Electronic Components Sales Market Analysis and Forecast (Q2 2024)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Volatility Rebounds

(2)Stable Growth of Electronic Information Manufacturing Industry

1.2 Semiconductor Market Analysis

(1)Seasonal Fluctuations in Semiconductor Production and Sales

(2)Semiconductor Exports Are Rapidly Recovering

(3)Semiconductor Market Confidence Rebounds

1.3 Chip Delivery Trend

(1)Chip Delivery Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

2.2 Distributor

2.3 System Integration

2.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Volatility Rebounds

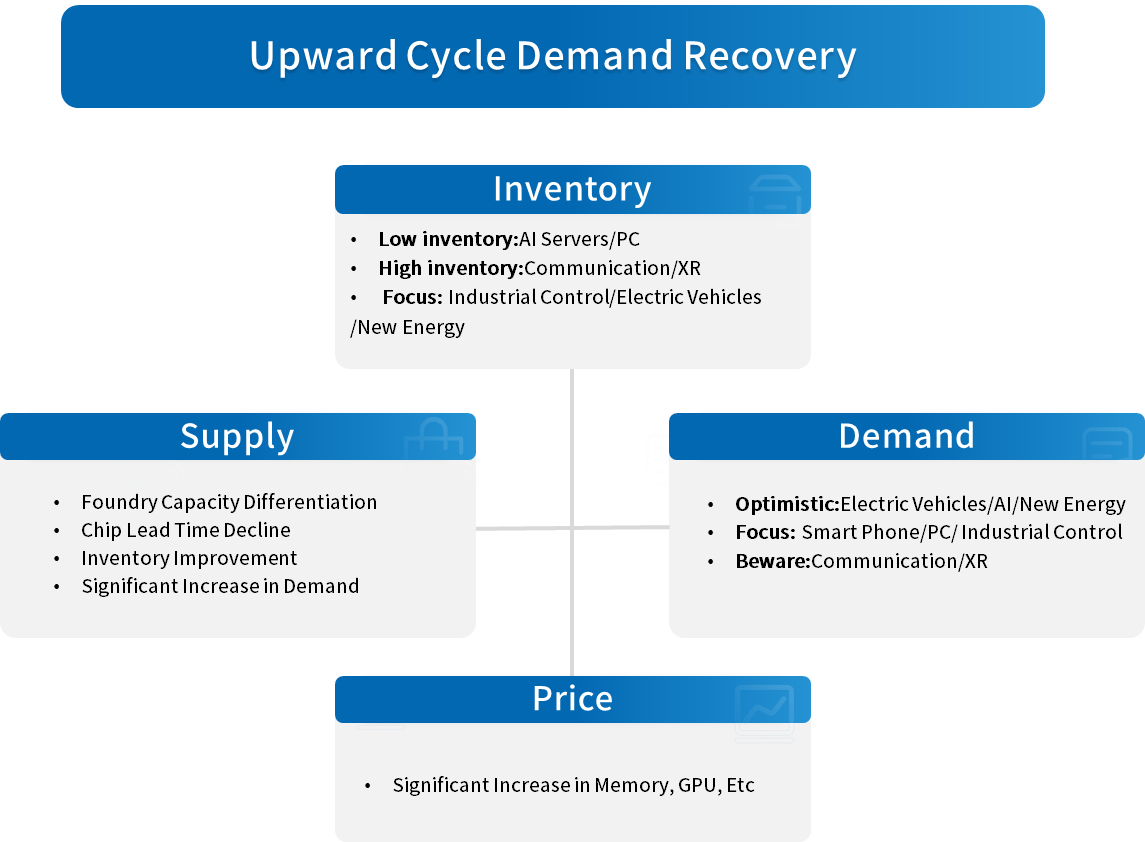

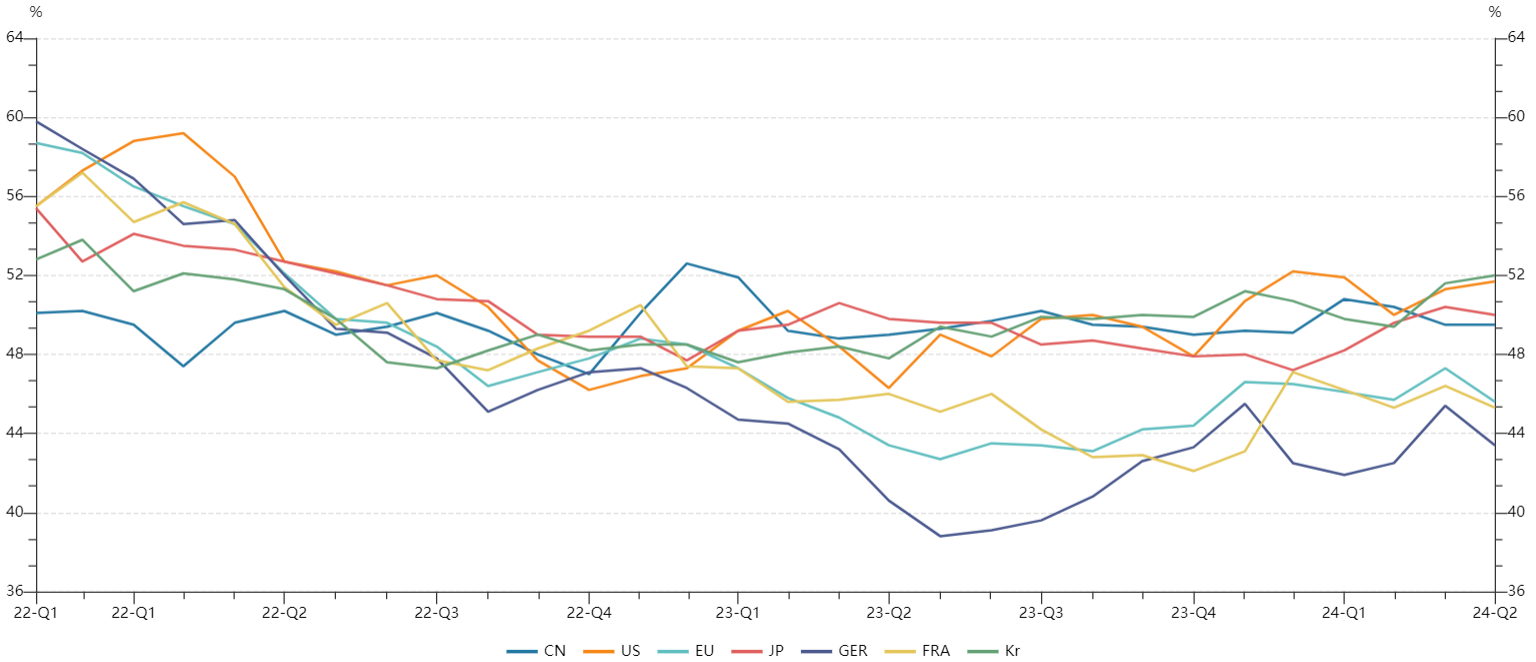

In Q2 2024, the global economy as a whole maintained a stable recovery tone, but unstable factors still exist. Specifically, the contradiction of uneven economic recovery in various countries is still prominent, with China and the United States showing significant signs of stability and recovery, and the European Union, represented by Germany and France, continuing to weaken. Looking ahead to Q3 2024, the global economy will remain stable within a range of fluctuations, continuing a mild recovery trend.

Chart 1: Manufacturing PMIs of Major Global Economies in Q2

Source: NBSPRC

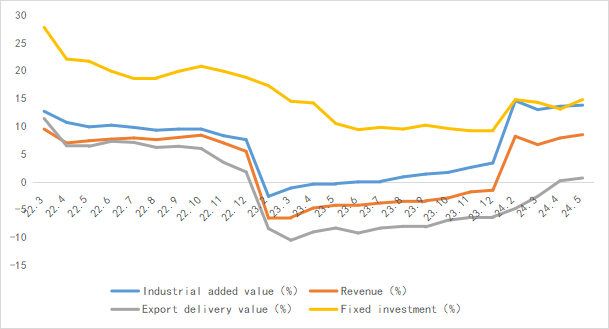

(2)Stable Growth of Electronic Information Manufacturing Industry

From January to May 2024, China's electronic information manufacturing industry saw steady growth in production, stable recovery in exports, monthly improvement in efficiency, accelerated investment growth, and significant overall growth in the industry.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2024

Source: MIIT

1.2 Semiconductor Market Analysis

(1)Seasonal Fluctuations in Semiconductor Production and Sales

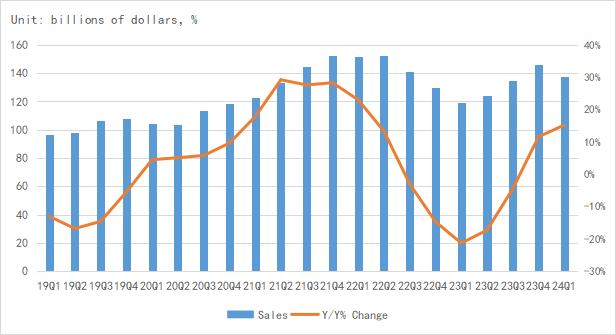

According to the latest data from SIA, global semiconductor industry sales in Q1 2024 were $137.7 billion, a year-on-year increase of 15.2% and a month on month decrease of 5.7%. From the perspective of regional markets, the sales volume in the Americas increased by 26.3% year on year, and that in Chinese Mainland increased by 27.4% year on year, continuing to lead the recovery of the global semiconductor market. SIA believes that the year-on-year increase is higher than the same period last year, and the main reason for the month on month decrease is seasonal. It is expected that the year-on-year increase in the second to fourth quarters of 2024 will reach double digits, and development expectations are optimistic.

Chart 3: Latest quarterly sales and growth rate of global semiconductor industry in 2024

Source: SIA, Chip Insights

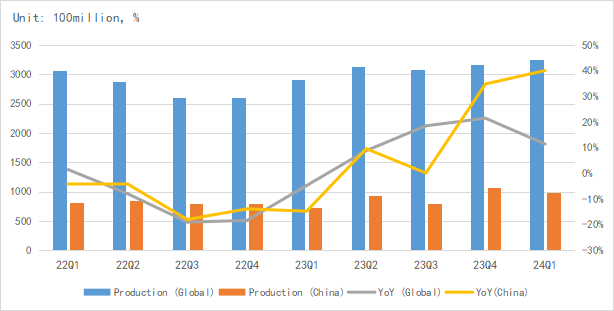

From the perspective of integrated circuit production, the global integrated circuit production in Q1 exceeded 320 billion pieces, a year-on-year increase of over 11%.China's production is about 98.1 billion pieces, a year-on-year increase of 40.0%, and China's production is showing a high-speed growth trend.

Chart 4: Latest global and Chinese quarterly integrated circuit production and growth rate in 2024

Source: MIIT,SIA, Chip Insights

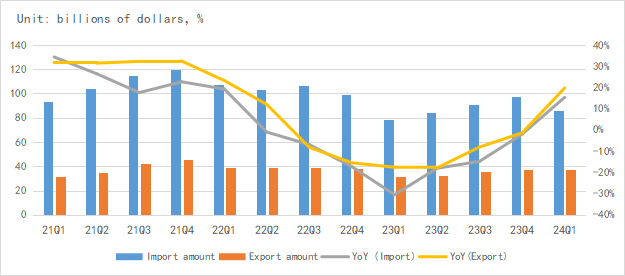

(2)Semiconductor Exports Are Rapidly Recovering

In terms of imports and exports, China's integrated circuit imports and exports rebounded significantly year-on-year in Q1, with a significant increase in export volume and a good trend of domestic chip substitution.

Chart 5: Latest quarterly import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA, Chip Insights

(3)Semiconductor Market Confidence Rebounds

From the perspective of the capital market index, the SOX index rose by 10.28% in Q2 2024, while the China SW industry index fell by 1.05%, indicating a polarization in domestic and international market transactions.

Chart 6: Trend of SOX and SW Index in Q2

Source: Wind

For more information, please refer to the attached report.