Electronic Components Sales Market Analysis and Forecast (Q3 2025)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Manufacturing Industry Has Returned to Stability

(2)Investment in the Electronic Information Manufacturing Industry Has Declined

(3)Demand for End-User Applications Is on the Rise

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Continue to Maintain Strong Momentum

(2)Semiconductor Exports Have Grown Relatively Fast

(3)Semiconductor Indices Saw Significant Gains

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Equipment/Silicon Wafer: Orders in the Chinese Market Are Performing Well

(2)Fabless/IDM: AI and Memory Sectors See Significant Benefits

(3)Foundry: Steady Recovery in Prosperity

(4)OSAT: Advanced Packaging and Testing Growth to Continue into Next Year

2.2 Distributor: Monitor the Impact of the Latest Controls

2.3 System Integration: Orders Rebound Significantly

2.4 Terminal Application

(1)Consumer Electronics: Maintain a Weak Recovery

(2)New Energy Vehicles: Profits See a Significant Decline

(3)Industrial Control: Orders Recover at an Accelerated Pace

(4)Photovoltaic: Demand Hits Bottom and Rebounds

(5)Energy Storage: Profits and Expectations on the Rise

(6)Data Center: Demand Continues to See Strong Growth

(7)Communication: Orders Show a Moderate Recovery

(8)Medical Equipment: The Market Continues to Undergo Transformation

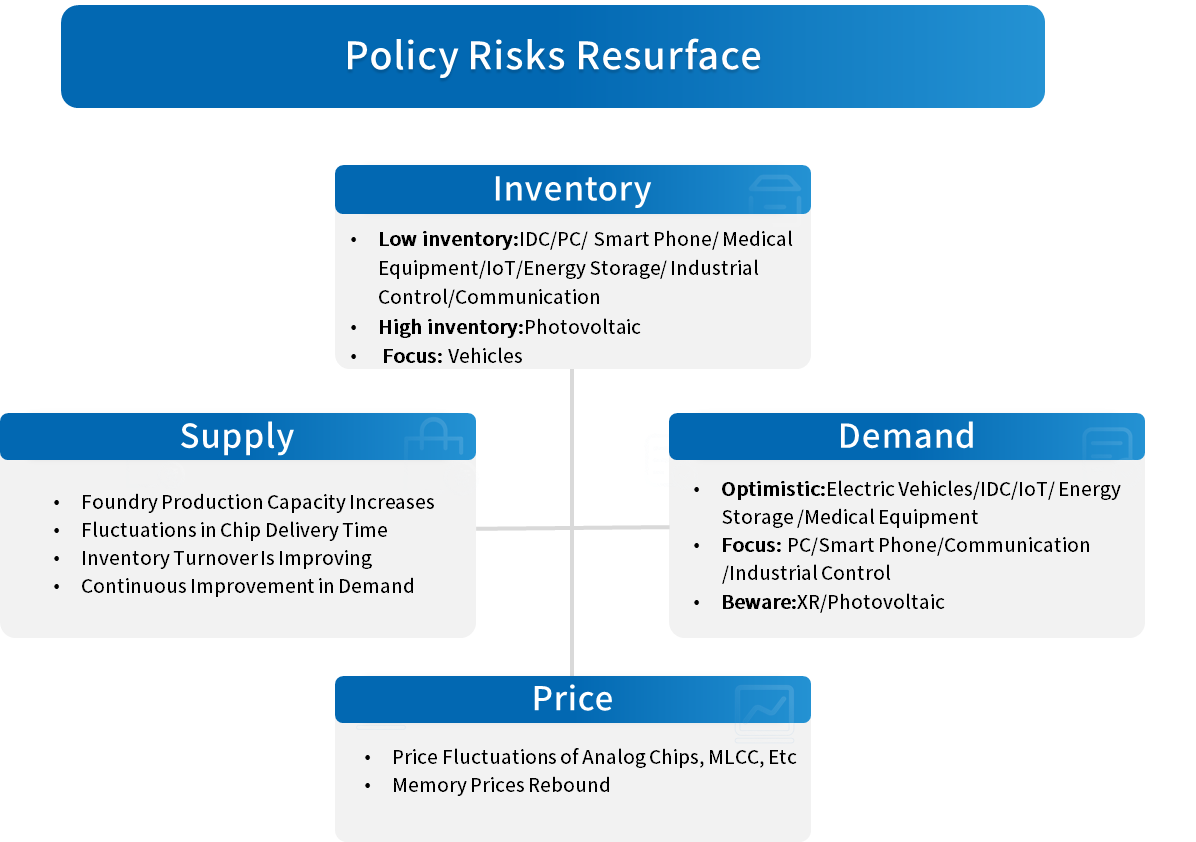

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Manufacturing Industry Has Returned to Stability

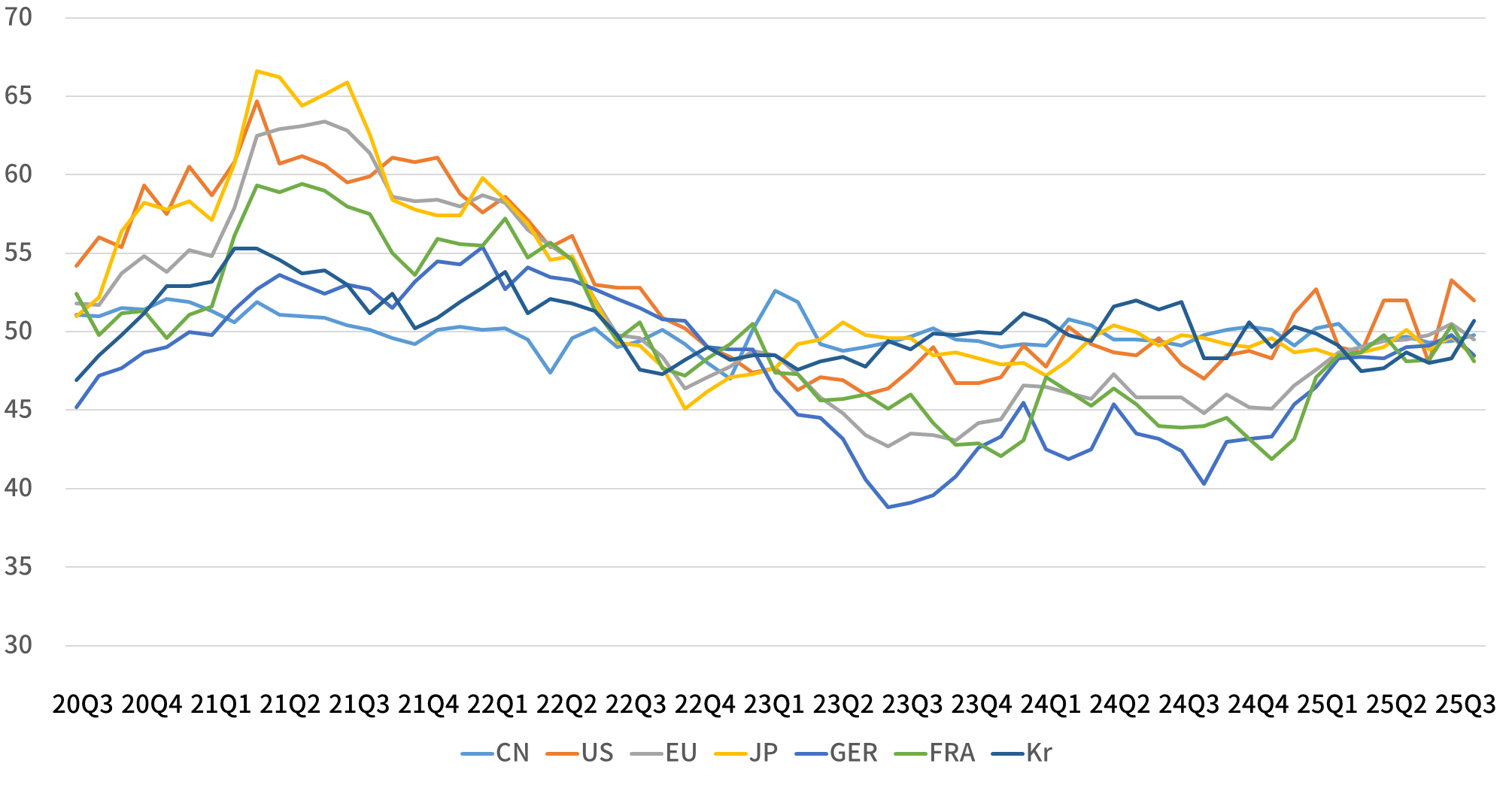

In Q3 2025, the global manufacturing industry remained in a downward range, while economic recovery maintained relative stability. Under the continuous disruption of trade frictions and geopolitical conflicts, the situation of weak global demand growth has not changed. However, the recovery in various countries, especially in the EU region, was relatively noticeable. The Organization for Economic Co-operation and Development (OECD) raised its forecast for this year's global economic growth from 2.9% (released in June) to 3.2%, while keeping its 2026 global economic growth forecast unchanged at 2.9%.

Chart 1: Manufacturing pmis of major global economies in Q3

Source: NBSPRC

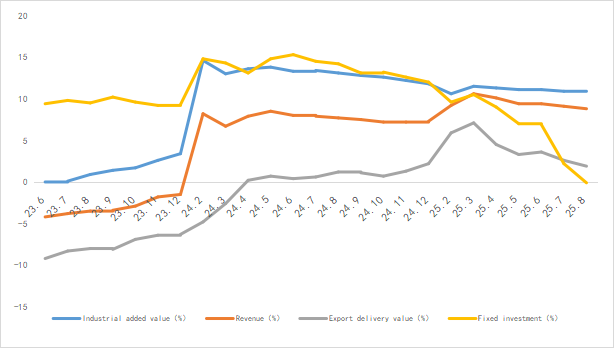

(2)Investment in the Electronic Information Manufacturing Industry Has Declined

From January to August 2025, China's electronic information manufacturing industry achieved rapid growth in production, saw a slight decline in exports, maintained steady improvement in benefits, and experienced a slowdown in investment growth. Overall, the industry maintained a sound development momentum.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

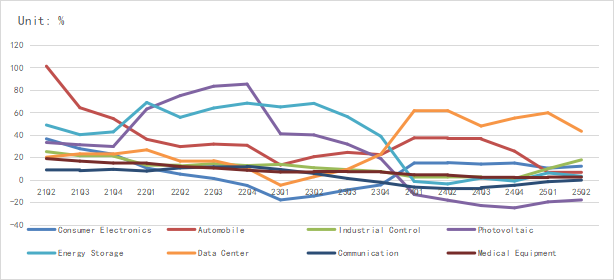

(3)Demand for End-User Applications Is on the Rise

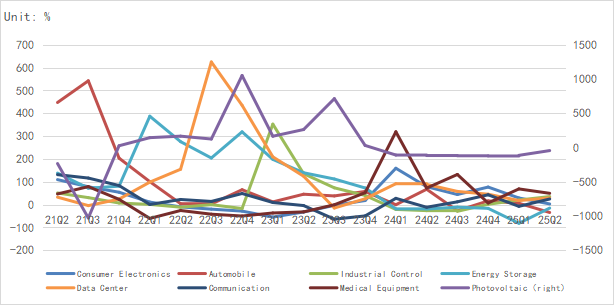

According to the latest data, the data center and medical device sectors remain relatively strong, demand for consumer electronics stays stable, the automotive and new energy sectors see a slight decline, while the industrial and communications sectors achieve significant growth.

In terms of revenue growth rate, the data center sector maintains a strong performance though with a slight slowdown, and the industrial market witnesses an accelerated recovery.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

In terms of net profit, the data center and medical device sectors remain stable, the industrial and communications sectors have seen a significant recovery, while the automotive and new energy sectors are under notable pressure.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

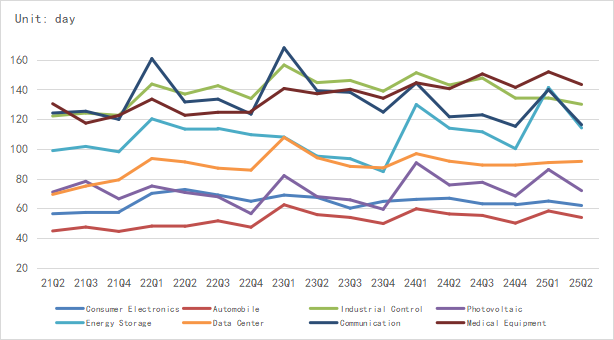

From the perspective of inventory trends, inventories in various end-user markets have fluctuated but shown a marked downward trend.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.