Electronic Components Sales Market Analysis and Forecast (May 2024)

Table Of Contents

Prologue

1 Macroeconomics in May

1.1 Global Manufacturing Sector Experiences a Weak Recovery

1.2 Significant Growth in the Electronic Information Industry

1.3 Semiconductor Sales Are Slowly Rebounding

2 Chip Delivery Tsrend in May 8 2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in May

4 Semiconductor Supply Chain in May

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in May

1.1 Global Manufacturing Sector Experiences a Weak Recovery

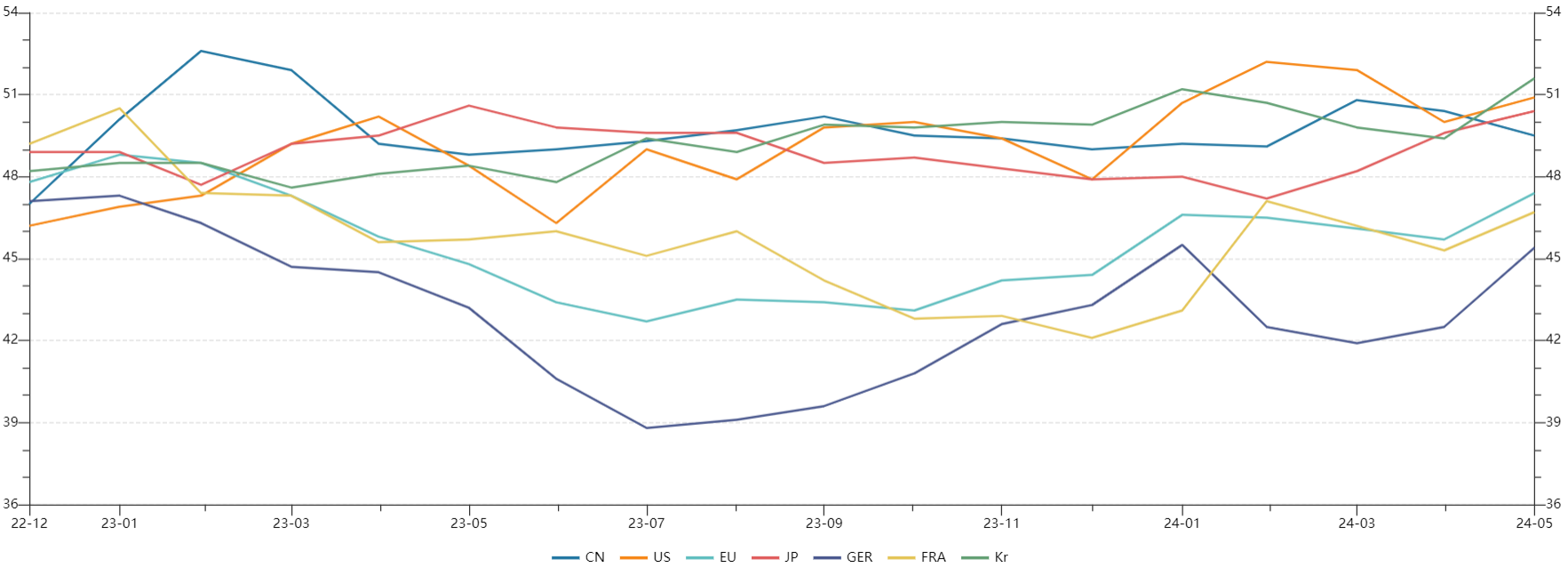

The stability of the global economic recovery is still insufficient, continuing the weak recovery trend. Specifically, except for the United States, Japan, and South Korea, major economies including China and the European Union are facing certain short-term pressures in their economic operations below the boom bust equilibrium line.

Chart 1: Manufacturing PMI of the world's major economies in May

Source: NBSPRC

The easing of inflationary pressure is one of the important basis for the improvement of global economic growth expectations. The IMF predicts that the overall global inflation rate will further decrease from an average of 6.8% per year in 2023 to an average of 5.9% per year in 2024.

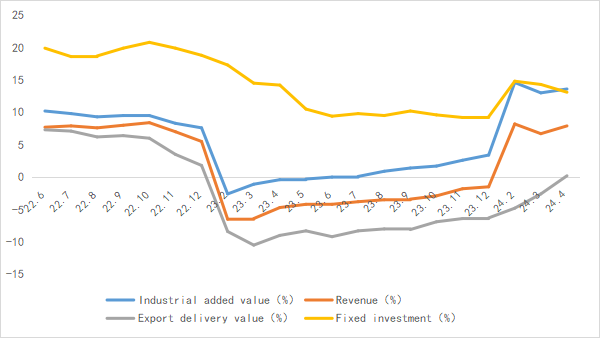

1.2 Significant Growth in the Electronic Information Industry

From January to April 2024, China's electronic information manufacturing industry saw steady growth in production, export recovery improved, efficiency continued to improve, investment maintained rapid growth, and the overall growth trend of the industry was significant.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2024

Source: MIIT

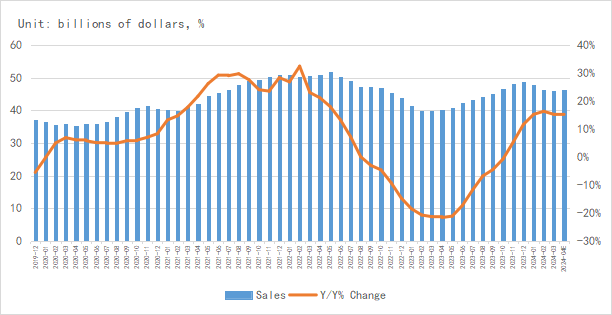

1.3 Semiconductor Sales Are Slowly Rebounding

According to SIA data, global semiconductor industry sales exceeded $46.1 billion in April, and the market continued to recover. Sales in Q1 have declined, reflecting a normal seasonal trend. It is expected that the market will continue to grow for the remaining time of this year, and with the expansion of cyclical technological recovery to other electronic terminal markets, it will support semiconductors to enter the next round of upward trend, lasting from the second half of this year to 2025.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA,SEMI,Chip Insights

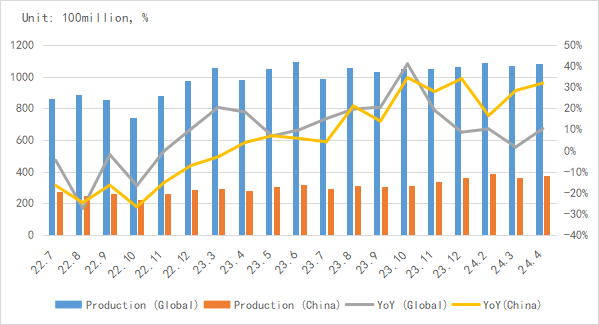

From the perspective of integrated circuit production, the global integrated circuit production in April was about 108.5 billion pieces, a year-on-year increase of 10.4%.China's production is about 37.6 billion pieces, a year-on-year increase of 31.9%. The domestic and international production has grown rapidly.

Chart 4: Latest global and Chinese integrated circuit production and growth rate in 2024

Source: MIIT,SIA,Chip Insights

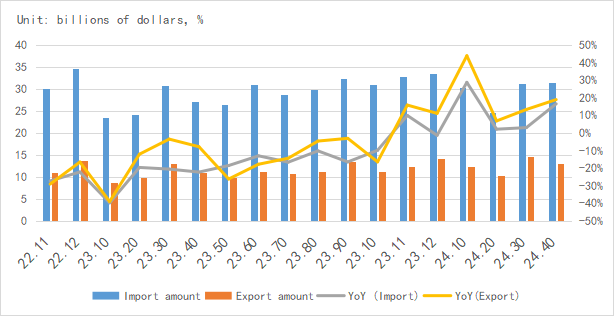

In terms of imports and exports, China's integrated circuit imports and exports increased rapidly year-on-year in April, indicating a clear trend of market recovery.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA,Chip Insights

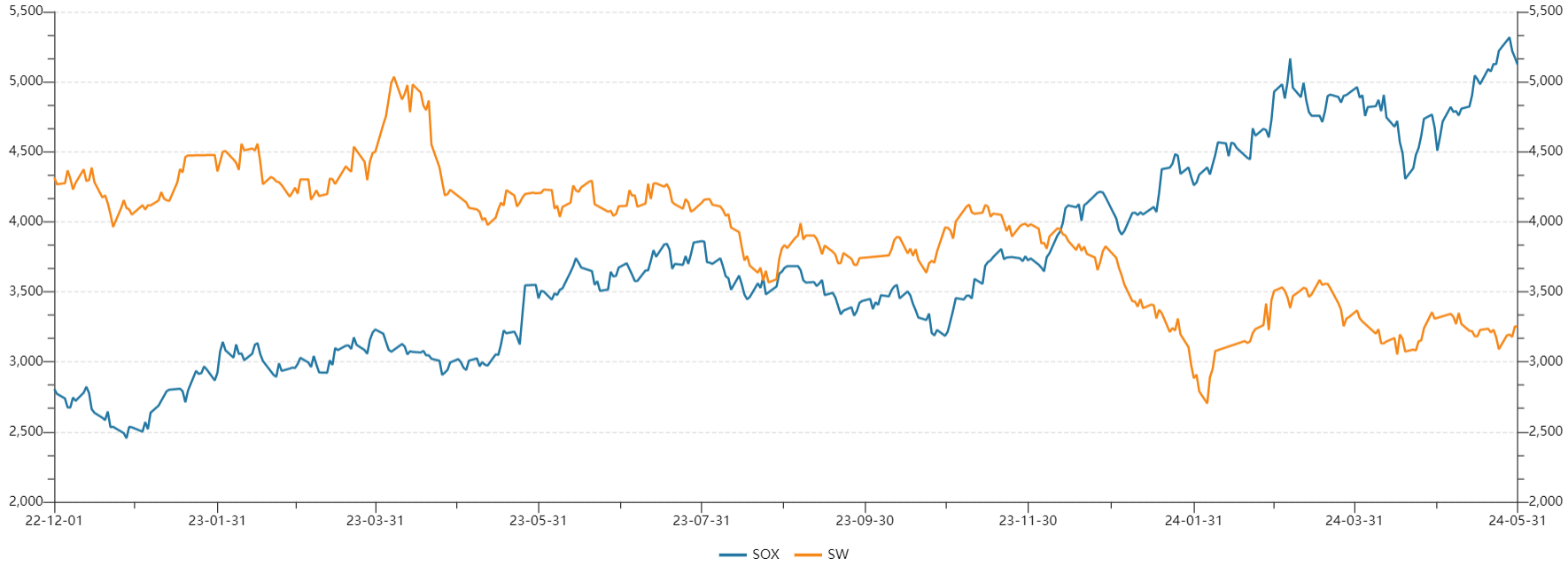

From the perspective of the capital market index, the SOX rose by 13.66% in May, while the China SW industry index fell by 2.80%. Global investors are optimistic about industry recovery expectations.

Chart 6: Trend of SOX and SW Index in May

Source: Wind,Chip Insights

For more information, please refer to the attached report.