Electronic Components Sales Market Analysis and Forecast (Q3 2024)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Continues to Be Sluggish

(2)Stable Growth of Electronic Information Manufacturing Industry

(3)Terminal Market Demand Differentiation

1.2 Semiconductor Market Analysis

(1)Semiconductor Production and Sales Remain Strong

(2)Stable Growth in Semiconductor Trade

(3)Semiconductor Index Fluctuation Adjustment

1.3 Chip Delivery and Price Trend

(1)Chip Delivery and Price Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

2.2 Distributor

2.3 System Integration

2.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

(8)Medical Equipment

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Continues to Be Sluggish

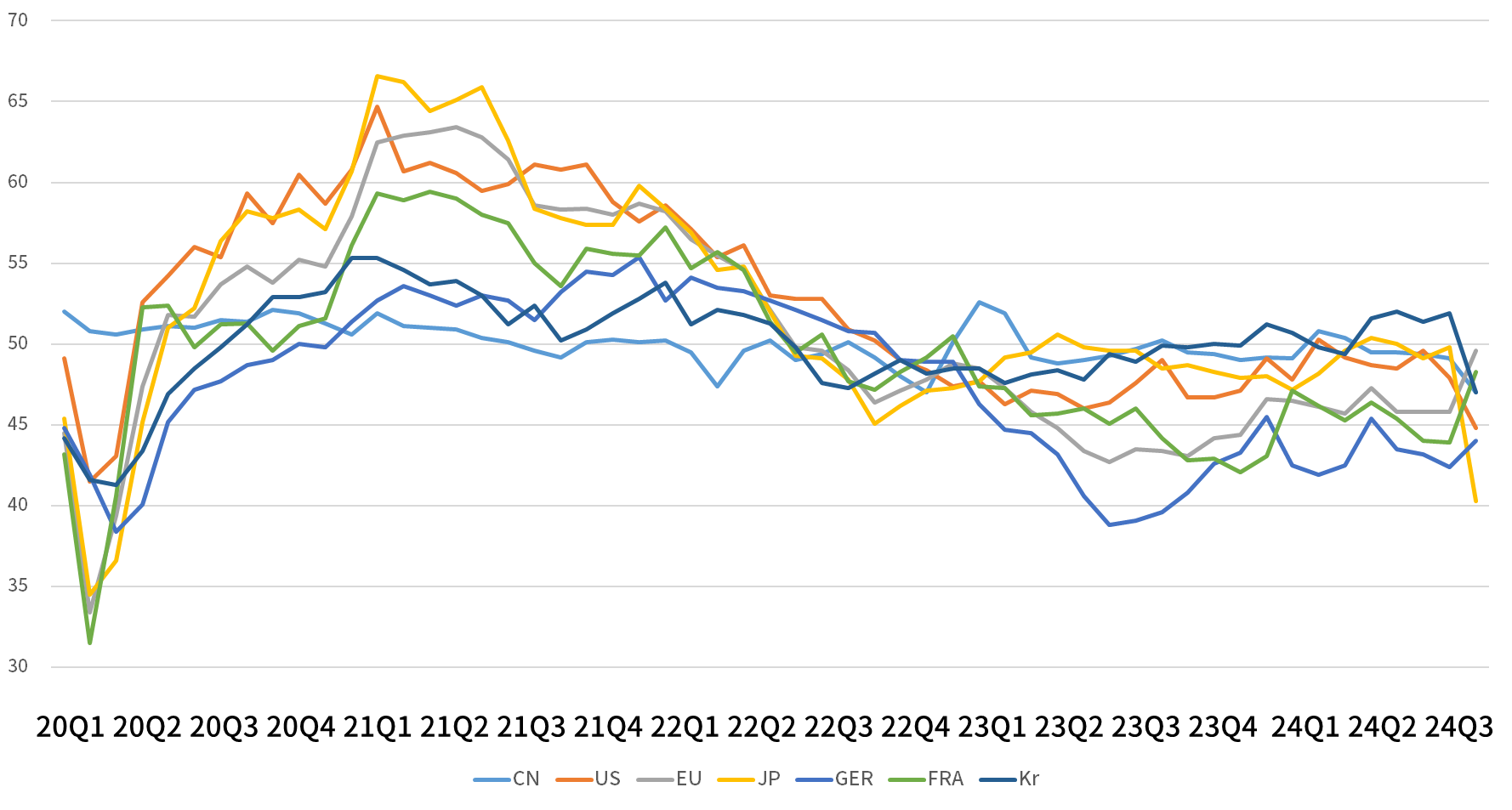

In Q3 2024, the recovery of the global manufacturing industry still needs to be strengthened, and there is significant downward pressure. Except for South Korea, China, the United States, Japan, and the European Union are all below the balance line of prosperity and decline, with geopolitical turmoil exceeding expectations. It is worth noting that China remains a stabilizer for global economic recovery, while the manufacturing industry in the European Union is weak and facing increasing downward pressure.

Chart 1: Manufacturing pmis of major global economies in Q3

Source: NBSPRC

In terms of growth expectations, major institutions around the world are relatively optimistic. The latest OECD report has raised its economic growth forecast for 2024 from 3.1% to 3.2%, while ADB expects the Asia Pacific region to grow by 5.0% in 2024.

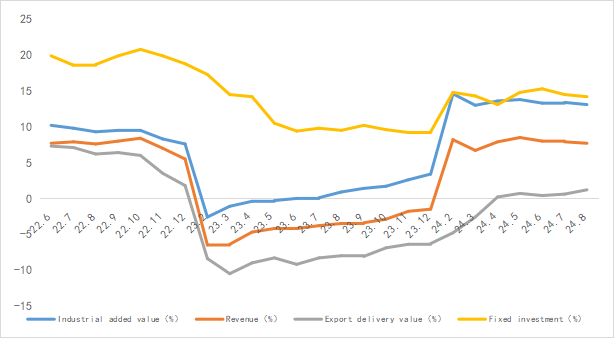

(2)Stable Growth of Electronic Information Manufacturing Industry

From January to August 2024, the production of China's electronic information manufacturing industry grew rapidly, exports continued to rebound, efficiency remained stable and improved, investment tended to be stable, and the industry's development trend was good.

Chart 2: Latest operation of electronic information manufacturing industry

Source: MIIT

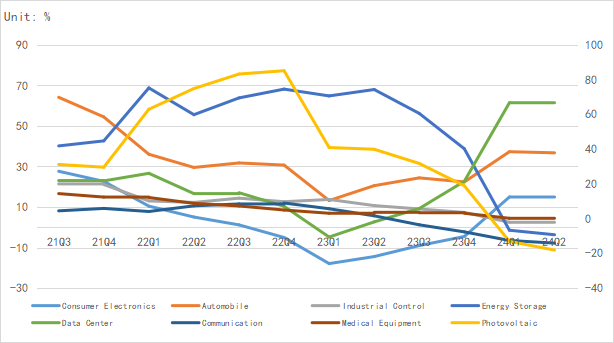

(3)Terminal Market Demand Differentiation

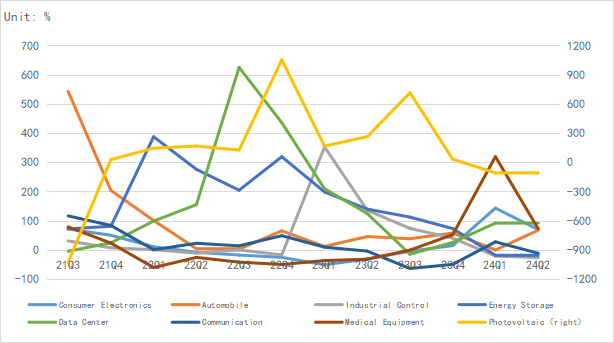

According to Chip Insights' analysis of the average revenue, net profit growth rate, and inventory trend of top manufacturers in various terminal markets, as of Q2 2024, data centers, automobiles, and consumer electronics have maintained growth, while new energy such as photovoltaics and energy storage have experienced significant declines. Industrial control and communication have bottomed out and rebounded, while demand for medical equipment remains stable.

From the perspective of revenue growth, the demand for data centers and automobiles is growing strongly, while consumer electronics and medical devices are growing steadily, and the decline in photovoltaic and energy storage is significant.

Chart 3: Latest average revenue growth rate of terminal manufacturers

Source: Chip Insights

In terms of net profit growth, markets such as data centers, consumer electronics, and medical devices have stable profits but have declined, indicating some market volatility. It is worth noting that the profit growth of photovoltaics has decreased significantly for two consecutive quarters, reflecting the fierce competition in the current industry market and the obvious pressure on manufacturers' profits.

Chart 4: Latest average net profit growth rate of terminal manufacturers

Source: Chip Insights

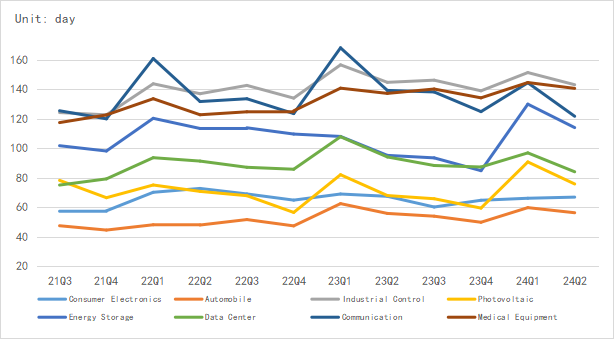

From the perspective of inventory trends, inventory in various terminal markets continues to be optimized, with significant improvements in markets such as photovoltaics, energy storage, and communications.

Chart 5: Latest average inventory growth rate of terminal manufacturers

Source: Chip Insights

For more information, please refer to the attached report.