Electronic Components Sales Market Analysis and Forecast (December 2025)

Table Of Contents

Prologue

1 Macroeconomics in December

1.1 The Global Manufacturing Industry Edged Down

1.2 Investment in the Electronic Information Manufacturing Industry Remains Sluggish

1.3 Strong Semiconductor Sales

2 Chip Delivery Trend in December

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in December

4 Semiconductor Supply Chain in December

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in December

1.1 The Global Manufacturing Industry Edged Down

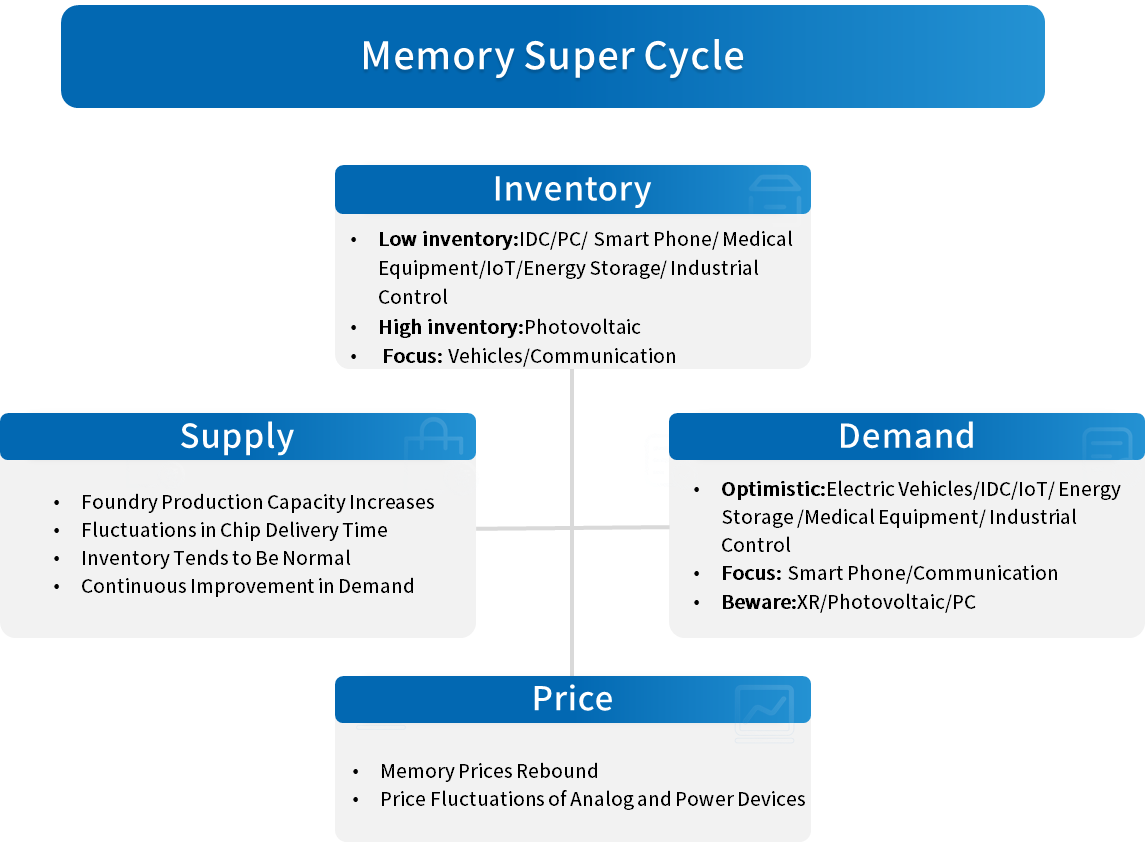

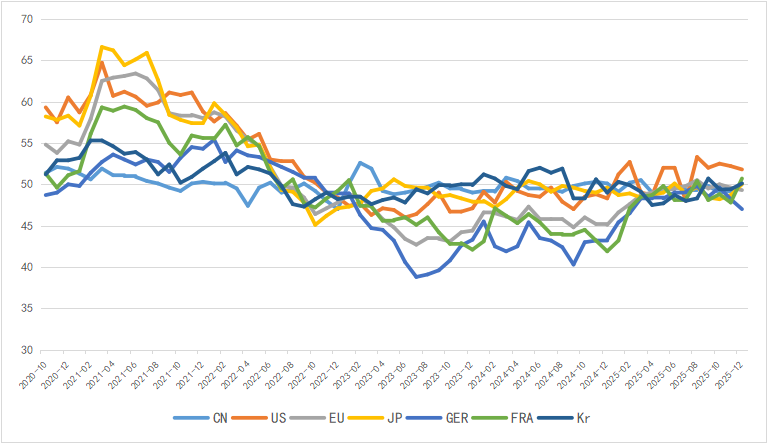

In December, the global manufacturing PMI slowed slightly, keeping the pattern of weak recovery intact. Under the multiple impacts of tariff policy effects and geopolitical conflicts, the global economy may still face uncertainties in 2026. China remains a stabilizer and ballast for the stable operation of the Asian and even the global economy. The IMF projects that China's economy will grow by 5.0% and 4.5% in 2025 and 2026 respectively.

Chart 1: Manufacturing PMI of the world's major economies in December

Source: NBSPRC

1.2 Investment in the Electronic Information Manufacturing Industry Remains Sluggish

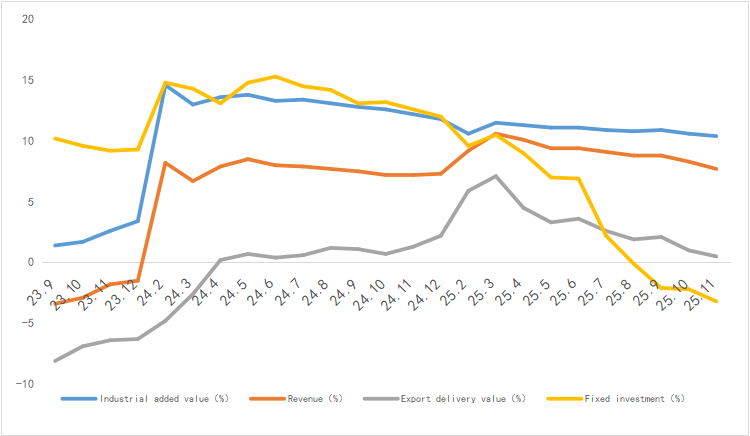

From January to November 2025, China’s electronic information manufacturing industry saw robust production growth, a slight drop in exports, steady improvement in benefits, and a continuous decline in investment, with the industry maintaining a sound overall development momentum.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

1.3 Strong Semiconductor Sales

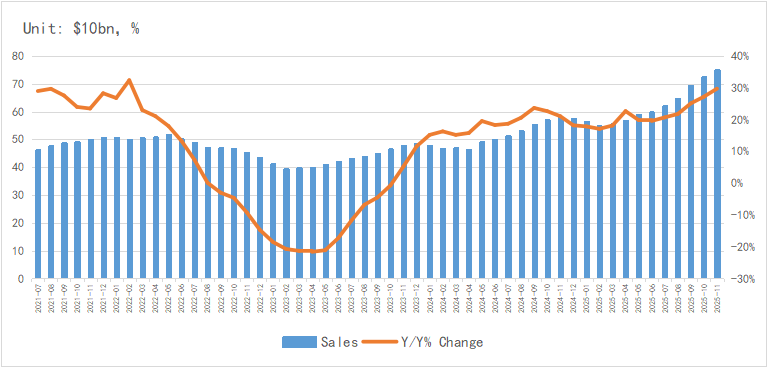

According to the latest data from the SIA, the global semiconductor market posted sales of $75.28 billion in November, representing a year-on-year increase of 29.8% and marking five consecutive months of growth exceeding 20%.

In terms of regional markets, the Asia-Pacific and the Americas led the market growth. Sales in the Americas rose by 23.0% year-on-year; those in mainland China increased by 22.9% year-on-year, and the Asia-Pacific region saw a year-on-year surge of 66.1%. Meanwhile, sales in Japan and Europe recorded a year-on-year change of -8.9% and 11.1% respectively.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

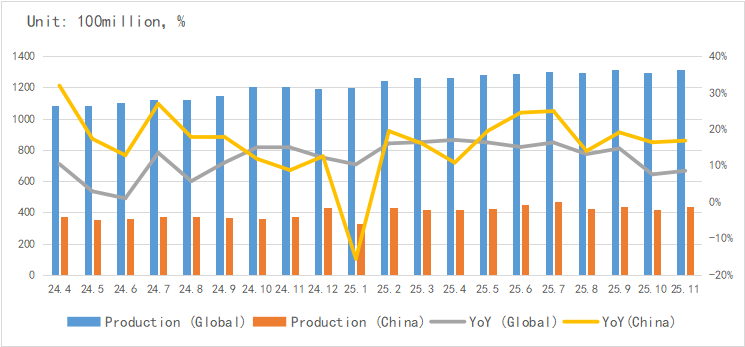

In terms of integrated circuit (IC) output, the global and Chinese IC output in November reached 131.1 billion units and 43.92 billion units respectively, maintaining a steady uptrend.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

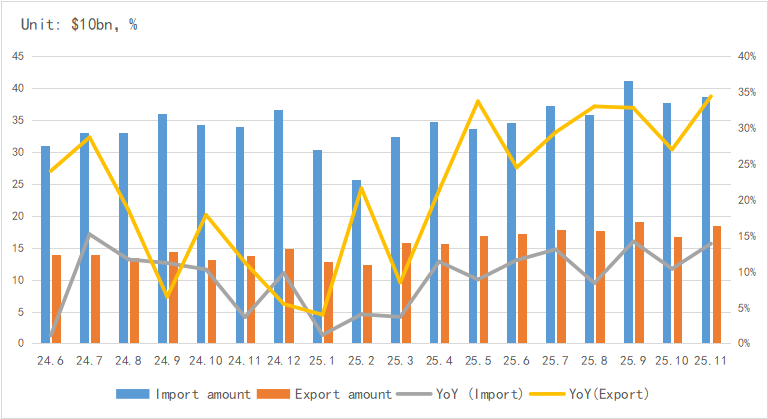

Regarding imports and exports, China's IC exports sustained a strong growth momentum in November, with an average monthly growth rate of over 30% in the past six months.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

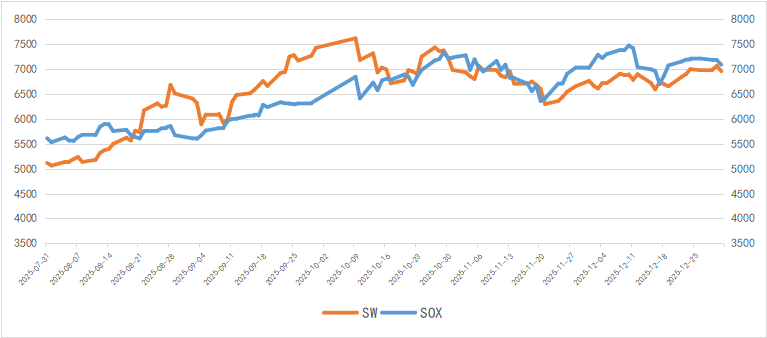

In terms of capital market indices, the Philadelphia Semiconductor Index (SOX) fell by 2.6% in December, while the China Semiconductor (SW) Industry Index edged up by 0.3%, indicating relative stability in the capital market.

Chart 6: Trend of SOX and SW Index in December

Source: Wind,Chip Insights

For more information, please refer to the attached report.