Electronic Components Sales Market Analysis and Forecast (September 2025)

Table Of Contents

Prologue

1 Macroeconomics in September

1.1 The global manufacturing sector maintains a stable posture

1.2 The Electronic Information Manufacturing Industry Maintains a Stable Posture

1.3 Semiconductor Sales Volume Remains Stable

2 Chip Delivery Trend in September

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in September

4 Semiconductor Supply Chain in September

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

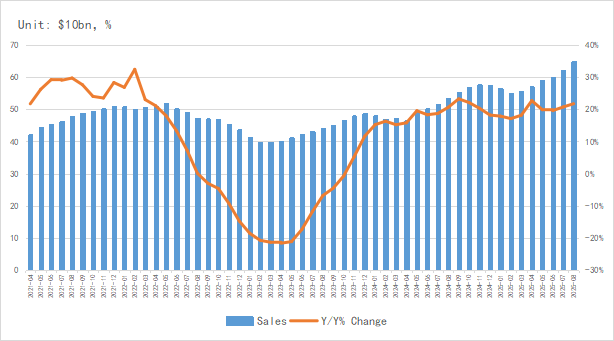

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in September

1.1 The global manufacturing sector maintains a stable posture

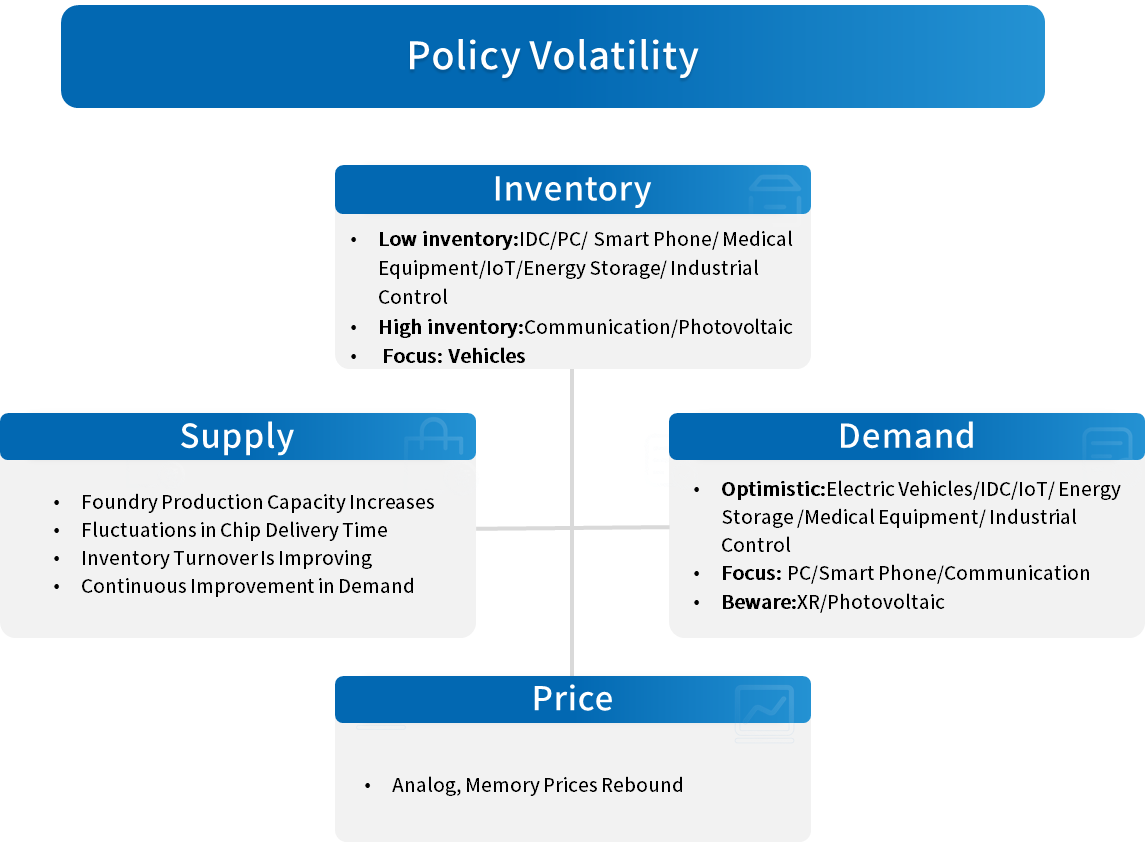

In September, the global manufacturing PMI (Purchasing Managers' Index) showed little fluctuation, and the economic recovery maintained a relatively stable momentum. Except for the United States and South Korea, the indices of China, the European Union and Japan declined. Although the global economic recovery has remained stable within a certain range, the situation of weak growth in market demand has not changed, and disruptions from trade frictions and geopolitical conflicts persist.

Chart 1: Manufacturing PMI of the world's major economies in September

Source: NBSPRC

1.2 The Electronic Information Manufacturing Industry Maintains a Stable Posture

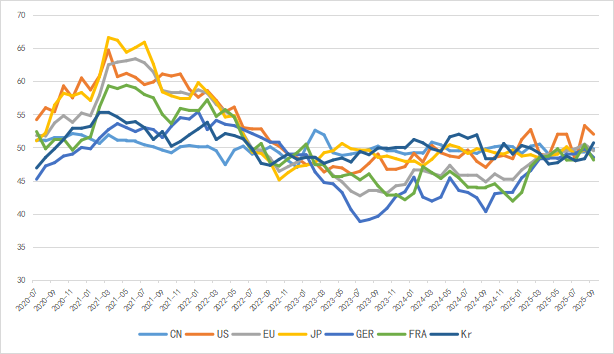

From January to August 2025, China's electronic information manufacturing industry has achieved rapid growth in production, seen a slight decline in exports, maintained a steady and positive trend in benefits, and experienced a slowdown in investment growth. Overall, the industry maintains a sound development momentum.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

1.3 Semiconductor Sales Volume Remains Stable

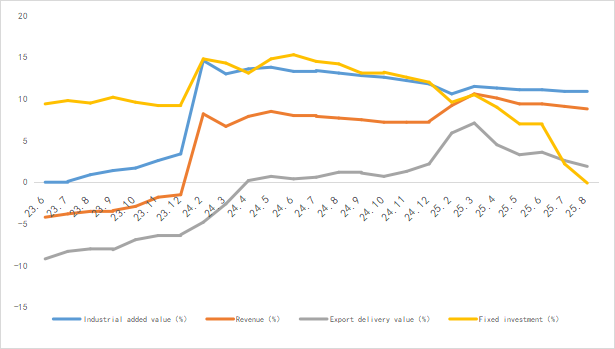

market sales reached $64.88 billion in August, representing a year-on-year (YoY) growth of 21.7%. This marks the 16th consecutive month that the YoY growth rate has exceeded 17%, continuing the strong growth momentum.

In terms of regional markets, the Asia-Pacific and Americas regions are the main growth drivers. Sales in the Americas market amounted to $20.78 billion, with a YoY increase of 25.5%.the Chinese mainland saw a YoY growth of 12.4%, while the Asia-Pacific region achieved a YoY growth of 43.1%. In contrast, sales in Japan and Europe recorded changes of -6.9% and 4.4% YoY, respectively.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

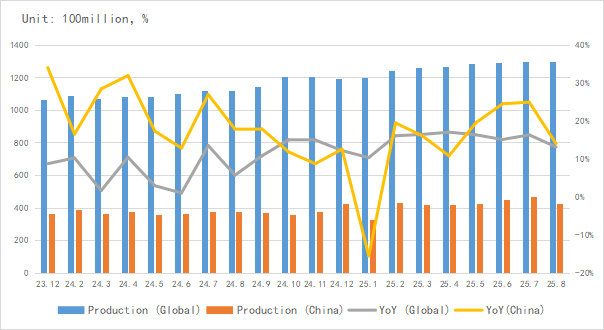

In terms of integrated circuit (IC) output, the global and China's IC output in August reached 129.5 billion units and 42.50 billion units respectively, with stable year-on-year (YoY) growth.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

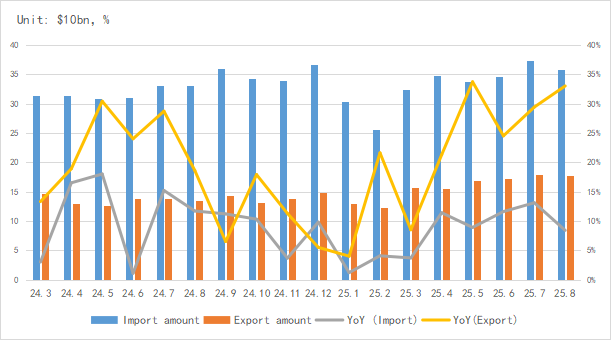

In terms of import and export, China's integrated circuit (IC) exports continued their strong growth in August, marking the 5th consecutive month with a growth rate exceeding 21%.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

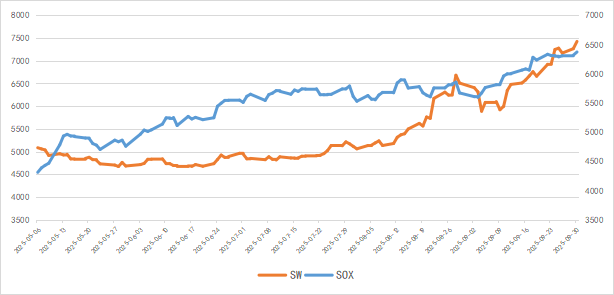

From the perspective of capital market indices, the Philadelphia Semiconductor Index (SOX) rose by 13.6% in September, and the China Semiconductor (SW) Industry Index increased by 15.9%. The prosperity of the global semiconductor capital market continues to move upward.

Chart 6: Trend of SOX and SW Index in September

Source: Wind,Chip Insights

For more information, please refer to the attached report.