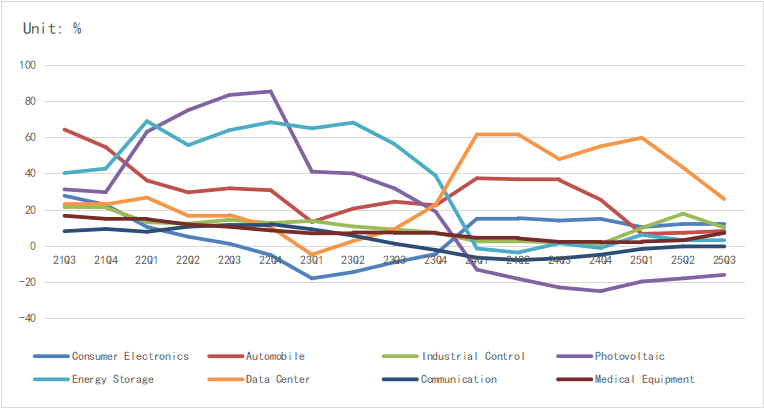

(3)End-market Application Demand Continues to Rise

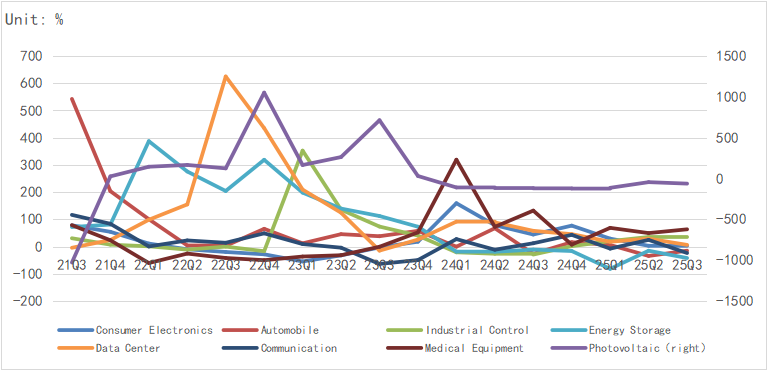

According to the latest data, the industrial sector has rebounded markedly. data centers and medical devices have maintained robust performance. consumer electronics demand has remained stable. Attention should be paid to the fluctuations in the new energy and automotive markets.

In terms of specific revenue growth rates, demand for industrial control products has registered a notable rebound, while the data center segment has sustained high growth with a slight downtick.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

In terms of net profit, industrial control posted the most significant growth, while communications and new energy sectors came under notable pressure.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

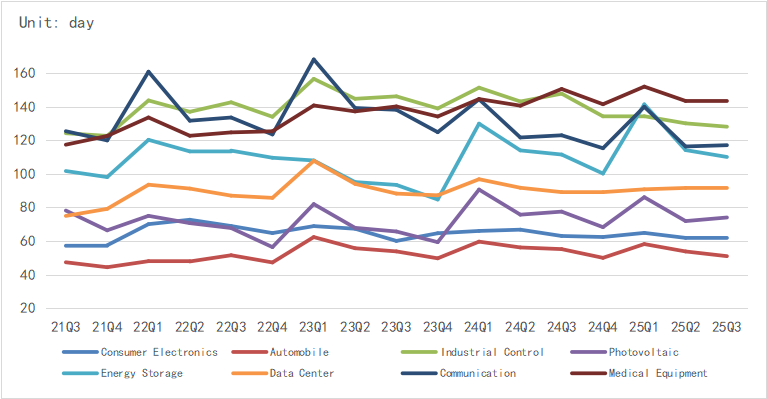

In terms of inventory trends, inventories across all end markets are stabilizing, with marked declines seen in sectors such as photovoltaics and energy storage.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.