Electronic Components Sales Market Analysis and Forecast (June 2025)

Table Of Contents

Prologue

1 Macroeconomics in June

1.1 The Global Manufacturing Industry Is Developing Steadily with a Positive Trend

1.2 Investment in the Electronic Information Manufacturing Industry Has Declined

1.3 Semiconductor Sales Are Growing Strongly

2 Chip Delivery Trend in June

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in June

4 Semiconductor Supply Chain in June

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

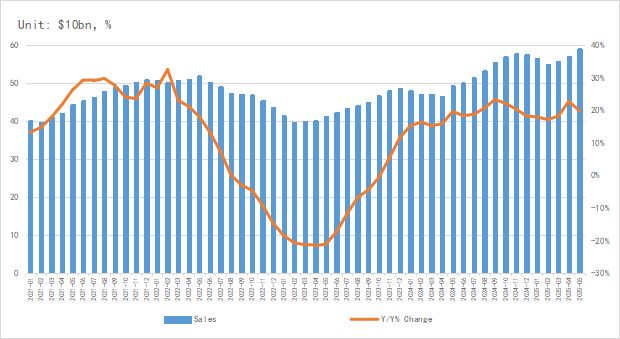

Prologue

1 Macroeconomics in June

1.1 The Global Manufacturing Industry Is Developing Steadily with a Positive Trend

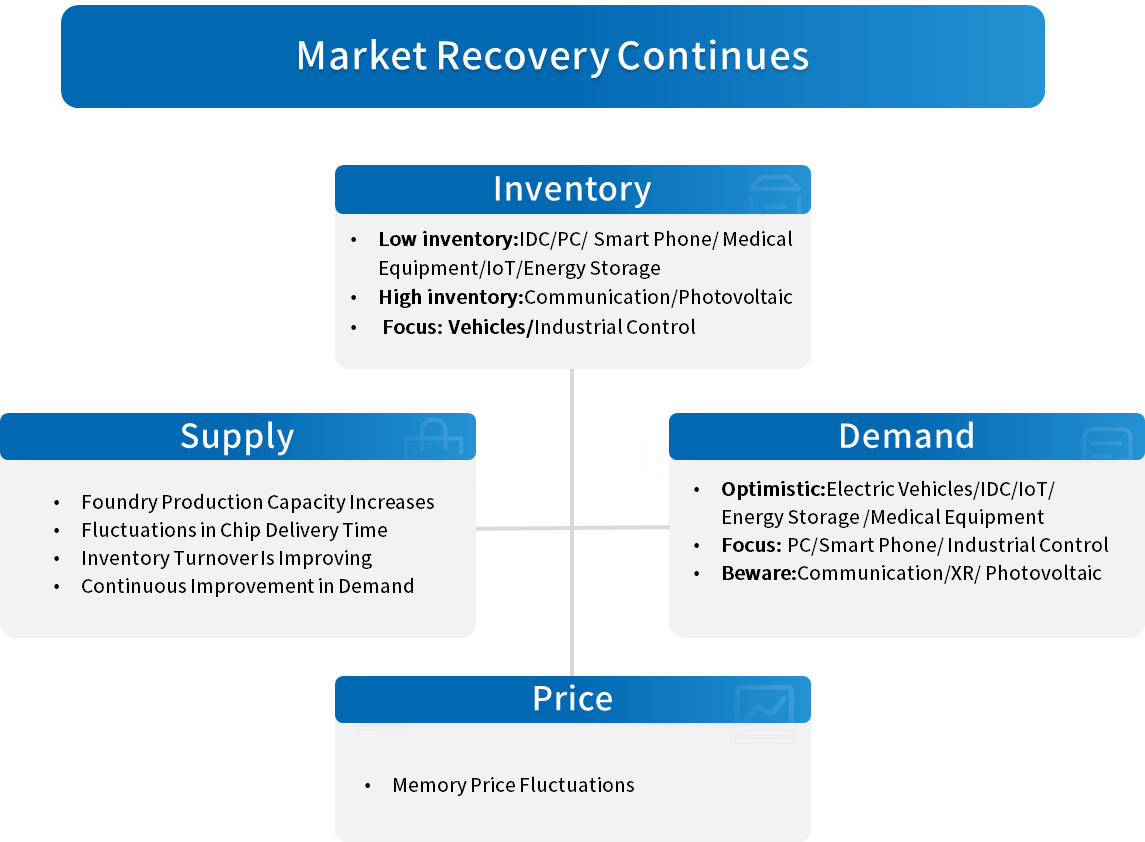

In June, the global manufacturing sector improved, with the fundamentals of economic operation remaining stable and positive. However, inflation divergence among countries intensified. Except for the United States and Japan, China, South Korea, and the European Union represented by Germany and France all stayed below the boom-bust balance line, and there were significant differences in inflation trends among various economies. Among them, the global manufacturing activities improved thanks to the normalization of Sino-US trade relations and enterprises' advance stockpiling behavior before the expiration of the tariff suspension on July 9.

Chart 1: Manufacturing PMI of the world's major economies inJune

Source: NBSPRC

1.2 Investment in the Electronic Information Manufacturing Industry Has Declined

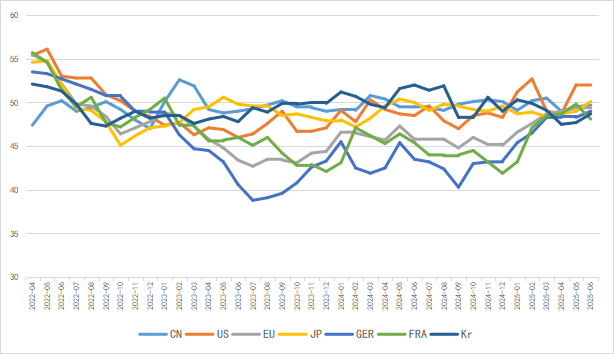

From January to May 2025, China's electronic information manufacturing industry saw relatively rapid growth in production, a slowdown in export growth, steady improvement in efficiency, and a decline in investment growth, with the industry as a whole maintaining a sound development momentum.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

1.3 Semiconductor Sales Are Growing Strongly

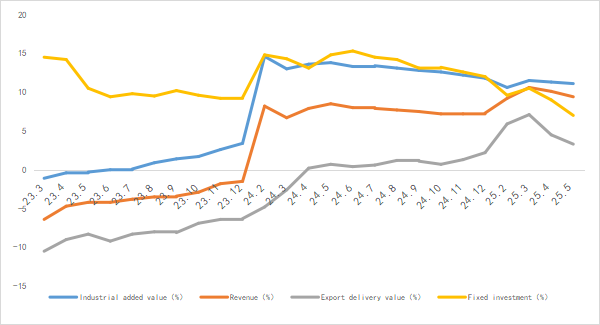

According to the latest data from the Semiconductor Industry Association (SIA), the global semiconductor market sales reached $58.98 billion in May 2025, a year-on-year increase of 17.1%, marking the 13th consecutive month with a year-on-year growth rate exceeding 17%.

In terms of regional markets, the Americas market maintained strong growth with a year-on-year increase of 32.0%.the Chinese mainland grew by 13.0% year-on-year.the Asia-Pacific region rose by 25.1% year-on-year.while sales in Japan and Europe increased slightly by 1.1% and 5.0% respectively.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

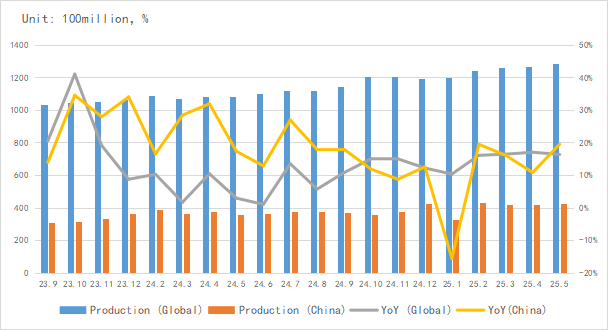

In terms of integrated circuit (IC) output, the global IC output in May was approximately 128.4 billion units, a year-on-year increase of 16.3%.China's output exceeded 42.35 billion units, with a cumulative output of 193.46 billion units from January to May, maintaining growth.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

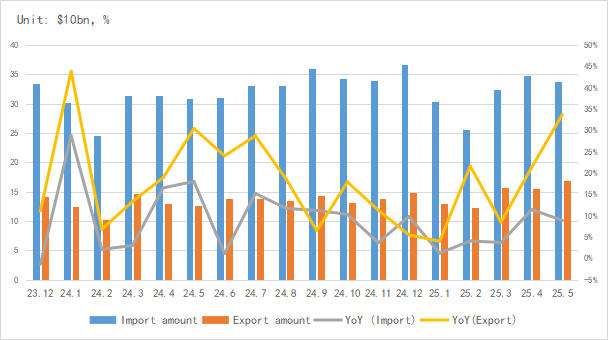

In terms of imports and exports, China's integrated circuit imports and exports maintained growth in May, with export growth surging to 33.7% year-on-year, hitting a new high for the same period in history.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

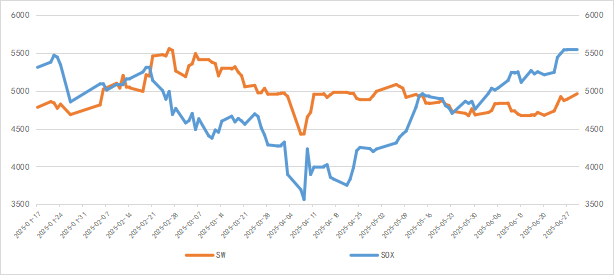

From the perspective of capital market indices, the SOX rose by 11.7% in June, and China's Semiconductor (SW) industry index increased by 5.3%. Both domestic and foreign semiconductor capital markets rebounded significantly due to the mitigation of tariffs.

Chart 6: Trend of SOX and SW Index inJune

Source: Wind,Chip Insights

For more information, please refer to the attached report.