Electronic Components Sales Market Analysis and Forecast (July 2024)

Table Of Contents

Prologue

1 Macroeconomics in July

1.1 Global Manufacturing Pressure Increases

1.2 The Electronic Information Manufacturing Industry Continues to Grow

1.3 Semiconductor Sales Remain Strong

2 Chip Delivery Trend in July

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in July

4 Semiconductor Supply Chain in July

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

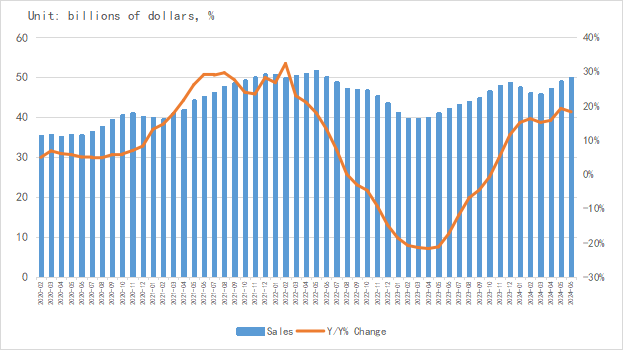

Prologue

1 Macroeconomics in July

1.1 Global Manufacturing Pressure Increases

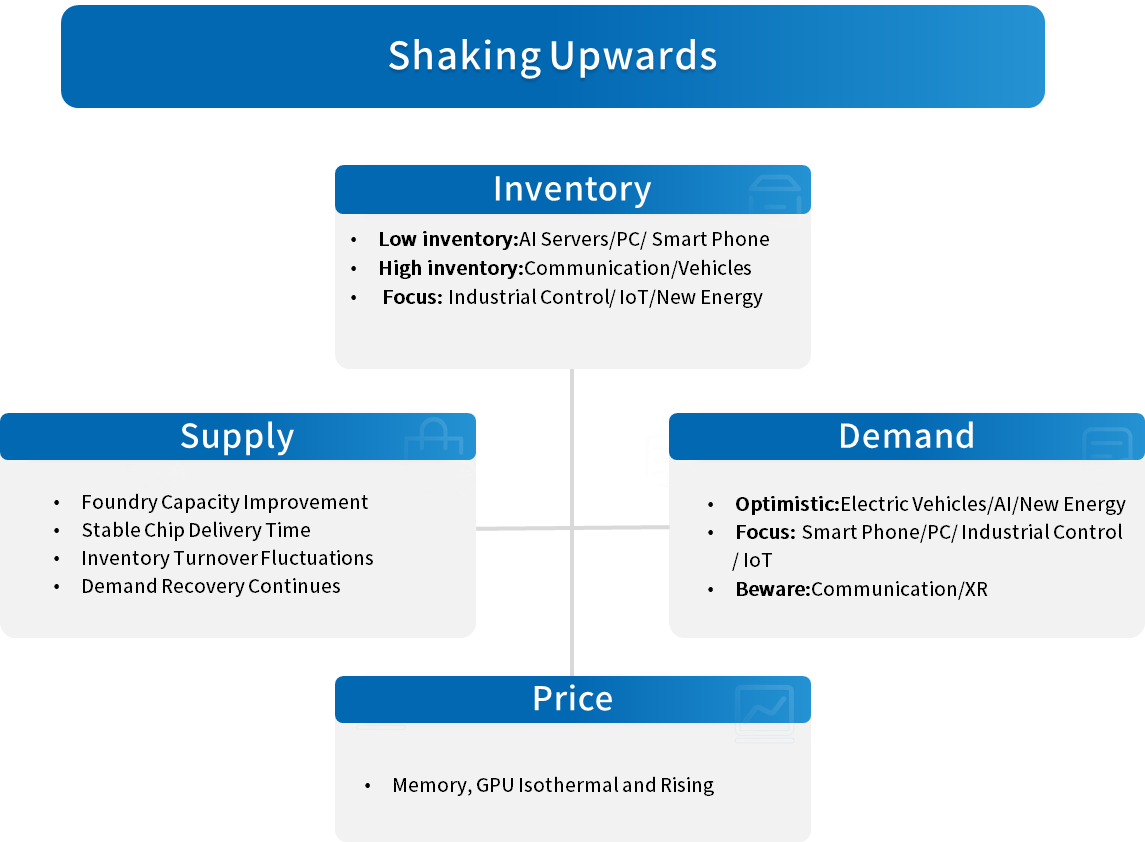

In July, the decline in the global PMI index widened year-on-year, and the momentum of economic recovery weakened. Specifically, except for South Korea, China, the United States, Japan, and the European Union represented by Germany and France are all below the balance line of prosperity and decline, and downward pressure has increased.

Chart 1: Manufacturing PMI of the world's major economies in July

Source: NBSPRC

Overall, the IMF maintains its forecast for a global economic growth rate of 3.2% in 2024 and believes that emerging economies in Asia, such as China, remain the main engines of the global economy. It has raised the economic growth rate of emerging market economies in Asia to 5.2% in 2024.

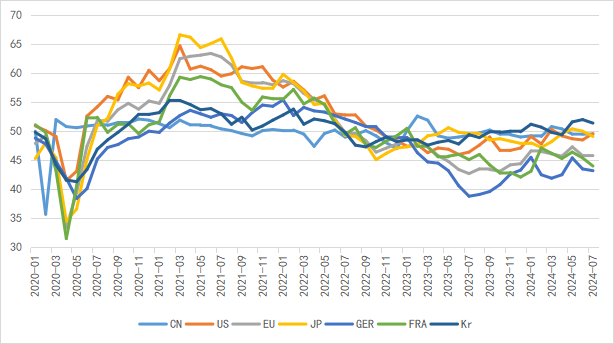

1.2 The Electronic Information Manufacturing Industry Continues to Grow

In the first half of 2024, China's electronic information manufacturing industry will experience rapid production growth, stable export recovery, stable efficiency growth, high-speed investment, and overall good development trend.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry

Source: MIIT

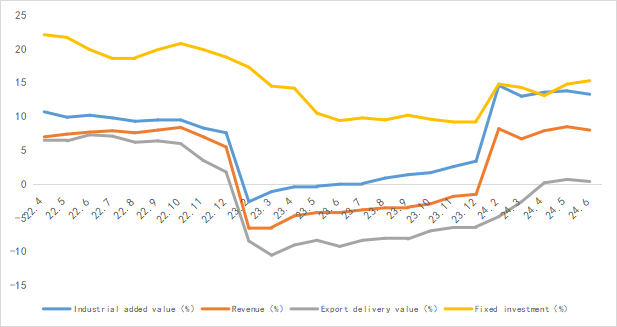

1.3 Semiconductor Sales Remain Strong

According to the latest data from SIA, the global semiconductor market sales in June 2024 were $49.98 billion, a year-on-year increase of 18.3% and a month on month increase of 1.7%, maintaining a high level of market demand. From the perspective of regional markets, the growth of the American market was the strongest, with a year-on-year growth of 42.8%, that of the Chinese Mainland region was 21.6%, and that of other regions, such as Europe and Japan, declined by -11.2% and -5.0% respectively. From the growth momentum of Q2 2024, the global semiconductor market remains strong, with quarterly sales increasing for the first time since Q4 2023.

Chart 3: Latest global semiconductor industry sales and growth rate

Source: SIA,SEMI,Chip Insights

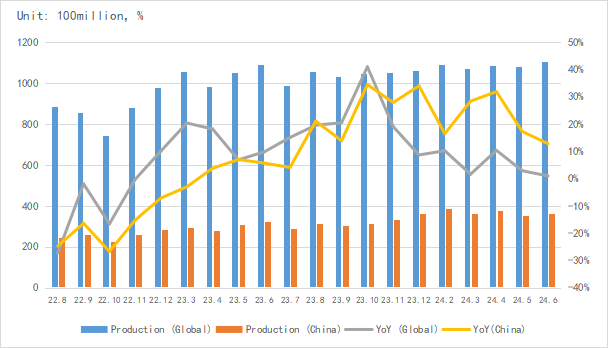

From the perspective of integrated circuit production, the global integrated circuit production in June was about 110.4 billion blocks, a year-on-year increase of 1.0%. China's production is about 36.2 billion yuan, a year-on-year increase of 12.8%. From the growth in the first half of the year, the global and Chinese integrated circuit production has rebounded significantly, and the growth trend continues.

Chart 4: Latest global and Chinese integrated circuit production and growth rate

Source: NBSPRC,SIA,Chip Insights

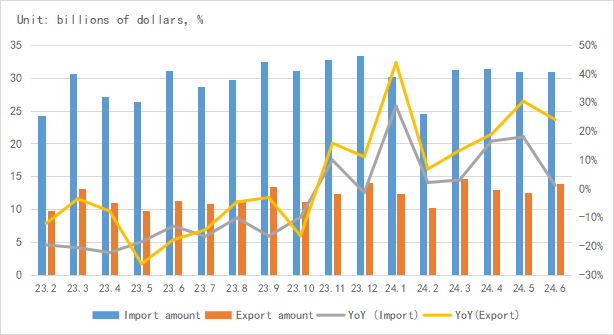

In terms of imports and exports, China's imports of integrated circuits slowed down in June, while exports continued to grow at a high rate, indicating a rapid increase in domestic chip self-sufficiency and a rapid growth in mature process related products.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China

Source: MIIT,SIA,Chip Insights

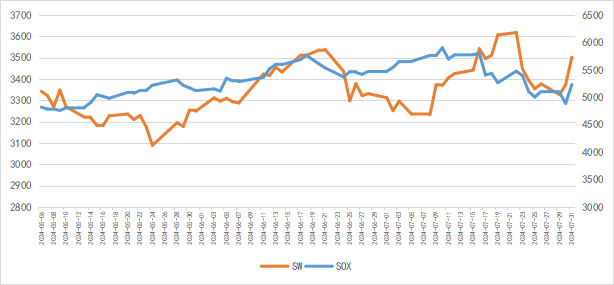

From the perspective of the capital market index, the SOX index decreased by 4.5% in July, while the Chinese SW industry index slightly rebounded by 5.7%. Investors have optimistic expectations for market growth, but there are slight fluctuations.

Chart 6: Trend of SOX and SW Index in July

Source: Wind,Chip Insights

For more information, please refer to the attached report.