Electronic Components Sales Market Analysis and Forecast (January 2025)

Table Of Contents Prologue

1 Macroeconomics in January

1.1 The Global Manufacturing Industry Continues Its Steady Recovery

1.2 The Electronic Information Manufacturing Industry Has Witnessed Rapid Growth

1.3 Semiconductor Sales Growth LED by China and the US, Reaching New Highs

2 Chip Delivery Trend in January

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in January

4 Semiconductor Supply Chain in January

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

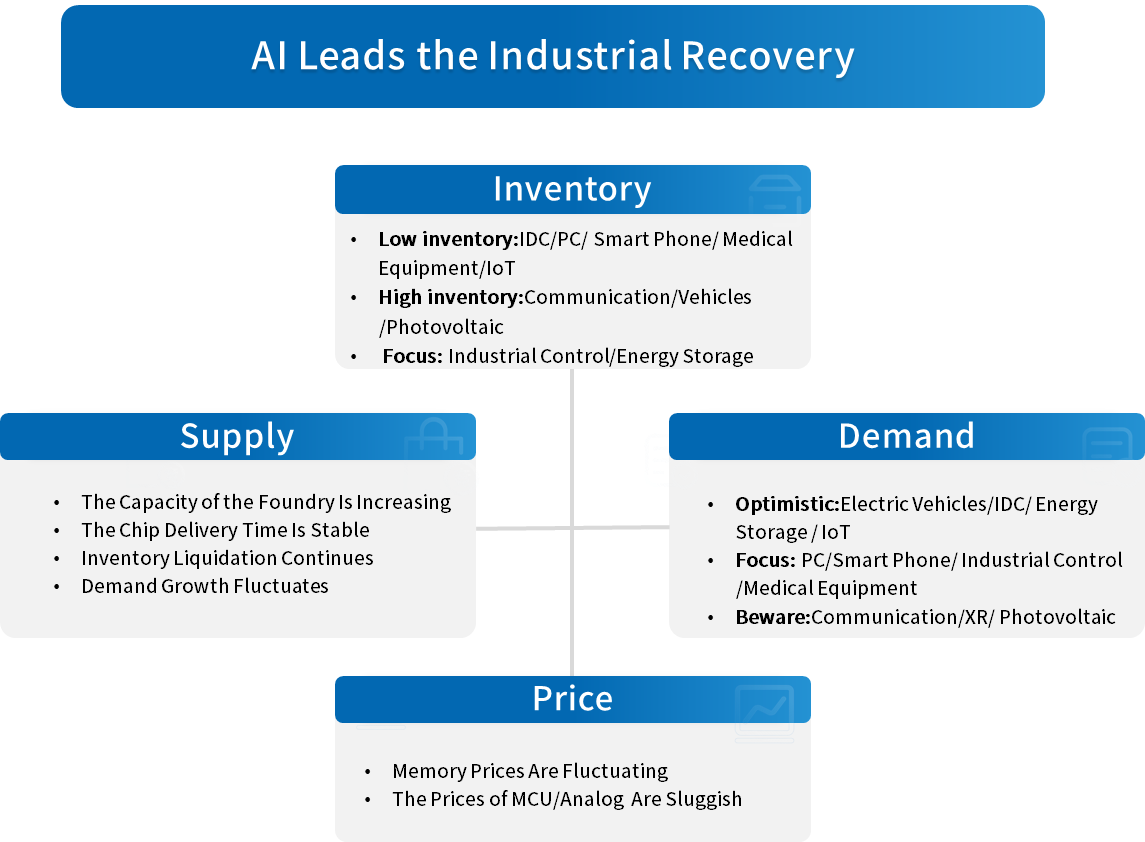

Prologue

1 Macroeconomics in January

1.1 The Global Manufacturing Industry Continues Its Steady Recovery

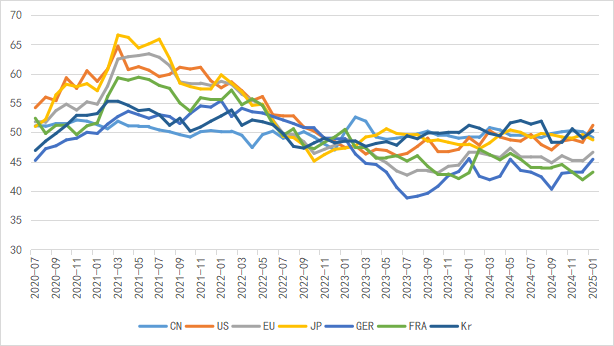

In January, the global manufacturing industry continued the steady recovery trend since the fourth quarter of last year, getting off to a good start. Among them, the United States and South Korea have a good growth momentum. The recovery of the European Union represented by Germany and France is unstable. China and Japan have some slowdown. Overall, although there are still uncertainties in the global economic recovery, initial signs of growth stability are emerging.

Chart 1: Manufacturing PMI of the world's major economies in January

Source: NBSPRC

The IMF forecasts that the global economic growth rate will reach 3.3% in 2025, higher than the 2.8% predicted by the United Nations in its latest projection.

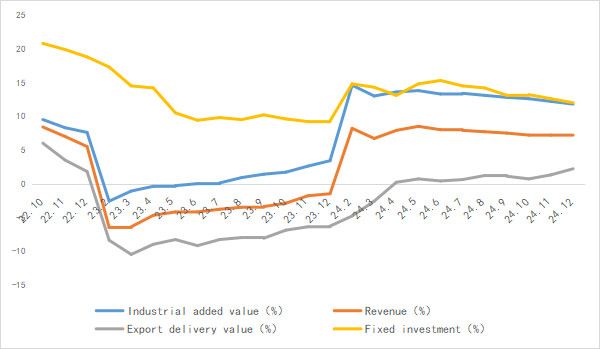

1.2 The Electronic Information Manufacturing Industry Has Witnessed Rapid Growth

In 2024, the production of China's electronic information manufacturing industry grew rapidly. Exports continued to recover, economic returns steadily improved, investment showed a clear upward trend, and the overall development of the industry was favorable.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

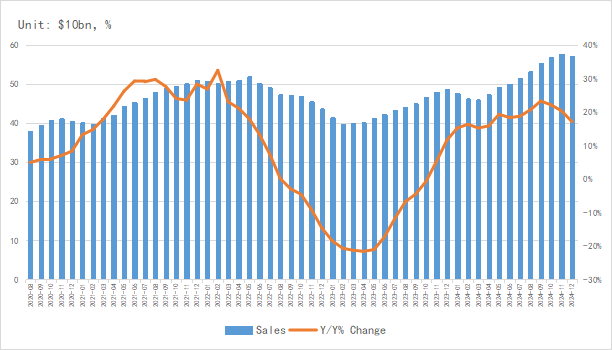

1.3 Semiconductor Sales Growth LED by China and the US, Reaching New Highs

According to the latest data from the SIA, the global semiconductor market sales in December 2024 were $56.97 billion, a year - on - year increase of 17.1%. The annual sales reached $627.6 billion, a year - on - year increase of 19.1%, breaking through the $600 - billion mark for the first time and setting an all - time high. It is expected that the market growth in 2025 will exceed double digits.

In terms of regional markets, looking at the annual data, the American market grew strongly, with a year - on - year increase as high as 44.8%. the Chinese mainland region increased by 18.3% year - on - year. Among them, the annual sales in Europe decreased by 8.1% year - on - year, and in Japan by 0.4%. The regional markets are significantly differentiated, and China and the US continue to lead the growth of the global semiconductor market.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

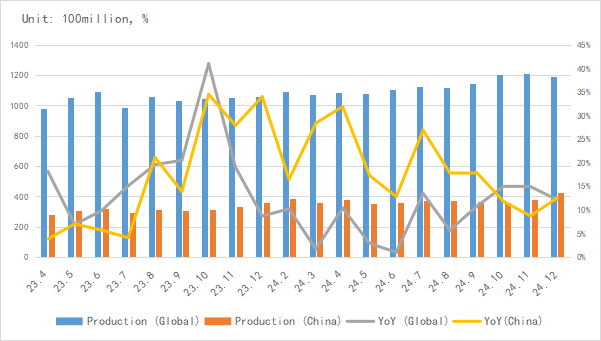

In terms of the output of integrated circuits, the global output of integrated circuits in December was approximately 119.6 billion pieces, a year - on - year increase of 12.1%. China's output was about 42.77 billion pieces, a year - on - year increase of 12.5%, and the cumulative annual output exceeded 451.4 billion pieces. The output of integrated circuits has maintained an upward trend, and the terminal demand has shown a significant recovery.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

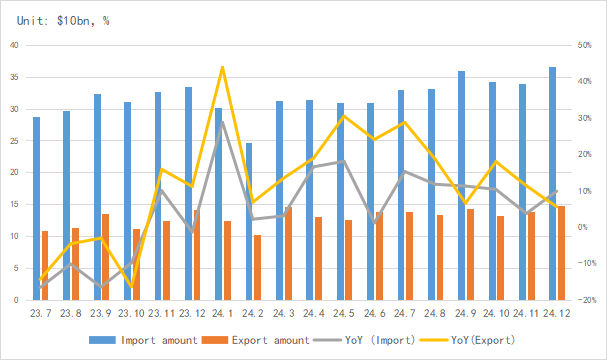

In terms of imports and exports, China's imports and exports of integrated circuits maintained growth in December. However, affected by the quarterly factor, exports declined.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

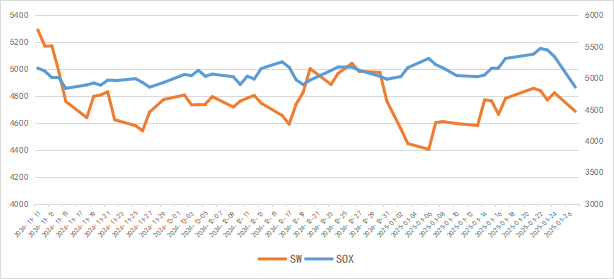

In terms of capital market indices, in January, the SOX index slightly declined by 0.1%, while the China Semiconductor SW industry index increased by 2.8%. The global semiconductor market showed significant fluctuations and adjustments.

Chart 6: Trend of SOX and SW Index in January

Source: Wind,Chip Insights

For more information, please refer to the attached report.