Electronic Components Sales Market Analysis and Forecast (Q2 2025)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Global Manufacturing Industry Is Under Significant Downward Pressure

(2)The Electronic Information Manufacturing Industry Remains Stable

(3)End Demand Continues to Recover

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Remain Strong

(2)Semiconductor Trade Is Relatively Stable

(3)Semiconductor Indices Fluctuate Upward

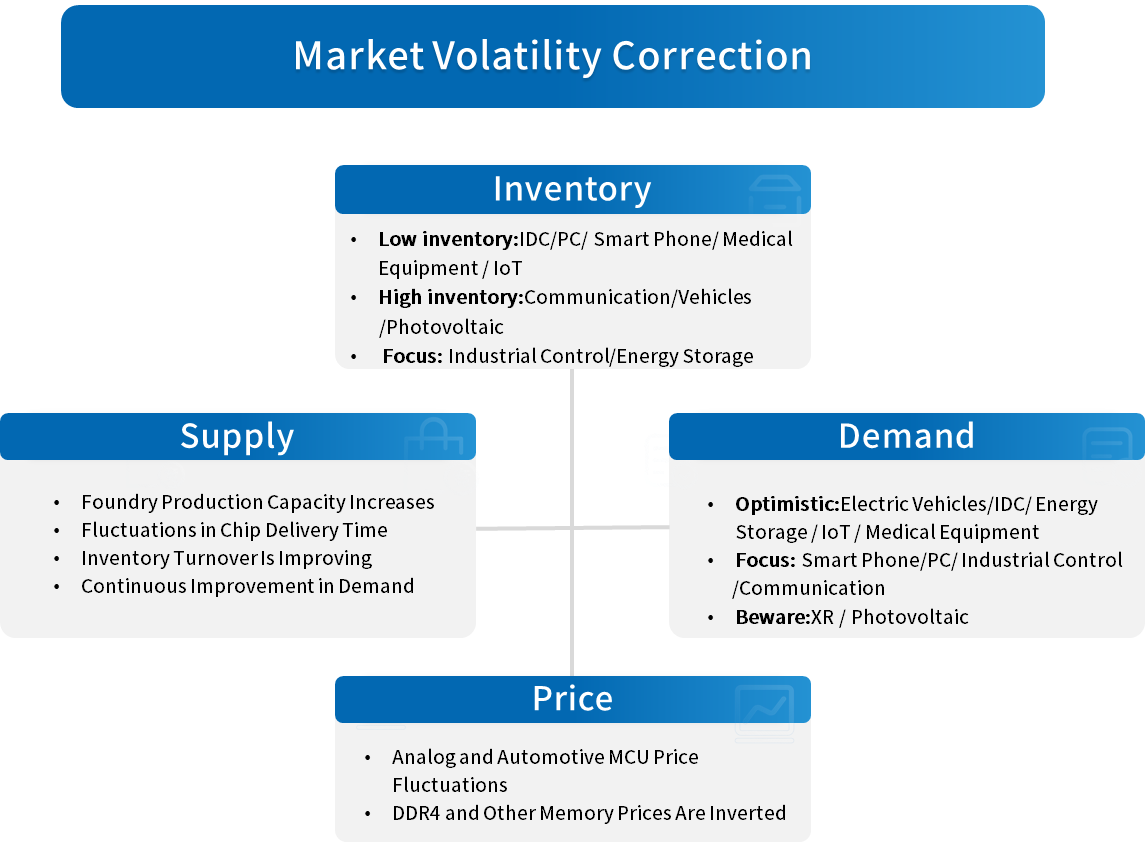

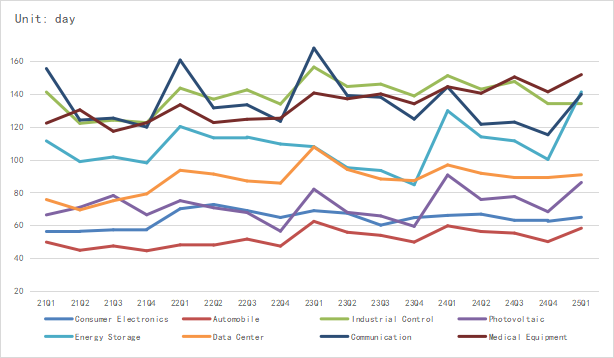

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Equipment/Silicon Wafer:The Prosperity of Materials Is on the Rise

(2)Fabless/IDM:Memory and Logic Chips Drive Significantly

(3)Foundry: Profits Hit Bottom and Rebound

(4)OSAT:Order Recovery

2.2 Distributor:Customers' Inventory Destocking Has Come to an End

2.3 System Integration: Automotive Sector Remains Weak, While AI-Related Sectors See Strong Growth

2.4 Terminal Application

(1)Consumer Electronics:Continuing Weak Recovery

(2)New Energy Vehicles:Significant Decline Amid Worsening Competition

(3)Industrial Control:Demand Has Rebounded Somewhat

(4)Photovoltaic:Expected to Bottom out and Rebound

(5)Energy Storage:Stable Orders with Optimistic Expectations

(6)Data Center:Strong supply chain orders in the Chinese market

(7)Communication:Pay Attention to the Impact of Optical Modules and Esim on the Supply Chain

(8)Medical Equipment:Leading Manufacturers Accelerate Localization Layout in China

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Global Manufacturing Industry Is Under Significant Downward Pressure

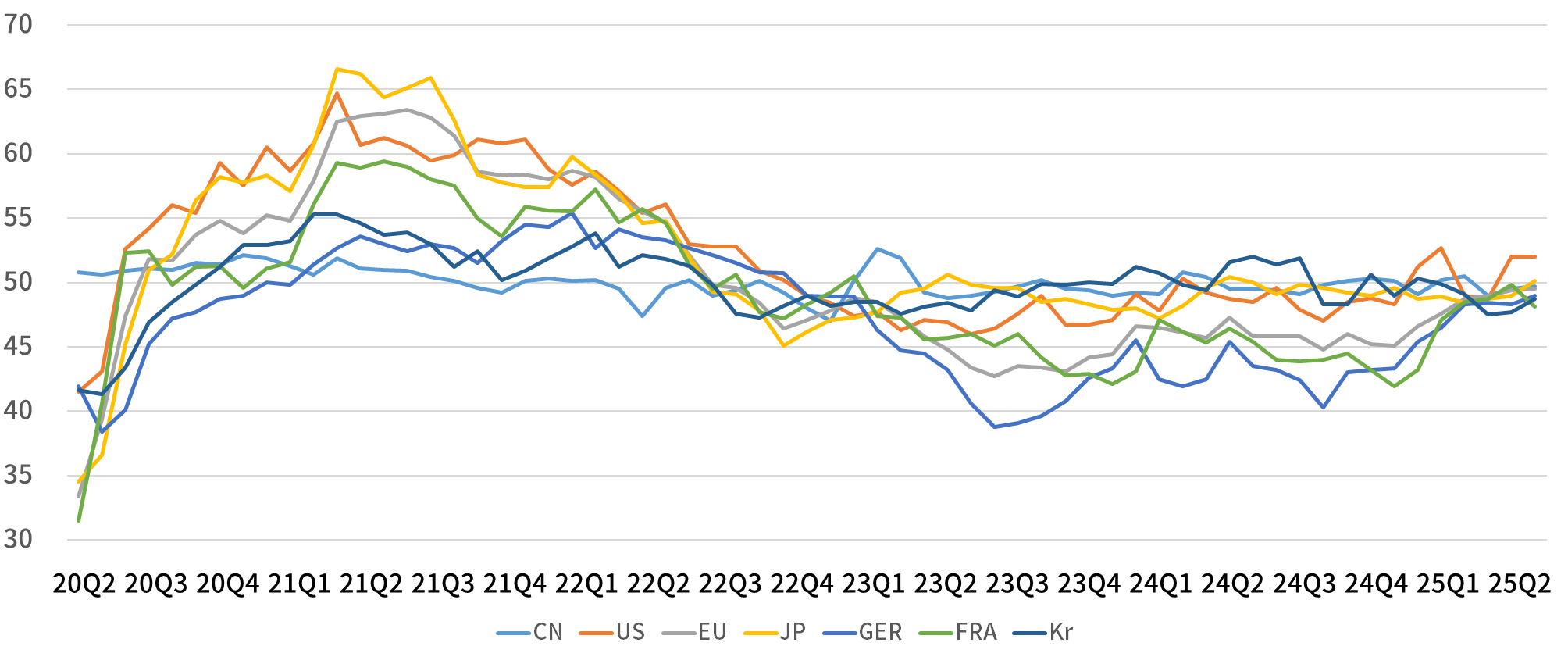

In the second quarter of 2025, The global manufacturing industry is in a contraction range and facing significant downward pressure. Affected by the unclear direction of the U.S. tariff increase policy and the continued existence of geopolitical conflicts, fluctuations in other countries except the United States are relatively greater. According to the latest forecast of the World Bank, the global economic growth expectation for this year has been lowered from 2.7% in January to 2.3%, and uncertainties still remain.

Chart 1: Manufacturing pmis of major global economies in Q2

Source: NBSPRC

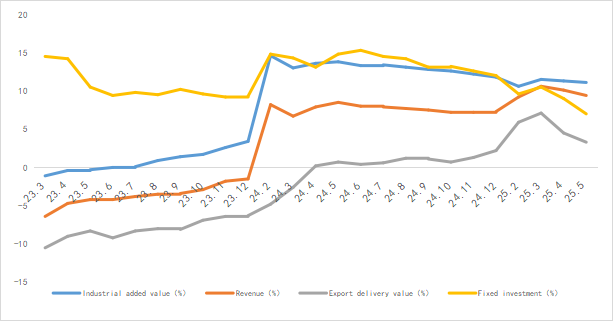

(2)The Electronic Information Manufacturing Industry Remains Stable

From January to May 2025, China's electronic information manufacturing industry saw relatively rapid growth in production, a significant slowdown in export growth, steady improvement in efficiency, and a decline in investment growth. The overall development trend of the industry remains sound.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

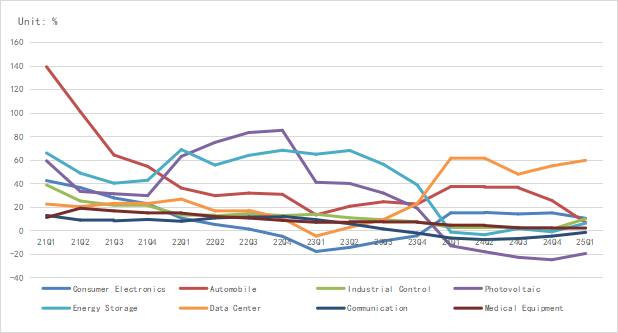

(3)End Demand Continues to Recover

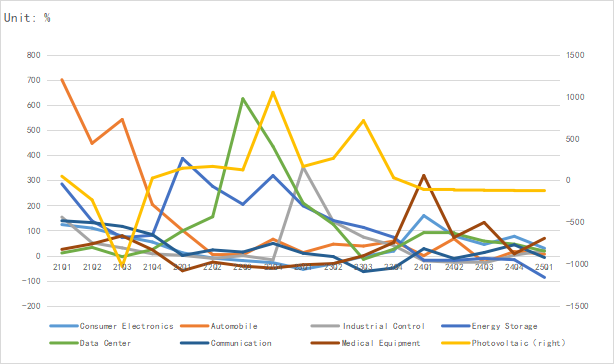

As of Q1 2025, data centers have maintained strong performance, consumer electronics and medical devices have remained relatively stable, automobiles have seen a decline, while industry and new energy have improved significantly.

In terms of revenue growth rate, data centers are the strongest, and the industrial market has rebounded significantly.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

In terms of net profit, data centers and consumer electronics remain relatively stable, industrial control profits have rebounded, and new energy continues to be under pressure.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

Looking at the inventory trend, inventory fluctuations in various terminal markets are obvious, with new energy showing the largest increase.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.