Electronic Components Sales Market Analysis and Forecast (December 2024)

Table Of Contents

Prologue

1 Macroeconomics in December

1.1 Global Manufacturing Industry Regains Stability

1.2 The Electronic Information Manufacturing Industry Has Rebounded Rapidly

1.3 Semiconductor Sales Remain Strong

2 Chip Delivery Trend in December

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in December

4 Semiconductor Supply Chain in December

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

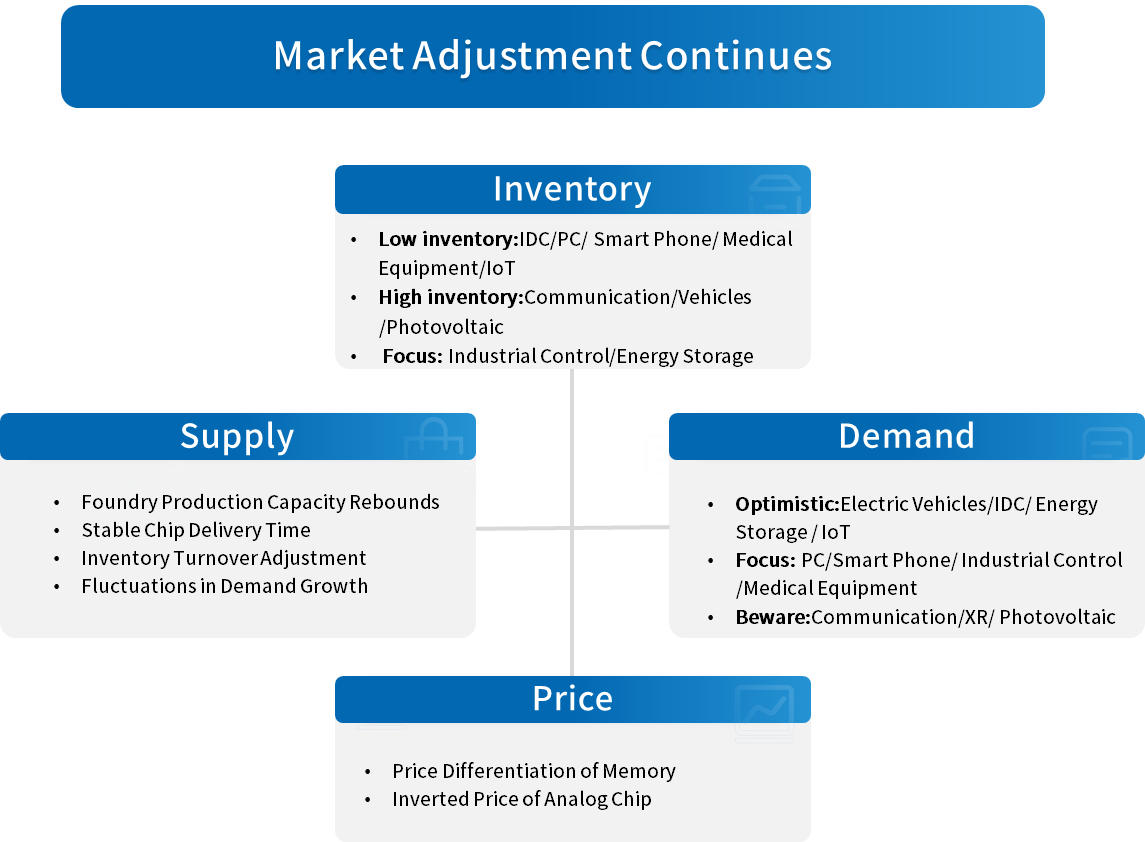

Prologue

1 Macroeconomics in December

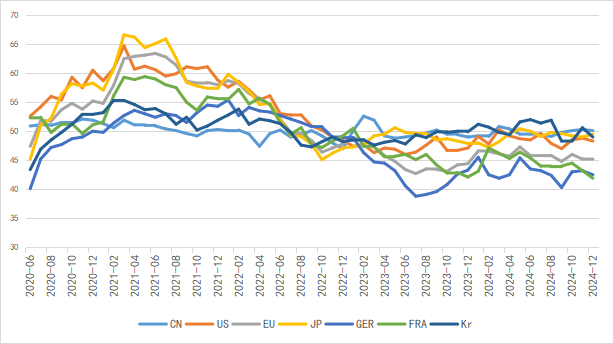

1.1 Global Manufacturing Industry Regains Stability

In December, the global manufacturing industry continued its steady growth trend. Among them, China has remained stable in the expansion range for three consecutive months, while the recovery momentum of the European Union represented by Germany and France is still relatively weak. Generally speaking, the global economy still shows a certain degree of resilience, but the differentiation of the global economy is obvious and the problem of unbalanced economic recovery is prominent.

Chart 1: Manufacturing PMI of the world's major economies in December

Source: NBSPRC

The United Nations predicts that the world economy is expected to grow by 2.7% in both 2024 and 2025, and the global economy will continue to maintain moderate growth.

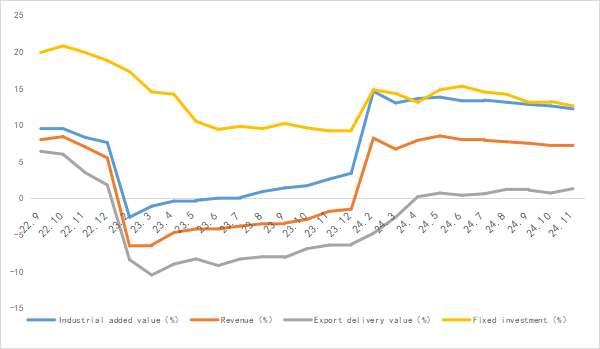

1.2 The Electronic Information Manufacturing Industry Has Rebounded Rapidly

From January to November 2024, China's electronic information manufacturing industry witnessed relatively rapid production growth. The decline in exports continued to narrow, its performance steadily improved, the growth momentum of investment was evident, and regional differentiation was pronounced.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

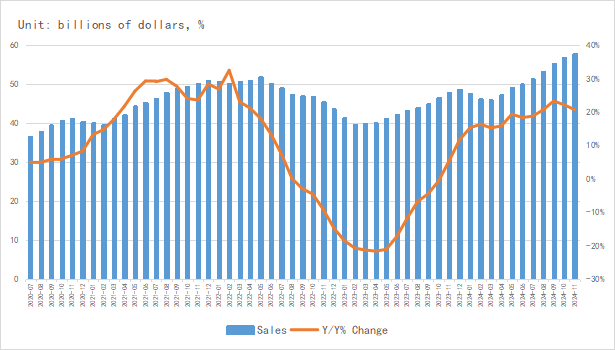

1.3 Semiconductor Sales Remain Strong

According to the latest data from SIA, the global semiconductor market sales in November 2024 were $57.82 billion, a year-on-year increase of 20.7%, setting a record for the highest monthly sales total in history. Monthly sales increased by 1.7% month on month, rebounding for 8 consecutive months.

In terms of regional markets, the Americas market has the strongest growth, with a year-on-year increase of 54.9%.Chinese Mainland increased by 12.1% year on year. Among them, monthly sales in Europe decreased by 5.8% year-on-year, with a significant impact from weak demand in the automotive and industrial sectors.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,Chip Insights

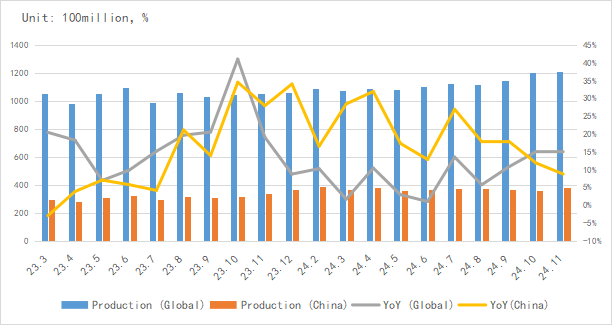

In terms of integrated circuit production, the global output of integrated circuits was approximately 120.8 billion units in November, with a year-on-year increase of 14.9%. China's output was around 37.6 billion units, with a year-on-year increase of 8.7%. The production of integrated circuits maintained an upward trend.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

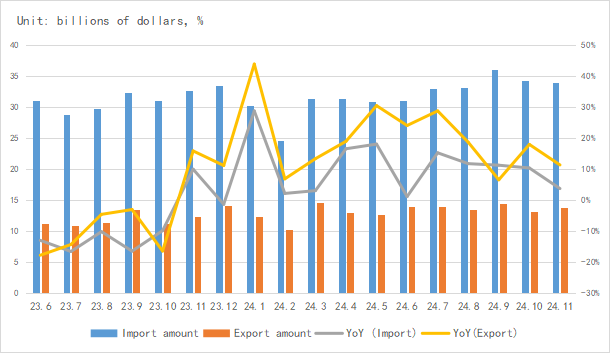

In terms of imports and exports, in November, the growth rate of China's integrated circuit imports slowed down, while the export value maintained rapid growth, and the trade deficit of the integrated circuit industry decreased.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

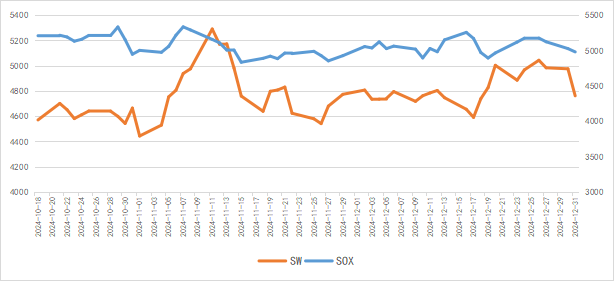

From the perspective of capital market indices, in December, the SOX and the China Semiconductor SW industry indices dropped by 1.5% and 0.9% respectively, indicating that the fluctuations and adjustments in the global semiconductor market continued.

Chart 6: Trend of SOX and SW Index in December

Source: Wind,Chip Insights

For more information, please refer to the attached report.