Electronic Components Sales Market Analysis and Forecast (Q4 2024)

Table Of Contents Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Continues to Recover

(2)The Electronic Information Manufacturing Industry Is Maintaining Stable and Positive Growth

(3)The Profitability of the Terminal Application Market Has Declined

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Continued to Be Robust

(2)The Growth of Semiconductor Trade Is Showing a Positive Trend

(3)The Fluctuations of the Semiconductor Index Continue

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment: Differentiation of Demand

(2)Fabless/IDM: Revenue Increase

(3)Foundry: Profits Are Relatively Sluggish

(4)OSAT: Profits Have Improved Significantly

2.2 Distributor: Uncertainty in the European and American Markets

2.3 System Integration: Consumer Growth Is Stable

2.4 Terminal Application

(1)Consumer Electronics: Profits Decline Under Fluctuating Demand

(2)New Energy Vehicles: Obvious Polarization Among Manufacturers and in the Market

(3)Industrial Control: The Bottoming-Out Trend of Demand Is Evident

(4)Photovoltaic: Both Revenues and Profits Decline under the Price War

(5)Energy Storage: Manufacturers' Revenues and Profits Improve under the Recovery of Demand

(6)Data Center: The Market Grows Strongly under Favorable Demand

(7)Communication: Orders and Investments Remain Depressed

(8)Medical Equipment: Revenues Slow Down Affected by the Chinese Market

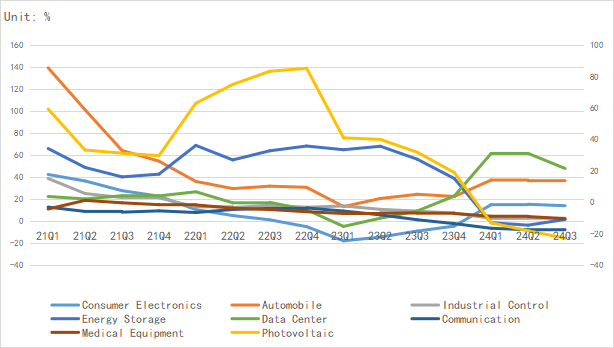

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

5 Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Continues to Recover

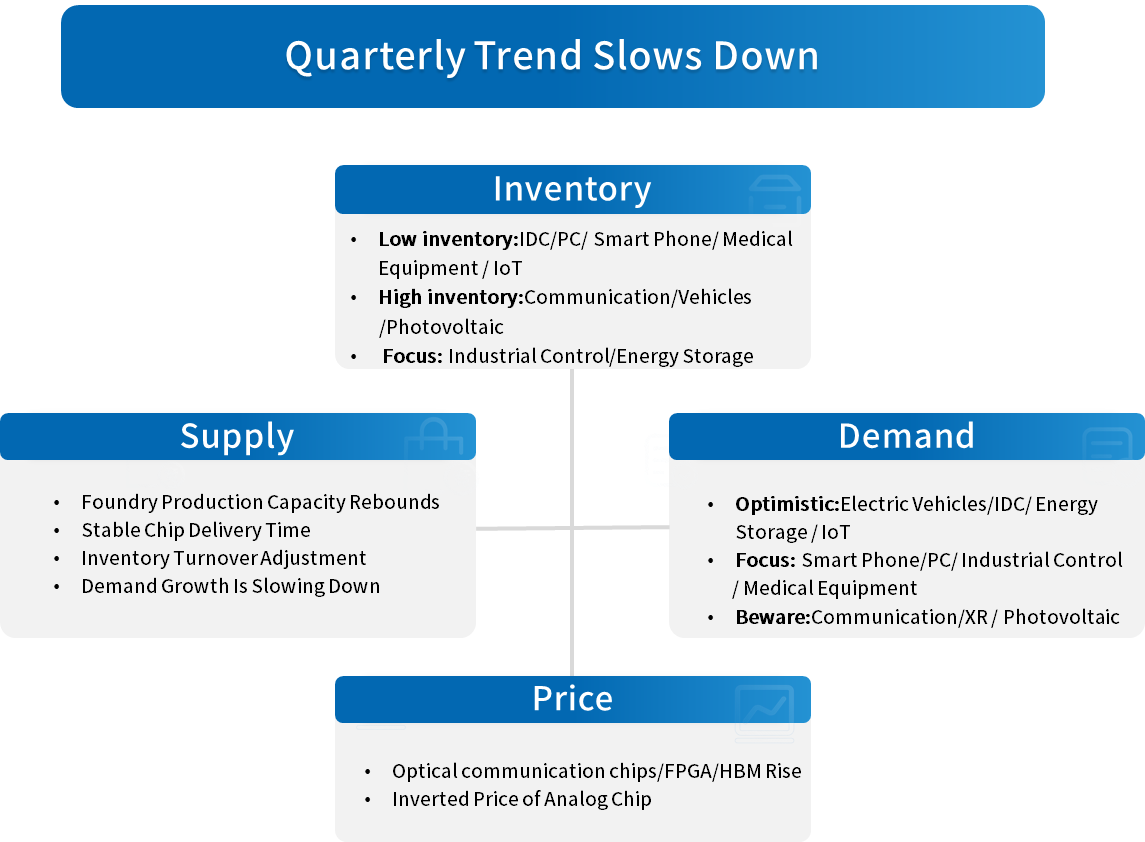

In Q4 2024, the global manufacturing industry maintained a steady recovery, and the overall growth level was better than that in the same period of 2023. Except for China, countries including the United States, Japan, South Korea and the European Union were all below the boom-bust line, which means that the driving force for the global economic recovery is still insufficient. Looking ahead to 2025, the global economy is expected to continue the steady recovery trend seen in 2024, but uncertainties still remain.

Chart 1: Manufacturing pmis of major global economies in Q4

Source: NBSPRC

The forecasts of economic growth rates for 2025 by major global institutions are all not lower than those for 2024. The IMF predicts that the global economic growth rate will be 3.2% in 2025, and the OECD has raised its expectation to 3.3%. It is worth noting that factors such as geopolitical conflicts and trade protectionism will continue to have an impact on the global economic recovery, and the tariff increase measures to be adopted by the US government will bring new uncertainties to the recovery of the world economy.

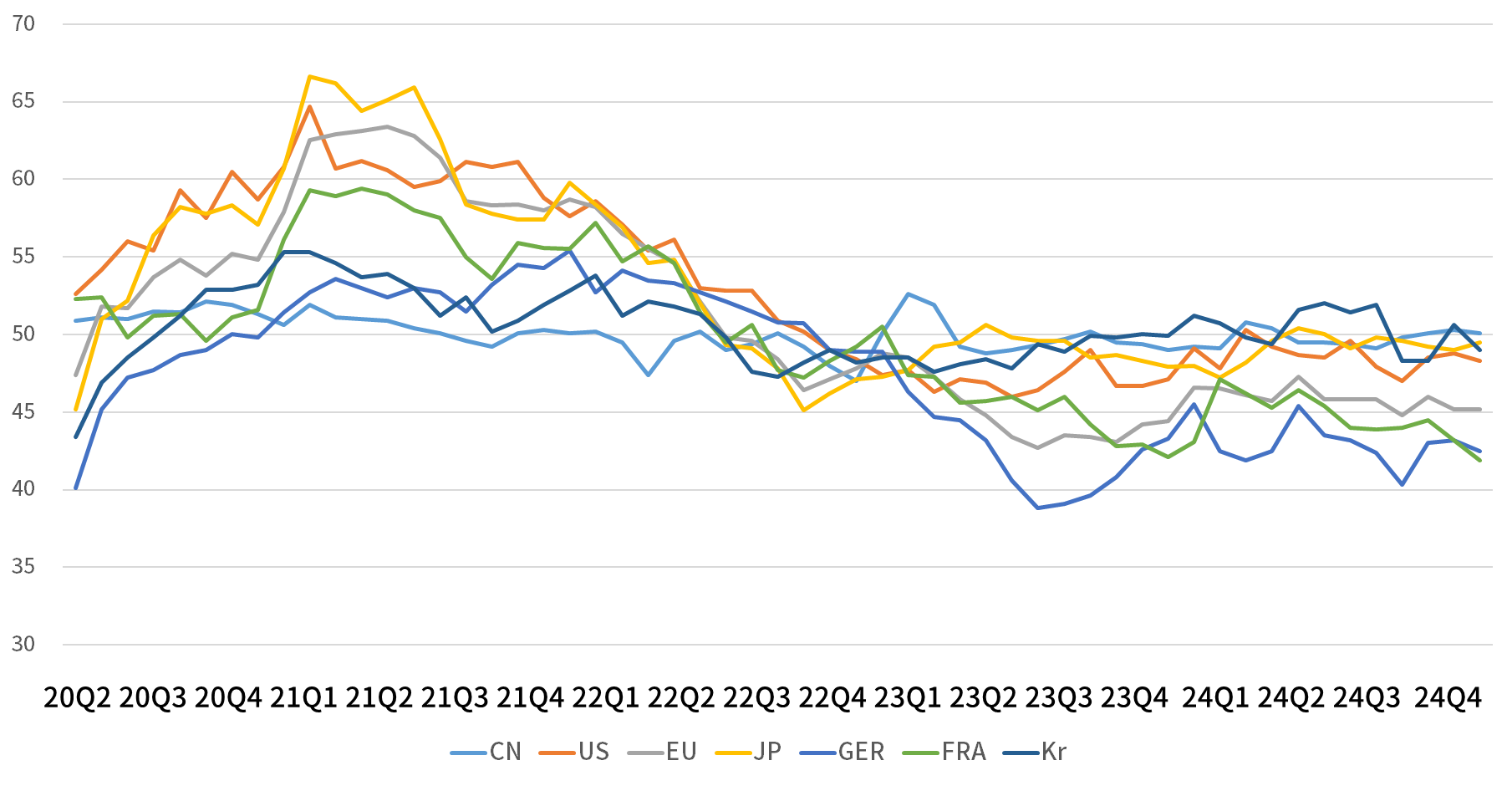

(2)The Electronic Information Manufacturing Industry Is Maintaining Stable and Positive Growth

From January to November 2024, China's electronic information manufacturing industry witnessed relatively rapid production growth. The decline in exports continued to narrow, its performance remained stable and on an upward trend, the growth momentum of investment was evident, and regional differentiation was pronounced.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

(3)The Profitability of the Terminal Application Market Has Declined

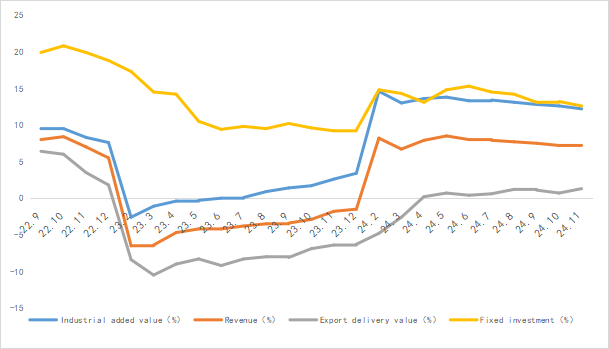

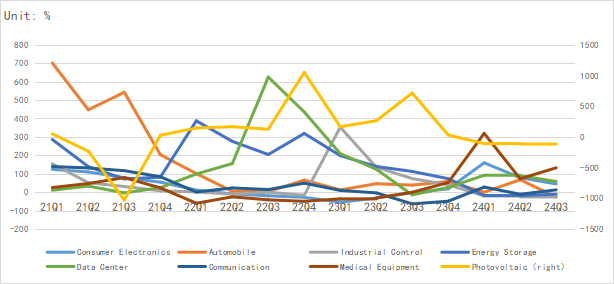

Based on Chip Insights' analysis of the average revenue, net profit growth rate, and inventory trends of leading manufacturers in various terminal markets, as of the third quarter of 2024, the data center, automotive, and consumer electronics sectors maintained high growth. The demand for consumer electronics and medical devices remained stable, the recovery in the energy storage and industrial control fields was good, while the photovoltaic and communication sectors witnessed significant declines.

In terms of revenue growth rate, the data center maintained a strong performance but experienced a certain degree of decline. The demand for consumer electronics and automobiles was stable, and the photovoltaic sector saw a relatively large decline.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

In terms of net profit growth, the profits of data centers, consumer electronics, and medical devices remained stable. It is worth noting that the decline in photovoltaic profit growth has expanded for three consecutive quarters, and manufacturers' profits continue to be under pressure.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

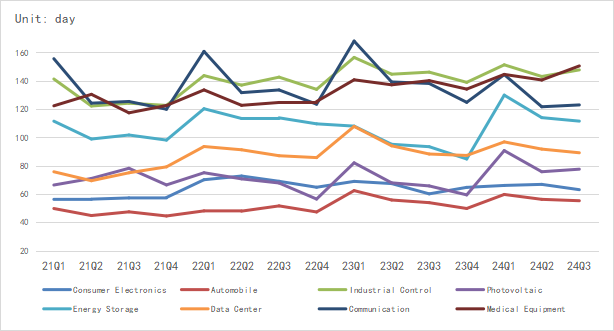

In terms of inventory trends, the inventories in various terminal markets have basically remained stable and continued to be optimized, with significant improvements seen in the energy storage sector.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.