Electronic Components Sales Market Analysis and Forecast (Q1 2025)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Global Manufacturing Industry Is Steadily Recovering

(2)The Electronic Information Manufacturing Industry Is Steadily Rising

(3)Improvement of Terminal Inventory

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Remain Strong

(2)The Semiconductor Trade Is Steadily Improving

(3)The Fluctuations of the Semiconductor Index Have Intensified

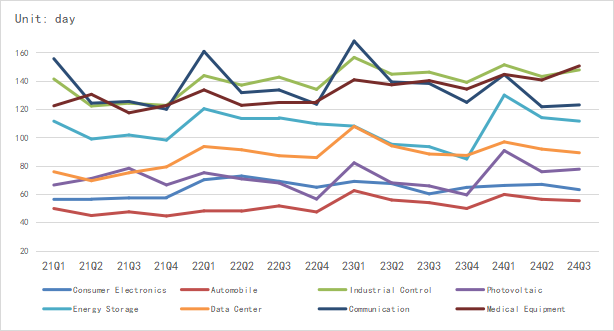

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment: The Demand for Equipment in China Is Growing

(2)Fabless/IDM: Pay Attention to the Impact of the Latest Tariff Adjustments

(3)Foundry: Profits Are Relatively Sluggish

(4)OSAT: Strong Profits

2.2 Distributor: Stable Orders

2.3 System Integration: Strong Growth in AI Foundry Services

2.4 Terminal Application

(1)Consumer Electronics: Demand Stabilizes and Profits Rebound

(2)New Energy Vehicles: Chinese Automakers Accelerate the Popularization of Intelligent Driving

(3)Industrial Control: Demand Has Obviously Bottomed out and Rebounded

(4)Photovoltaic: Losses Decrease and Overseas Orders Are Promising

(5)Energy Storage: Stable Order Growth but Obvious Profit Fluctuations

(6)Data Center: The Demand for the Supply Chain in the Chinese Market Has Exploded

(7)Communication: AI-Related Investment Becomes the Focus of the Industrial Chain Layout

(8)Medical Equipment: The Demand in the Chinese Market Is Uncertain

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)The Global Manufacturing Industry Is Steadily Recovering

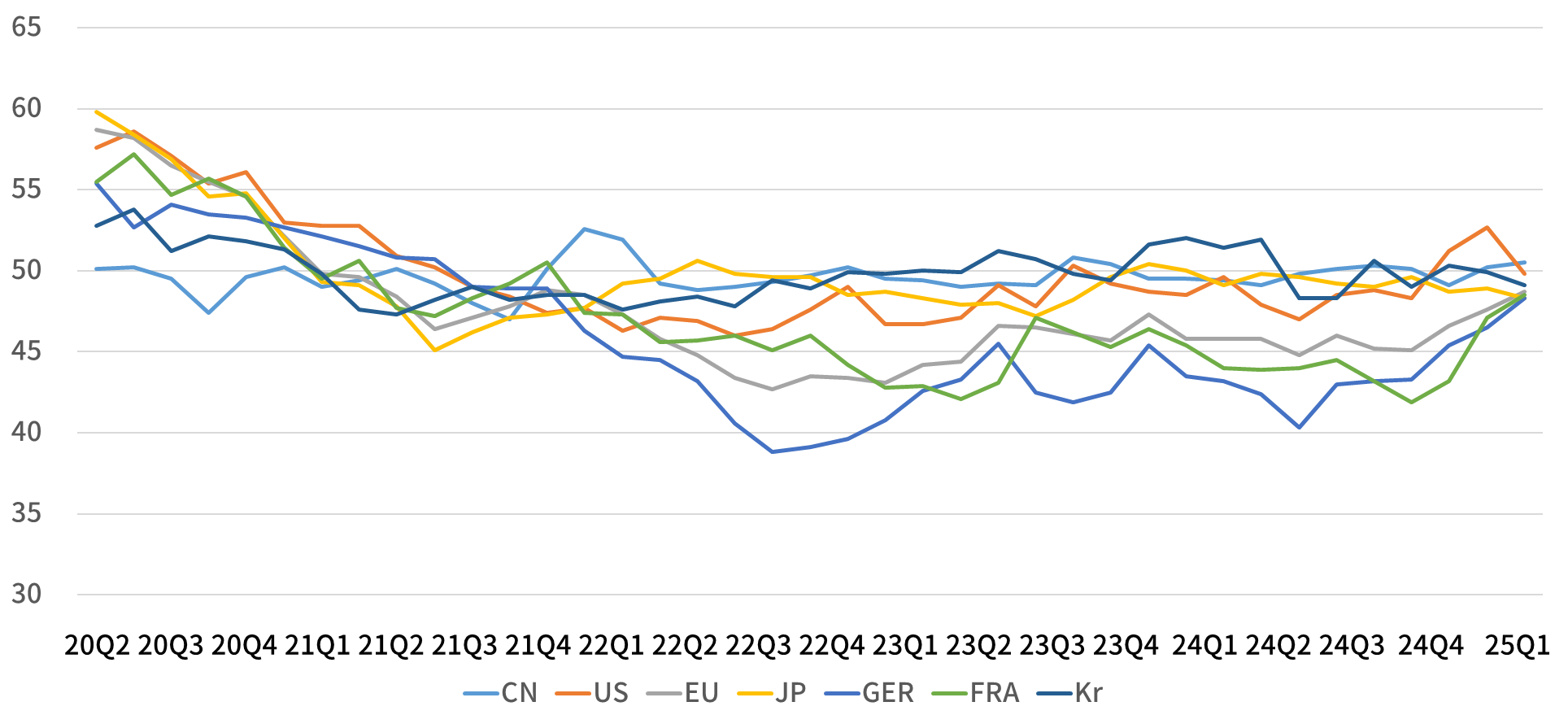

In Q1 2025, the recovery of the global manufacturing industry was relatively stable, but the economy continued to exhibit the characteristics of a new normal of low-speed growth. Apart from China and the United States, Japan, South Korea, and the European Union represented by Germany and France have relatively large fluctuations, and the economies of various regions continue to diverge. Among them, the overall recovery of the manufacturing industry in the European Union is still relatively weak, and Asia, represented by China, will still be the main engine of the world economy.

Chart 1: Manufacturing pmis of major global economies in Q1

Source: NBSPRC

It is worth noting that the new tariff policy of the United States has intensified the risks of global trade frictions and supply chain disruptions. Affected by this, both the OECD and IMF have lowered their global economic growth forecasts.

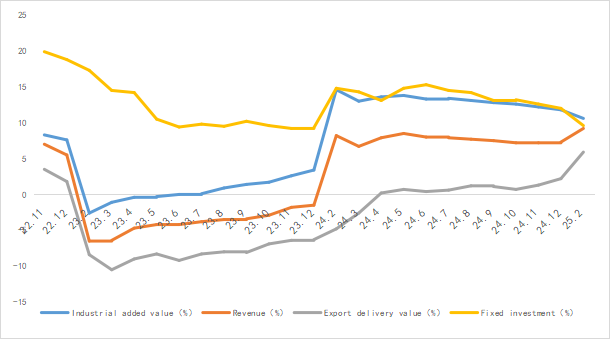

(2)The Electronic Information Manufacturing Industry Is Steadily Rising

From January to February 2025, the production of China's electronic information manufacturing industry grew relatively rapidly, exports continued to recover, economic benefits declined to some extent, the growth rate of investment decreased slightly, and the overall development trend of the industry was good.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

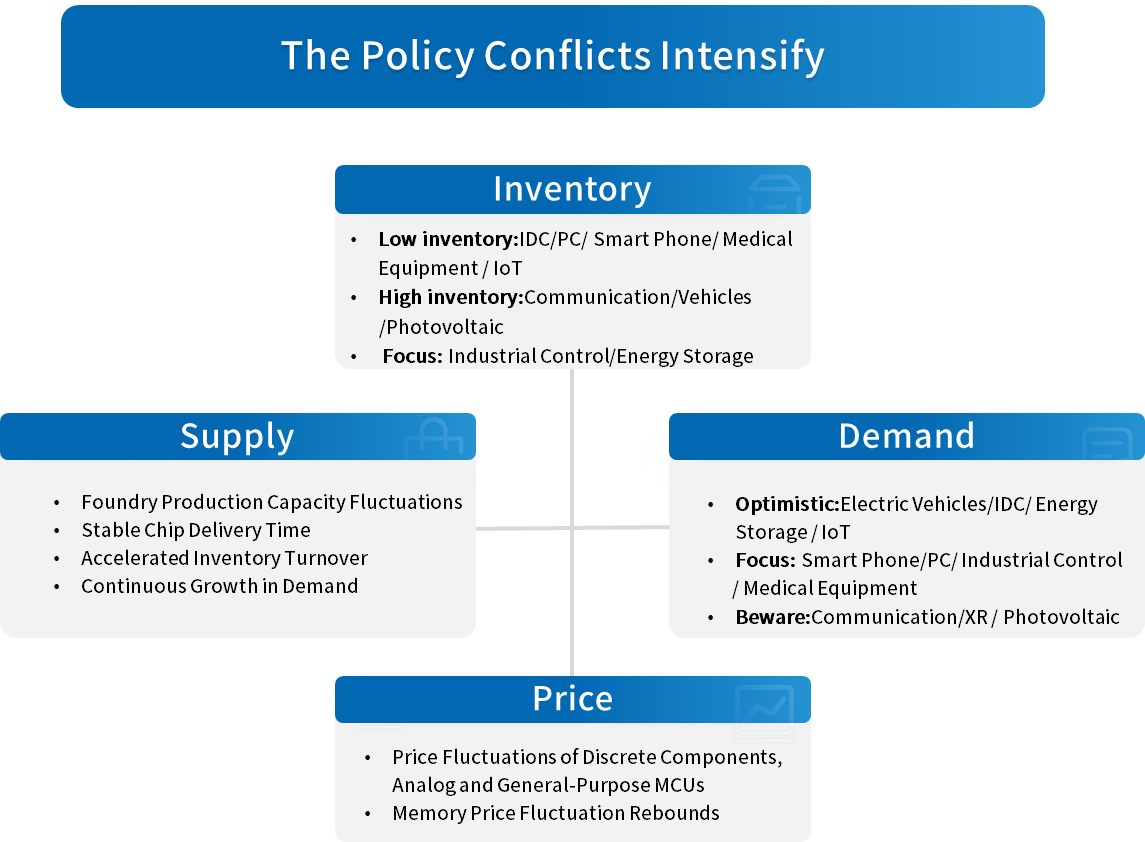

(3)Improvement of Terminal Inventory

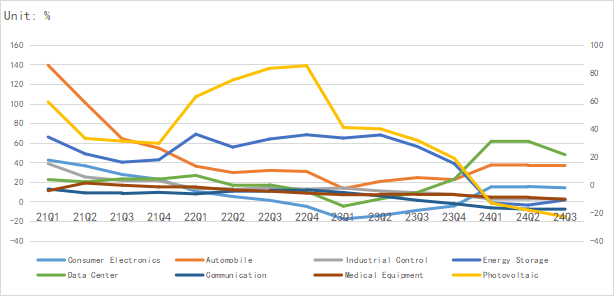

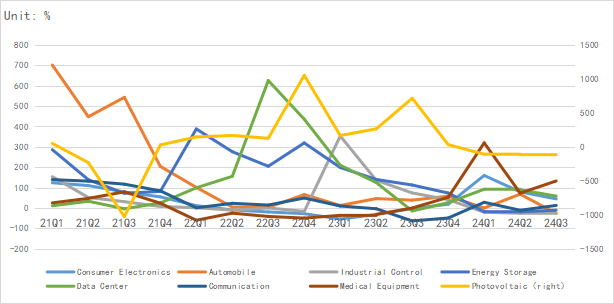

According to Chip Insights' analysis of the average revenue, net profit growth rate and inventory trends of leading manufacturers in various terminal markets, as of the fourth quarter (Q4) of 2024, the data center and consumer electronics sectors were relatively stable, the industrial and automotive sectors showed significant improvements, and the new energy sector experienced large fluctuations.

In terms of revenue growth rate, the data center remained robust, the demand for consumer electronics and automobiles was stable, and the decline in the photovoltaic sector narrowed.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

Regarding net profit growth, the data center and consumer electronics sectors were relatively stable. The profits of the automotive and industrial control sectors rebounded, while those related to new energy continued to be under pressure.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

In terms of inventory trends, the inventory liquidation in various terminal markets accelerated, and the industrial control, medical and communication sectors witnessed relatively significant improvements.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.