Electronic Components Sales Market Analysis and Forecast (November 2025)

Table Of Contents

Prologue

1 Macroeconomics in November

1.1 Weak Fluctuations in Global Manufacturing

1.2 Sluggish Investment in Electronic Info Manufacturing

1.3 Strong Semiconductor Sales

2 Chip Delivery Trend in November

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in November

4 Semiconductor Supply Chain in November

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

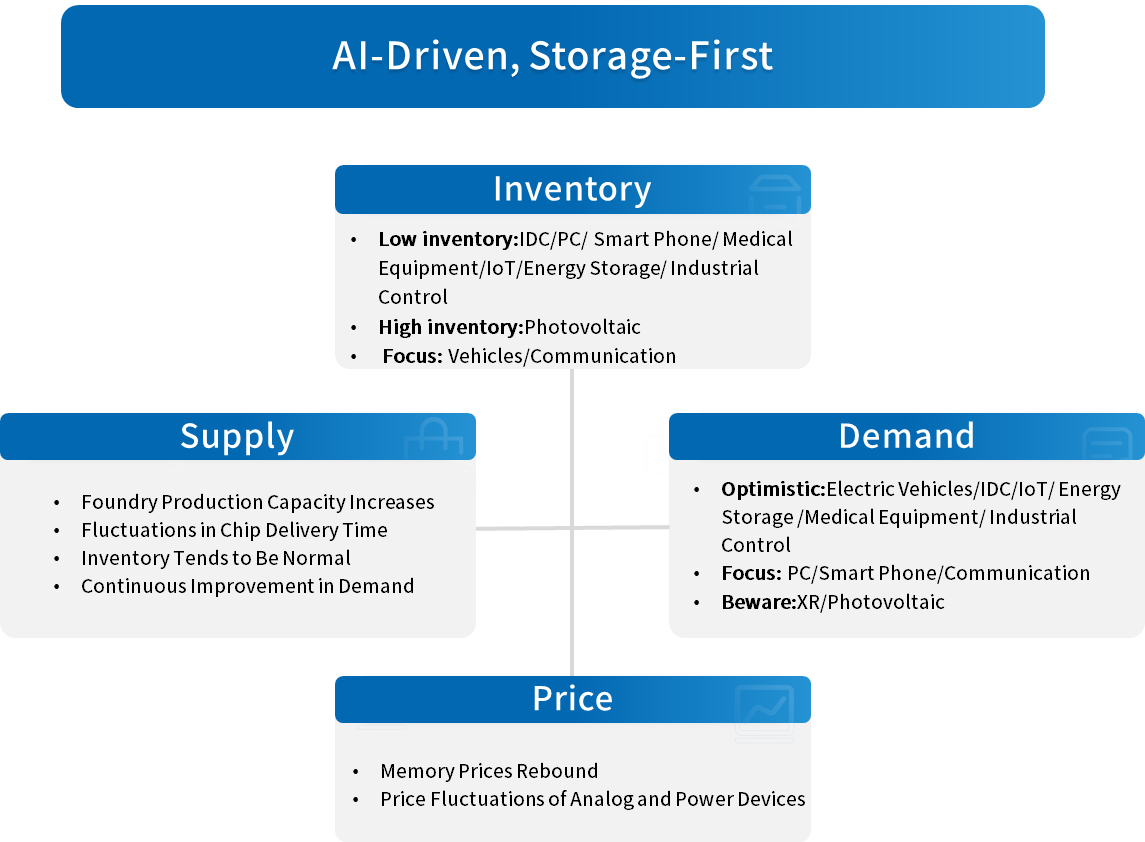

Prologue

1 Macroeconomics in November

1.1 Weak Fluctuations in Global Manufacturing

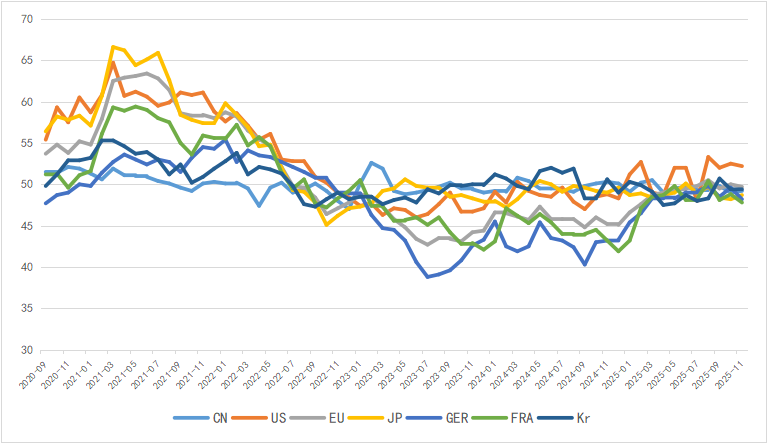

In November, the global manufacturing PMI declined slightly, and the recovery momentum of major economies remained relatively weak. Except for the United States, the PMIs of China, Germany, France, South Korea and Japan were all below the boom-bust line. Notably, the EU manufacturing PMI unexpectedly fell back below the boom-bust line, with manufacturing sectors in both Germany and France deteriorating.

Chart 1: Manufacturing PMI of the world's major economies in November

Source: NBSPRC

1.2 Sluggish Investment in Electronic Info Manufacturing

From January to October 2025, China's electronic information manufacturing industry maintained steady growth in production, saw a slight decline in exports, achieved steady improvement in benefits, and experienced a slight drop in investment, with the overall development of the industry remaining stable.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

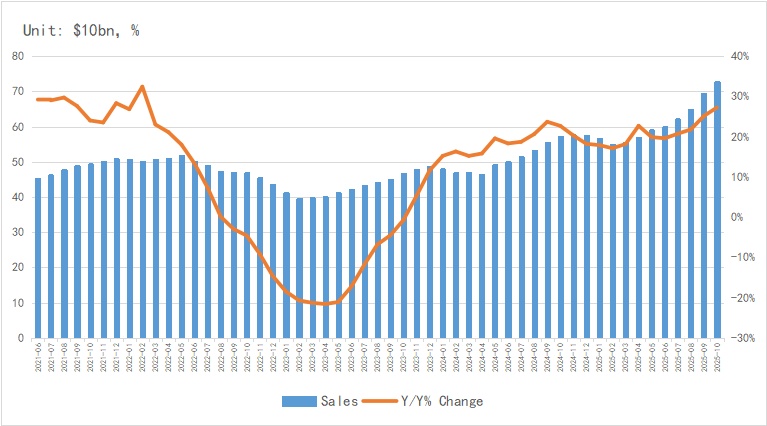

1.3 Strong Semiconductor Sales

According to the latest data from SIA, the global semiconductor market sales reached $72.71 billion in October, representing a year-on-year growth of 27.2%. WSTS predicts that the global semiconductor sales will hit $772.2 billion this year, with a year-on-year increase of 22.5%, and the market is expected to approach $1 trillion by 2026.

In terms of regional markets, the Asia-Pacific and the Americas remain the core markets. The Americas market posted a year-on-year growth of 24.8%. the Chinese mainland saw a year-on-year increase of 18.5%. the Asia-Pacific region achieved a year-on-year growth of 59.6%. while sales in Japan and Europe stood at -10.0% and 8.3% year-on-year, respectively.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

Source: SIA,Chip Insights

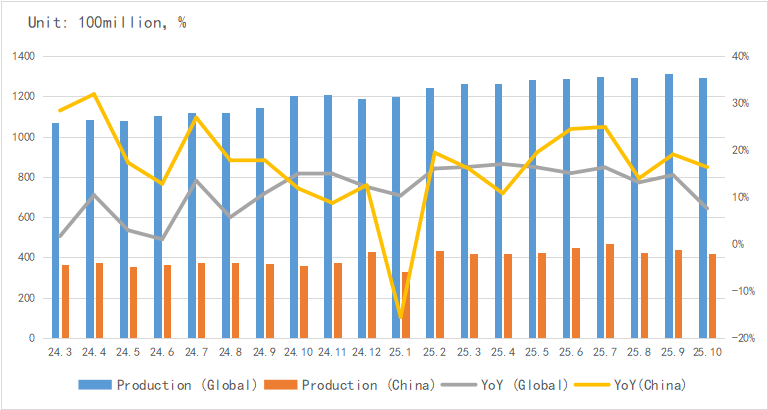

From the perspective of integrated circuit (IC) output, the global and Chinese IC output in October reached 129.6 billion units and 41.73 billion units respectively, showing a slight fluctuation.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

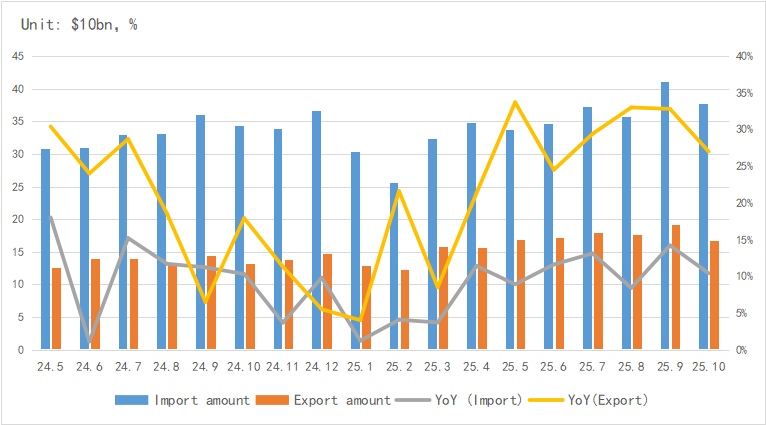

In terms of import and export, China's IC exports maintained strong growth in October, with an average monthly growth rate of over 30% in the past five months.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

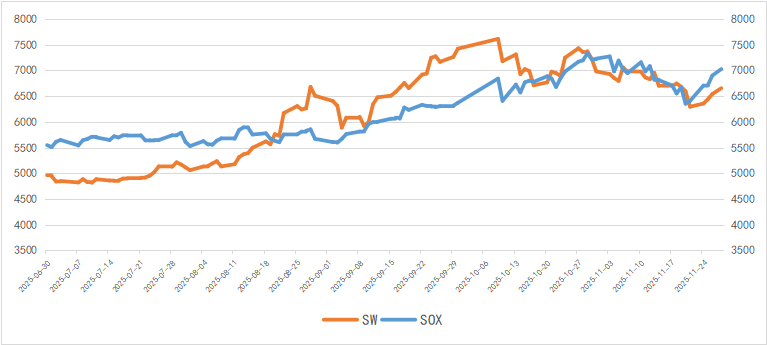

From the perspective of capital market indices, the Philadelphia Semiconductor Index (SOX) fell by 3.4% in November, and the China Semiconductor (SW) Industry Index dropped by 4.0%,indicating obvious volatility in the capital market.

Chart 6: Trend of SOX and SW Index in November

Source: Wind,Chip Insights

For more information, please refer to the attached report.