Electronic Components Sales Market Analysis and Forecast (February 2025)

Table Of Contents

Prologue

1 Macroeconomics in February

1.1 Global Manufacturing Continues Upward Trend

1.2 Stable Growth in Electronic Information Manufacturing Industry

1.3 The Positive Trends in Semiconductor Sales Continue

2 Chip Delivery Trend in February

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in February

4 Semiconductor Supply Chain in February

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

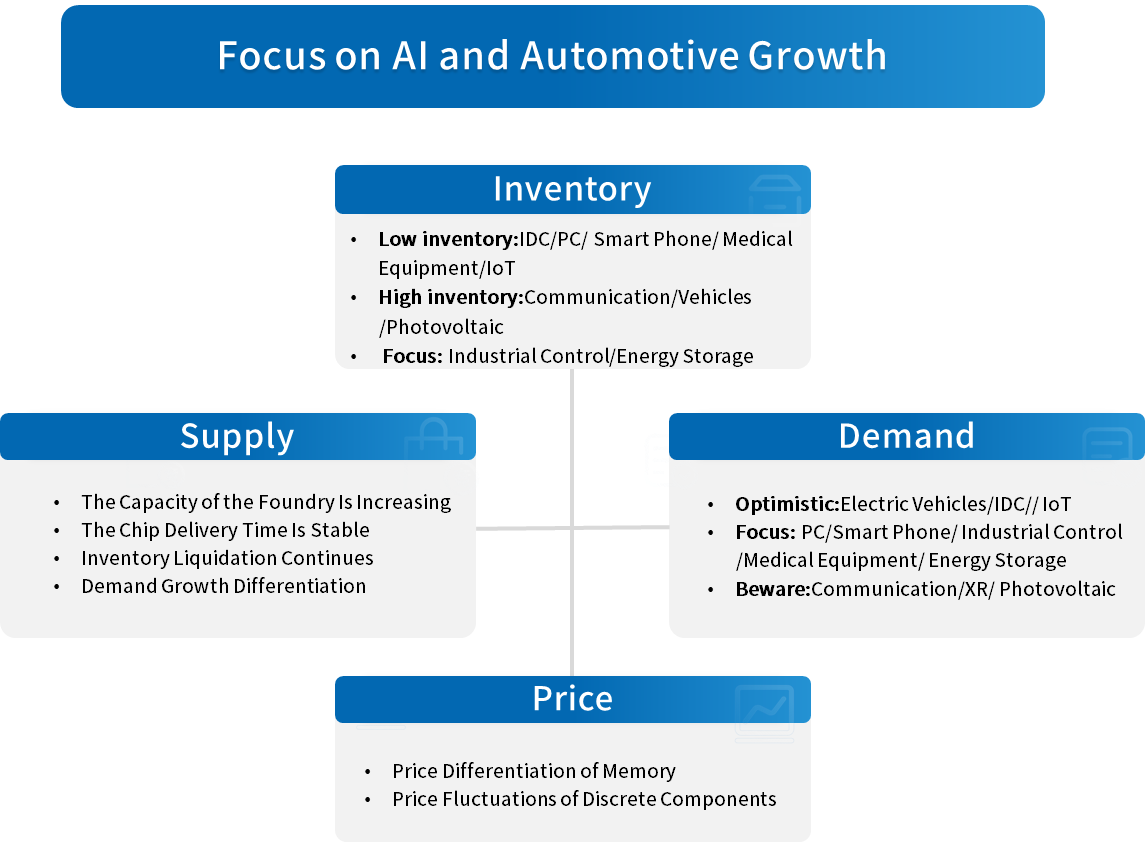

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in February

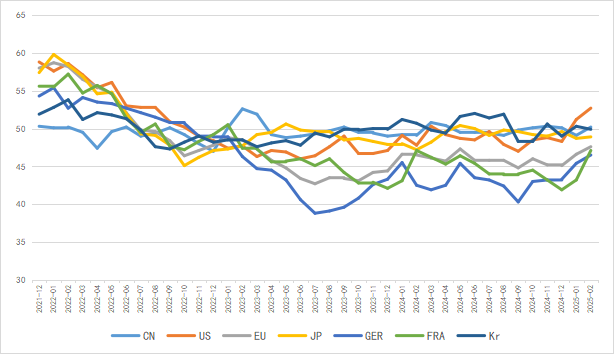

1.1 Global Manufacturing Continues Upward Trend

In February, global manufacturing maintained steady recovery momentum, yet faces multiple uncertainties in growth. Apart from China and the U.S., countries including Japan, South Korea, and key EU members like Germany and France remained below the boom-bust threshold (50% manufacturing PMI). Notably, U.S. tariff policies are driving up global supply chain costs, compounded by energy price volatility in Europe. These factors are creating stagflationary pressures on manufacturing recovery, potentially exacerbating market fluctuations.

Chart 1: Manufacturing PMI of the world's major economies in February

Source: NBSPRC

United Nations predicts China's manufacturing rebound to drive accelerated growth in Asian manufacturing sector.East Asia's economic growth rate to reach 4.7% in 2025, sustaining high-level performance.

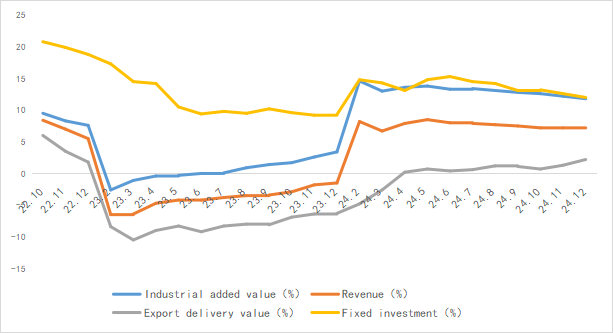

1.2 Stable Growth in Electronic Information Manufacturing Industry

From January to December 2024, China's electronic information manufacturing industry demonstrated steady production growth, improved export and investment performance, and maintained robust overall development momentum.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

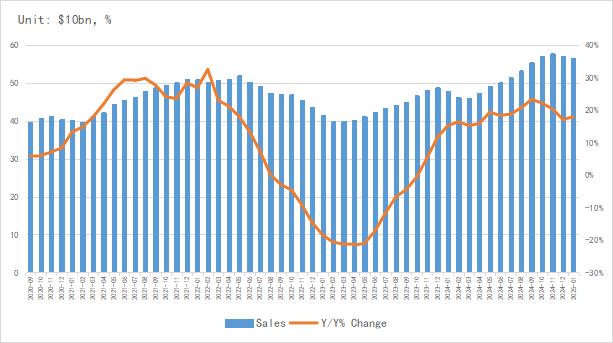

1.3 The Positive Trends in Semiconductor Sales Continue

According to the latest data from the Semiconductor Industry Association (SIA), the global semiconductor market sales in January 2025 amounted to $56.52 billion, a year-on-year increase of 17.9%. The year-on-year growth rate has exceeded 17% for nine consecutive months, and the market maintains a growth trend.

In terms of regional markets, the American market continues to boom, with a year-on-year growth of as high as 50.7%.In the Chinese mainland, affected by the season, there is a year-on-year growth of 6.5%. Japan has a slight recovery of 5.7%, and the sales in Europe continue to decline by 6.4%.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

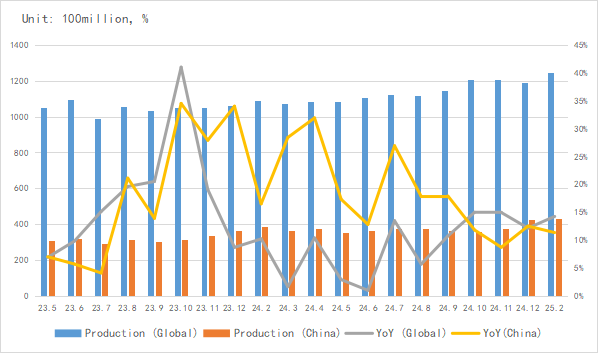

In terms of the output of integrated circuits, the global output of integrated circuits in February was approximately 124.4 billion pieces, a year-on-year increase of 14.2%.China's output exceeded 43 billion pieces, maintaining steady growth.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

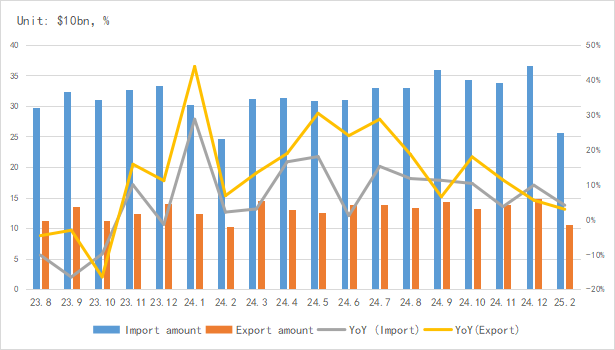

In terms of imports and exports, from January to February, China's imports and exports of integrated circuits maintained growth, with cumulative year-on-year increases of 2.7% and 11.9% respectively. On a monthly basis, there was a decline in February due to quarterly influences.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

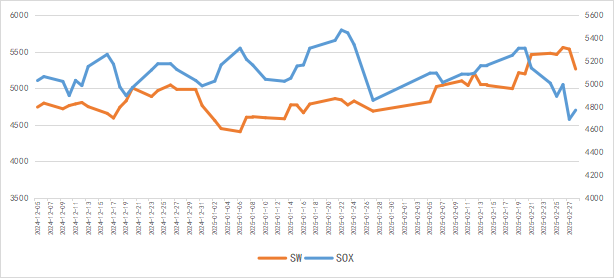

In terms of capital market indices, the SOX index fell by 6.4% in February, while China's Semiconductor SW industry index rose by 9.3%. The rise of Chinese AI models has had a significant impact on both domestic and foreign stock markets.

Chart 6: Trend of SOX and SW Index in February

Source: Wind,Chip Insights

For more information, please refer to the attached report.