2025 Electronic Component Sales Market Analysis and 2026 Trend Outlook

Table Of Contents

Prologue

1 Review of the Electronic Components Industry in 2025

1.1 Major Annual Supply Chain Events and Their Impacts

1.2 Review of Lead Times and Developments of Key Brands

1.3 Semiconductor Sales Volume and Trade Situation

1.4 Production Capacity and Orders Across the Supply Chain

2 Outlook for Opportunities in the Electronic Component Industry Chain in 2026

2.1 Growth Forecasts for All Upstream Segments of Electronic Components

(1)Fabless/IDM: Uncertainties Remain in Automotive Demand

(2)Distributors: AI Becomes the Core Growth Driver

(3)Tier1: Traditional Giants Under Significant Pressure

(4)EMS/ODM/OEM: It Is an Irresistible Trend to Lay out AI

2.2 Growth Forecast for Major Application Markets of Electronic Components

2.3 Outlook on Market Opportunities in the Electronic Component Supply Chain

(1)Bullish on China's Computing Power Demand and Breakthrough

(2)Iteration of Intelligent Driving and Robot Applications Expected

(3)Accelerated Innovation and Upgrading of New Consumer Categories

3 Analysis of Global Electronic Component Industry Trends in 2026

3.1 Semiconductor Growth May Accelerate

3.2 Global AI Enters a Super Cycle

3.3 The Component Distribution Market is Concentrating Among Leading Players

3.4 Economic Expectations Recover, and Exports May Maintain Steady Growth

Disclaimer

Prologue

1 Review of the Electronic Components Industry in 2025

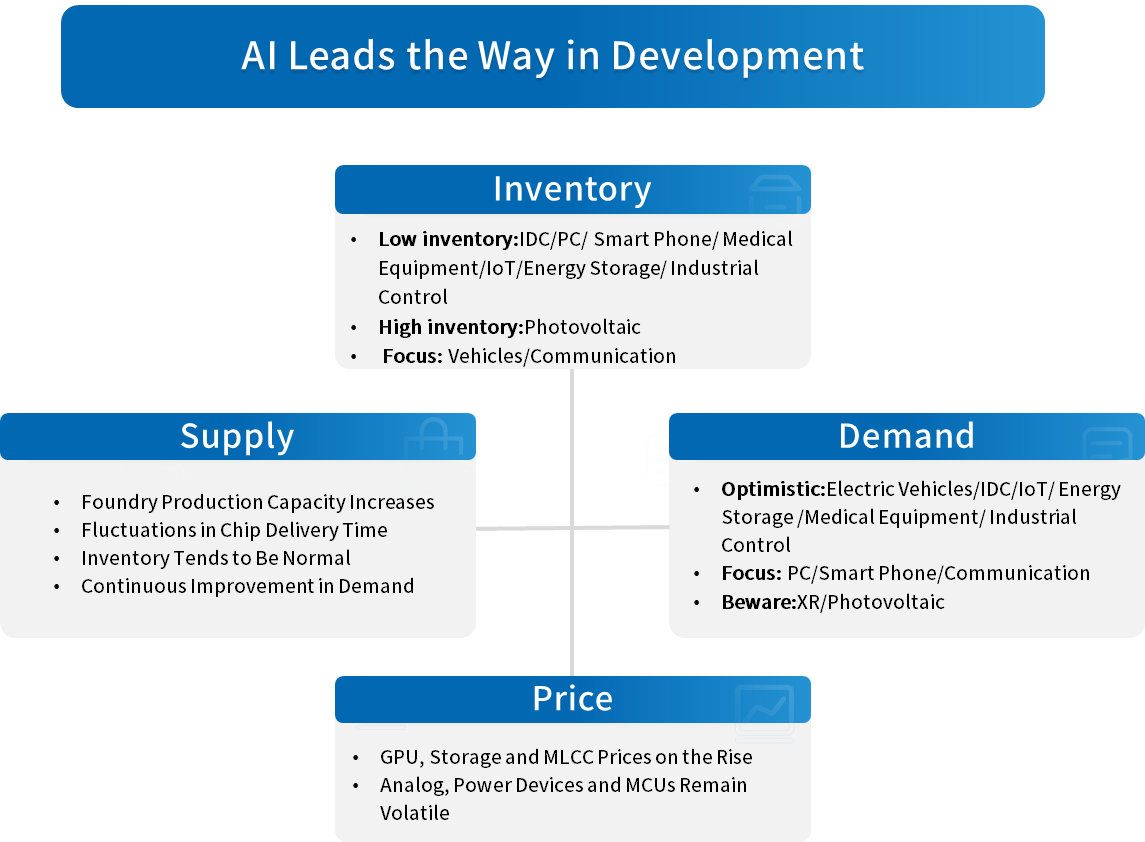

Looking back at 2025, supply chain volatility intensified. Driven by the robust demand for AI, the global semiconductor industry entered a cycle of structural strong growth. From the perspective of the electronic component supply chain, lead times for various product categories extended slightly, prices of some products rose significantly, and demand maintained a high level of prosperity. However, policy factors continued to pose uncertainties to the supply chain. Looking ahead to 2026, the industry is expected to maintain a medium-to-high speed growth trajectory, and there is an optimistic outlook on the demand growth of the AI server supply chain represented by China.

1.1 Major Annual Supply Chain Events and Their Impacts

In 2025, the global electronic component industry evolved amid a complex interplay of multiple variables. The uncertainty of the international trade environment, industrial policy adjustments in major economies, and the demand for supply chain autonomy and security together shaped the main theme of the year. Inside the industry, a dual scenario emerged: on one hand, incremental markets such as AI drove strong demand for semiconductors including computing power and storage products. on the other hand, mature markets like consumer electronics continued to face the challenges of supply chain restructuring and cost optimization. Overall, the competitive dimension of the industry has expanded from a pure contest of technology and cost to a comprehensive competition centered on supply chain resilience, ecological integrity, and policy adaptability.

For more information, please refer to the attached report.