2024 Electronic Component Sales Market Analysis and 2025 Trend Outlook

Table Of Contents

Prologue

1 Review of the Electronic Components Industry in 2024

1.1 Major Events and Impacts in the Annual Supply Chain

1.2 Delivery Time and Trend Analysis of Key Brands

1.3 Import and Export and Going Global of Electronic Components

(1)China's Semiconductor Import and Export Remain Positive

(2)The Overseas Expansion of Electronic Components Has Become a New Highlight

1.4 Summary of the Electronic Component Supply Chain in 2024

(1)Growth Forecast for Each Link in the Upstream of Electronic Components

(2)The Impact of Inventory Reduction in the Supply Chain Continues

(3)Both the Volume and Price of AI-Related Chip Categories Rose

2 Outlook on Opportunities for Electronic Components in 2025

2.1 Growth Forecast for Each Link in the Upstream of Electronic Components

(1)Fabless/IDM: Stable Growth in Orders

(2)Distributors: Optimistic About Recovery

(3)Tier1: Double Decrease in Revenue and Profit

(4)EMS/ODM/OEM: Optimistic About AI Growth

2.2 Outlook for Main Application Market Opportunities

(1)AI and New Energy Are at the Forefront of Growth

(2)Growth Forecast of Electronic Components in Key Markets

2.3 AI Analysis of Supply Chain Opportunities

(1)AI Drives Both the Volume and Price of Data Center Infrastructure to Rise

(2)AI Accelerates Consumer Electronics to Enter a Replacement Cycle

(3)AI Drives the Automotive Industry to Evolve towards Intelligence

2.4 Analysis on the Import and Export Markets and Trends of Key Applications

(1)Automobiles: Exports of new energy vehicles maintain high growth

(2)Photovoltaic: Europe is the Core Export Market

(3)Energy Storage: The United States Has Become the Core Market for New Orders

(4)Consumer Electronics: Supply Chain Migration Impact to be Monitored

3 Analysis of Global Electronic Component Industry Trends in 2025

3.1 Semiconductor Growth May Slow Down

3.2 AI-Driven Growth is Prominent

3.3 Component Distribution Market Landscape to be Remodeled

3.4 2025 China Electronic Component Trade and Overseas Layout Trends

(1)China's Integrated Circuit Trade Deficit Continues to Narrow

(2)Southeast Asia and South America Will Become Key Focuses for Electronic Component Manufacturers Going Global

3.5 Policy and Tariff Changes Are Frequent, Increasing Uncertainties in the Supply Chain

Disclaimer

Prologue

1 Review of the Electronic Components Industry in 2024

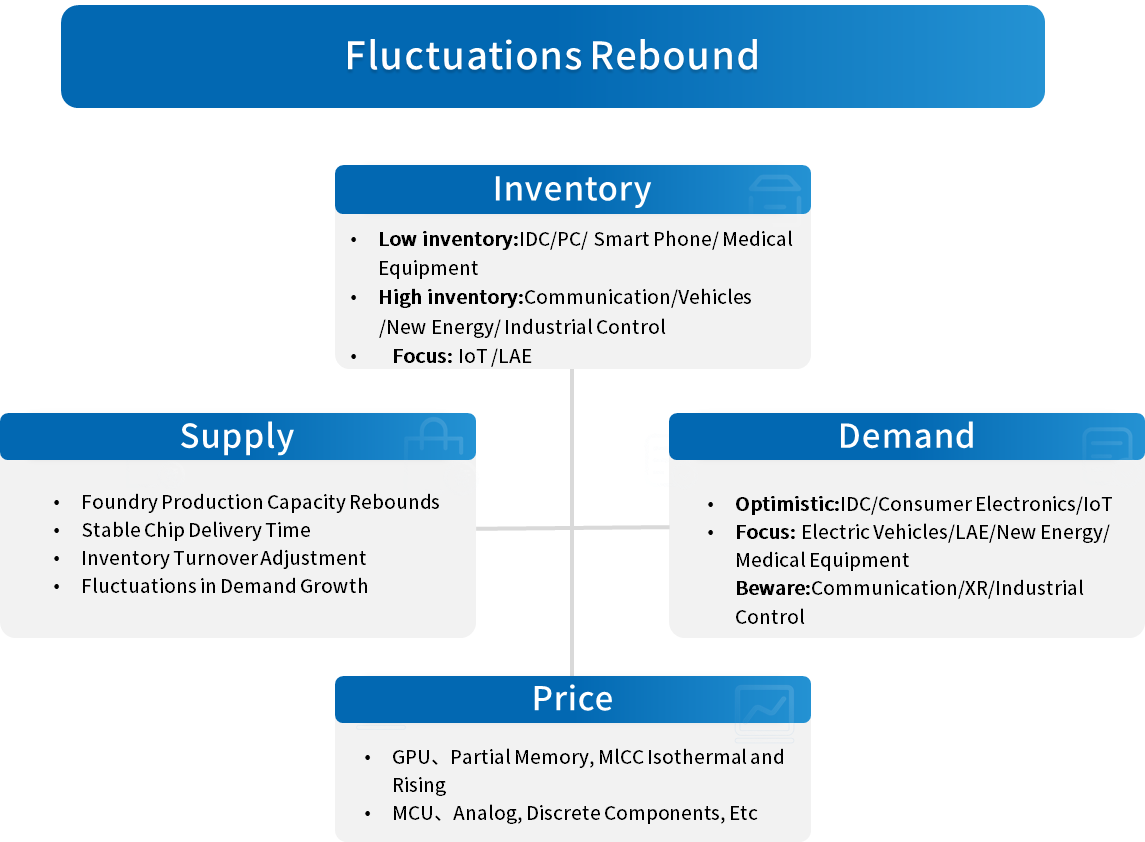

Looking back on 2024, problems such as the weak downward trend of the macroeconomy, frequent trade conflict games, and intensified industrial differentiation and fragmentation have worsened. However, driven by the demands of consumer electronics, AI, electric vehicles, and new energy, the global semiconductor sales have rebounded strongly. From the perspective of the electronic component supply chain, the delivery time of chips in various categories has returned to normal, prices have been significantly repaired, and some have rebounded significantly. The delivery rhythm of customers is stable. However, the inventory digestion is not as expected, resulting in the continuous oscillation of the supply chain. Looking forward to the new year, although the structural differentiation in the global semiconductor market still exists, and the recovery of the automotive and industrial sectors is weaker than expected, the overall growth trend is stable, and the industry is gradually entering an upward cycle.

1.1 Major Events and Impacts in the Annual Supply Chain

In 2024, policy and tariff changes had a significant impact on the global electronic component supply chain. The US further tightened its controls on China, and the EU actively promoted the adjustment of tariffs on electric vehicles imported from China. The aftereffects of Trump's re - election victory have intensified global conflicts in fields such as semiconductors, electric vehicles, artificial intelligence, new energy, and consumer electronics. Notably, Intel is facing difficulties, and WT has surpassed Arrow to rank first in revenue, indicating continuous changes in the semiconductor industry pattern. More than 14,600 Chinese chip manufacturers have been cancelled or closed down, and the semiconductor industry will still face challenges in the coming year.

For more information, please refer to the attached report.