Electronic Components Sales Market Analysis and Forecast (June 2024)

Table Of Contents

Prologue

1 Macroeconomics in June

1.1 Global Manufacturing Industry Volatility Rebounds

1.2 Stable Growth of Electronic Information Manufacturing Industry

1.3 Semiconductor Sales Higher Than Expected

2 Chip Delivery Trend in June

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in June

4 Semiconductor Supply Chain in June

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in June

1.1 Global Manufacturing Industry Volatility Rebounds

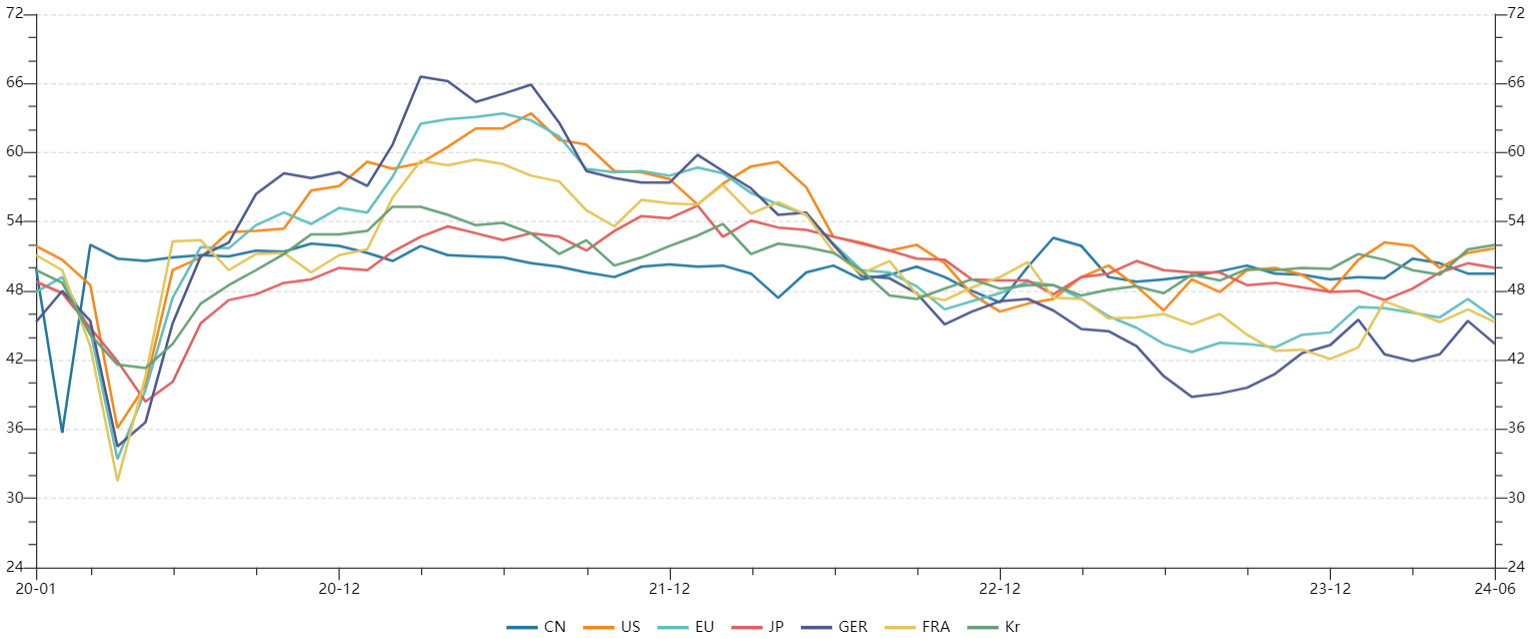

In June, the global economy continued its mild recovery trend, with unstable factors still present. Specifically, apart from the United States, Japan, and South Korea, China, as well as the European Union represented by Germany and France, are still experiencing unstable recovery under the 50 point mark.

Chart 1: Manufacturing PMI of the world's major economies in June

Source: NBSPRC

Summarizing the PMI trend of the manufacturing industry in the first half of the year, the global economy as a whole has maintained a stable recovery tone. INDESA has raised its economic growth forecast, raising the world economic growth forecast for 2024 from 2.4% at the beginning of the year to 2.7%. At the same time, the WTO's outlook on global trade prospects is also becoming more positive. It is expected that global commodity trade volume will gradually recover in 2024 and 2025, with a growth rate of 2.6% in 2024 and 3.3% in 2025.

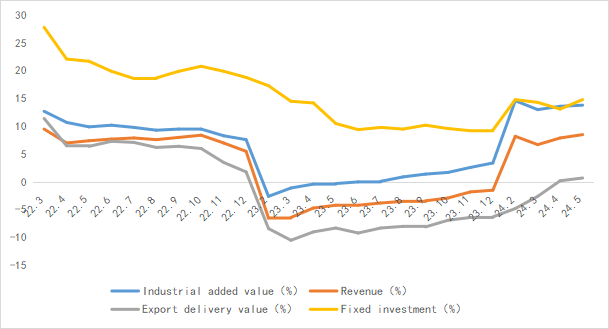

1.2 Stable Growth of Electronic Information Manufacturing Industry

From January to May 2024, China's electronic information manufacturing industry saw steady growth in production, stable recovery in exports, monthly improvement in efficiency, accelerated investment growth, and significant overall growth in the industry.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2024

Source: MIIT

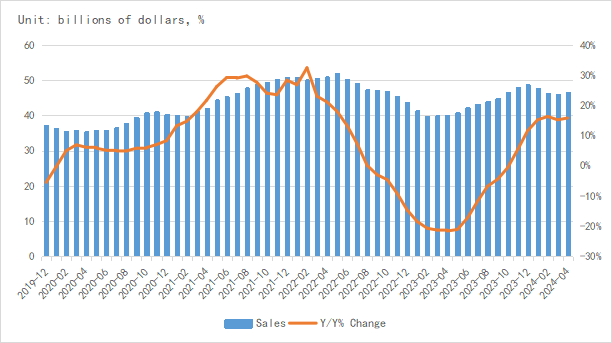

1.3 Semiconductor Sales Higher Than Expected

According to the latest data from SIA, the global semiconductor market sales reached 46.4 billion US dollars, a year-on-year increase of 15.8% and a month on month increase of 1.1%, indicating a good market growth momentum. From the perspective of regional markets, the sales volume in the Americas increased by 32.4% year on year, and that in Chinese Mainland increased by 23.4% year on year, continuing to lead the recovery of the global semiconductor market. The latest forecast from WSTS shows that global annual sales will reach $611.2 billion in 2024, with a year-on-year growth rate adjusted from 13.1% to 16.0%, indicating a higher than expected recovery in the global semiconductor market.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA,SEMI,Chip Insights

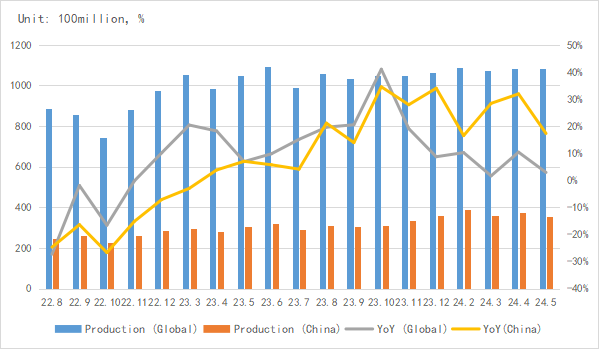

From the perspective of integrated circuit production, the global integrated circuit production in May was about 108.2 billion pieces, a year-on-year increase of 2.9%.China's production is about 35.45 billion pieces, a year-on-year increase of 17.3%. There are certain fluctuations in domestic and international production, and the growth trend continues.

Chart 4: Latest global and Chinese integrated circuit production and growth rate in 2024

Source: MIIT,SIA,Chip Insights

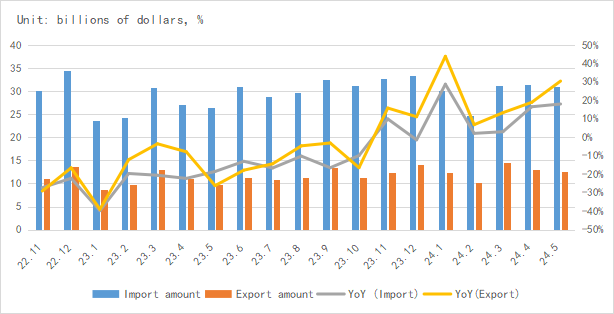

In terms of imports and exports, China's integrated circuit imports and exports continued to grow year-on-year in May, with particularly strong export growth, indicating a good trend of domestic chip substitution.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA,Chip Insights

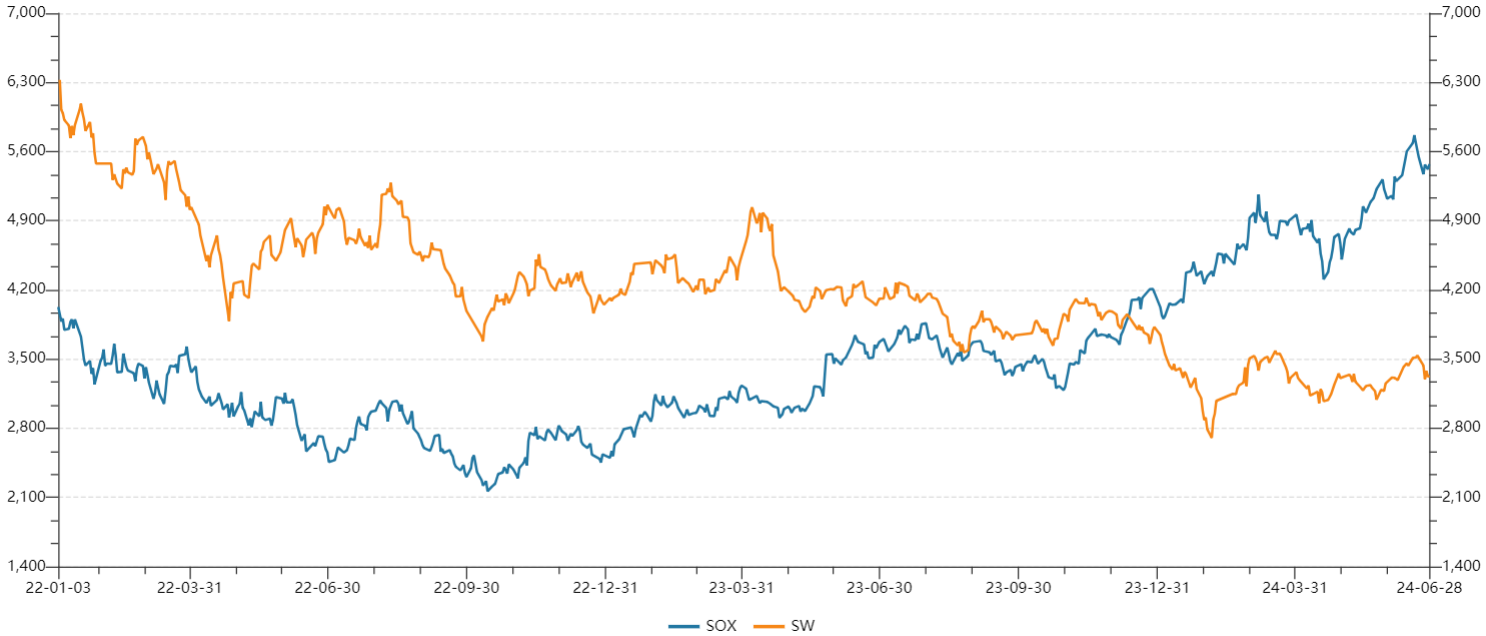

From the perspective of the capital market index, the SOX index rose by 6.21% in June, while the China Semiconductor SW index slightly rebounded by 0.6%. The growth expectation of the semiconductor market remains optimistic.

Chart 6: Trend of SOX and SW Index in June

Source: Wind,Chip Insights

For more information, please refer to the attached report.