Electronic Components Sales Market Analysis and Forecast (September 2024)

Table Of Contents

Prologue

1 Macroeconomics in September

1.1 Global Manufacturing Industry Needs Improvement

1.2 The Electronic Information Manufacturing Industry Continues to Grow

1.3 Semiconductor Sales Growth Remains Strong

2 Chip Delivery Trend in September

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in September

4 Semiconductor Supply Chain in September

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Data Center

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in September

1.1 Global Manufacturing Industry Needs Improvement

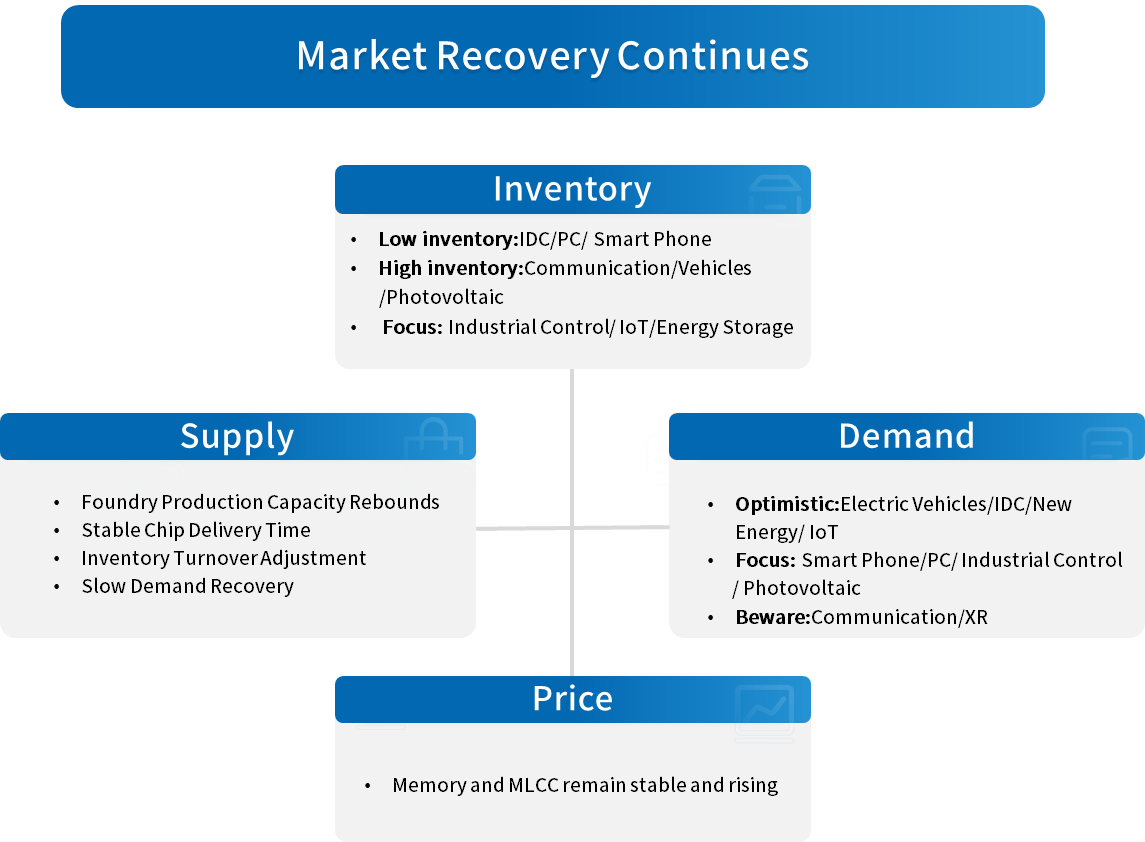

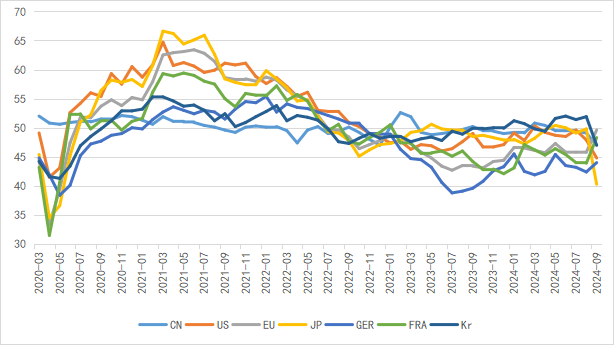

In September, the recovery of the global manufacturing industry still needs to be strengthened. The European Union, represented by China, the United States, Japan, South Korea, Germany, and France, is still below the balance line of prosperity and decline. Among them, China continues to serve as a stabilizer for global economic recovery, the manufacturing industry in the United States remains weak, the manufacturing industry in the European Union is weak and facing increasing downward pressure, and the manufacturing industries in South Korea and Japan have declined. Overall, the global manufacturing industry still needs to improve its recovery efforts, and geopolitical turmoil has exceeded expectations.

Chart 1: Manufacturing PMI of the world's major economies in September

Source: NBSPRC

In terms of growth expectations, major institutions around the world are relatively optimistic. The latest OECD report has raised its economic growth forecast for 2024 from 3.1% to 3.2%, indicating that the global economy is in a stabilizing phase. According to WTO data, the latest global goods trade sentiment index is 103, higher than the benchmark point of 100. ADB expects developing economies in the Asia Pacific region to grow by 5.0% in 2024, up 0.1% from the April forecast.

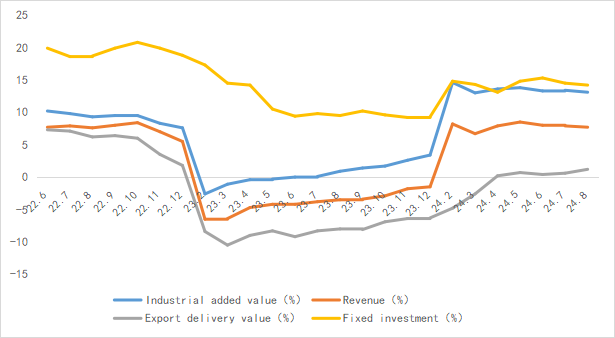

1.2 The Electronic Information Manufacturing Industry Continues to Grow

From January to August 2024, the production of China's electronic information manufacturing industry grew rapidly, exports continued to rebound, efficiency remained stable and improved, investment tended to be stable, and the industry's development trend was good.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

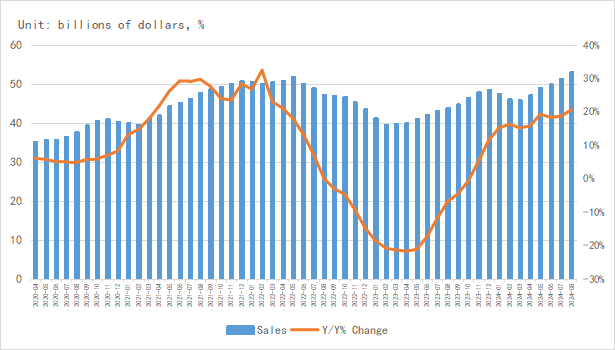

1.3 Semiconductor Sales Growth Remains Strong

According to the latest data from SIA, the global semiconductor market sales in August 2024 were $53.12 billion, a year-on-year increase of 20.6% and a month on month increase of 3.5%. The year-on-year sales growth rate reached the highest percentage since April 2022, with monthly sales rebounding for five consecutive months.

In terms of regional markets, the Americas market still has the strongest growth, with a year-on-year increase of up to 43.9%.Chinese Mainland grew 19.2% year on year, continuing to lead the recovery of the global semiconductor market. It is worth noting that monthly sales in all regions of the world have increased for the first time since October 2023, indicating a strong recovery trend in the global semiconductor market.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,SEMI,Chip Insights

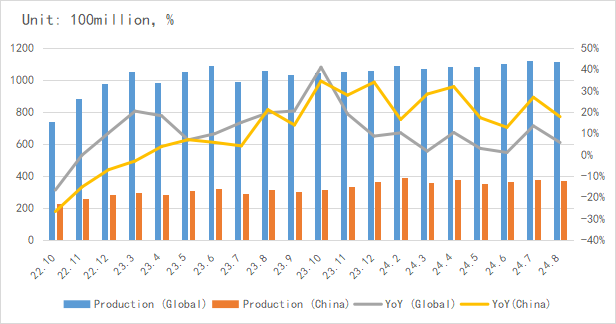

From the perspective of integrated circuit production, the global integrated circuit production in August was about 111.9 billion blocks, a year-on-year increase of 5.7%.China's production is about 37.29 billion yuan, a year-on-year increase of 17.8%. The integrated circuit industry continues its upward trend, and the industry is recovering steadily.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

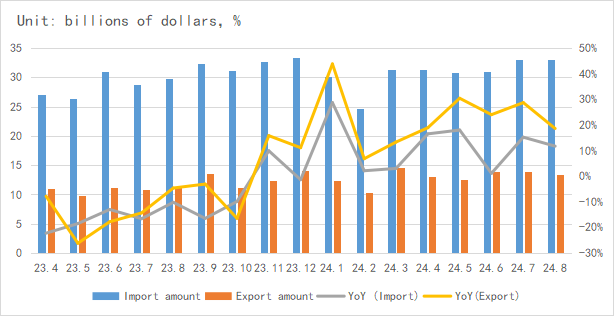

In terms of imports and exports, China's integrated circuit imports and exports maintained strong growth in August, showing a good situation of double-digit double growth for two consecutive months, indicating that China's integrated circuit industry is gradually recovering from downward pressure and regaining vitality.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

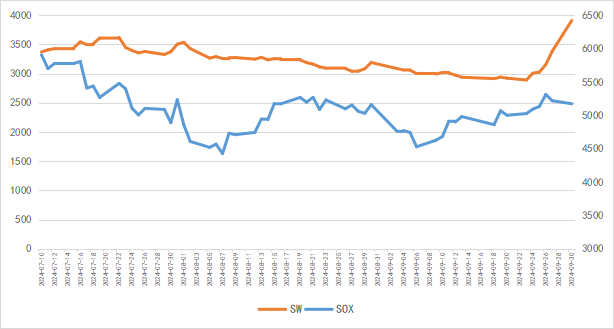

From the perspective of the capital market index, SOX increased by 8.7% in September, while the Chinese SW industry index grew by 26.7%. The global semiconductor market is expected to rebound rapidly, and the Chinese integrated circuit market is showing significant positive news.

Chart 6: Trend of SOX and SW Index in September

Source: Wind,Chip Insights

For more information, please refer to the attached report.