Electronic Components Sales Market Analysis and Forecast (November 2024)

Table Of Contents

Prologue

1 Macroeconomics in November

1.1 Global Manufacturing Industry Steadily Recovers

1.2 The Electronic Information Manufacturing Industry Maintains Growth

1.3 Optimistic Semiconductor Sales Expectations

2 Chip Delivery Trend in November

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventosry in November

4 Semiconductor Supply Chain in November

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in November

1.1 Global Manufacturing Industry Steadily Recovers

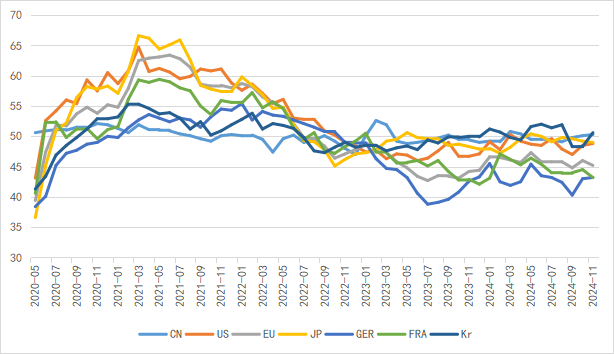

In November, the global manufacturing industry maintained a stable recovery trend. Among them, China has shown an accelerated recovery trend for two consecutive months, while the United States, Japan, and South Korea have remained relatively stable. The recovery trend of the European Union, represented by Germany and France, is still relatively weak. It should be noted that Europe, as one of the major economies in global manufacturing growth, is expected to remain stagnant until Q2 2025, resulting in a weak foundation for sustained and stable recovery of the global economy.

Chart 1: Manufacturing PMI of the world's major economies in November

Source: NBSPRC

The IMF predicts that the global economic growth rate will remain stable at around 3.2% in 2024, continuing to be lower than the average annual growth rate of 3.8% from 2000 to 2019, indicating that the current economic recovery is still relatively weak.

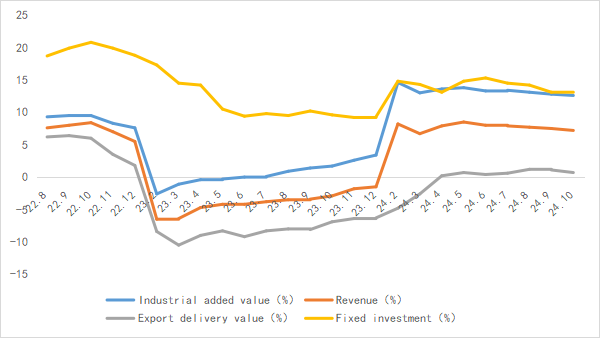

1.2 The Electronic Information Manufacturing Industry Maintains Growth

From January to November 2024, the production growth rate of China's electronic information manufacturing industry was relatively fast, exports maintained growth, and efficiency steadily improved. The overall development trend of the industry was good.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

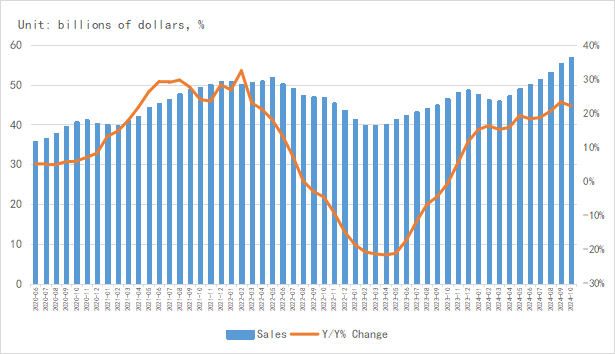

1.3 Optimistic Semiconductor Sales Expectations

According to the latest data from SIA, the global semiconductor market sales in October 2024 were $56.88 billion, a year-on-year increase of 22.1%. Monthly sales increased by 4.1% month on month, marking the seventh consecutive month of recovery. Among them, SIA and WSTS have simultaneously raised their global sales forecasts for 2024 to 19% and 20%, respectively, showing optimism for the global semiconductor performance for the whole year.

In terms of regional markets, the Americas market still has the strongest growth, with a year-on-year increase of 54.0%. Chinese Mainland saw a year-on-year growth of 17.0%. It is worth noting that monthly sales in Europe decreased by 7.0% year-on-year, and the weak impact continues.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,SEMI,Chip Insights

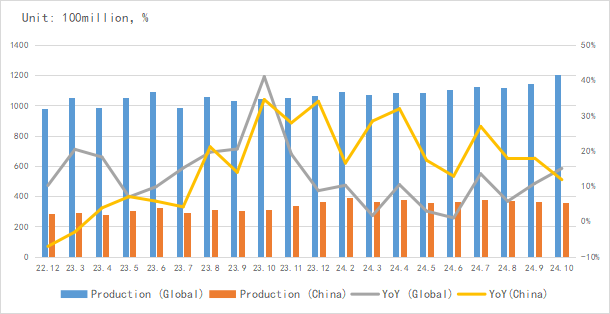

From the perspective of integrated circuit production, the global integrated circuit production in October was about 120.5 billion blocks, a year-on-year increase of 15.0%. China's production is about 35.86 billion yuan, a year-on-year increase of 11.8%.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

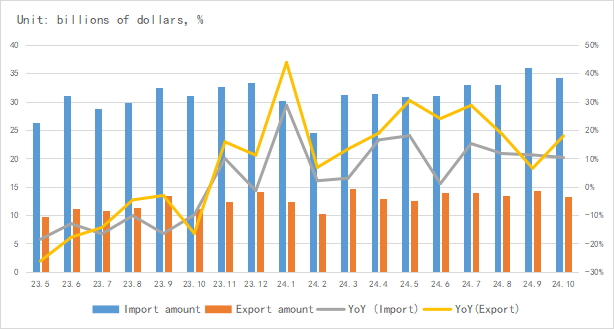

In terms of imports and exports, China's integrated circuit imports and exports remained strong in October, and the trade growth of the integrated circuit industry remained stable.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

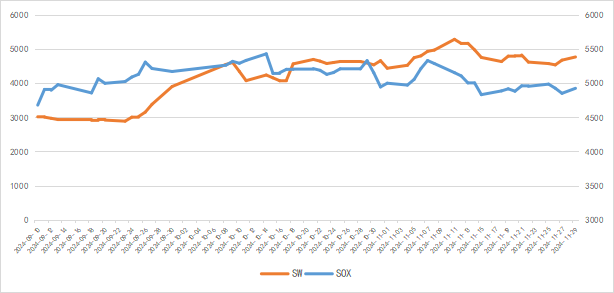

According to the capital market index, the SOX slightly fell by 1.5% in November, while the China Semiconductor SW Index rose by 7.4%. The global semiconductor capital market is subject to frequent fluctuations due to policy influences, while the Chinese market remains stable.

Chart 6: Trend of SOX and SW Index in November

Source: Wind,Chip Insights

For more information, please refer to the attached report.