Electronic Components Sales Market Analysis and Forecast (April 2024)

Table Of Contents

Prologue

1 Macroeconomics in April

1.1 Mild Recovery of Global Manufacturing Industry

1.2 Improvement in the Electronic Information Manufacturing Industry

1.3 Semiconductor Sales Are on the Rise

2 Chip Delivery Trend in April

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in April

4 Semiconductor Supply Chain in April

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in April

1.1 Mild Recovery of Global Manufacturing Industry

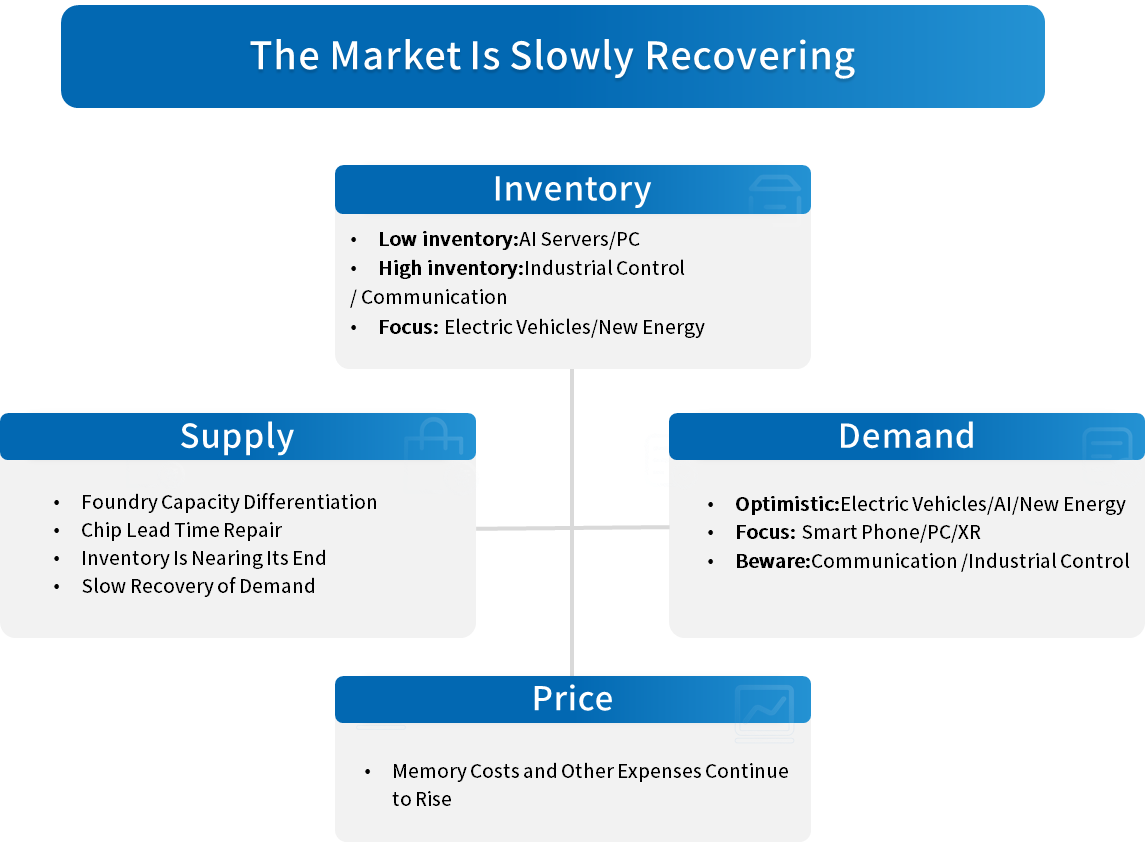

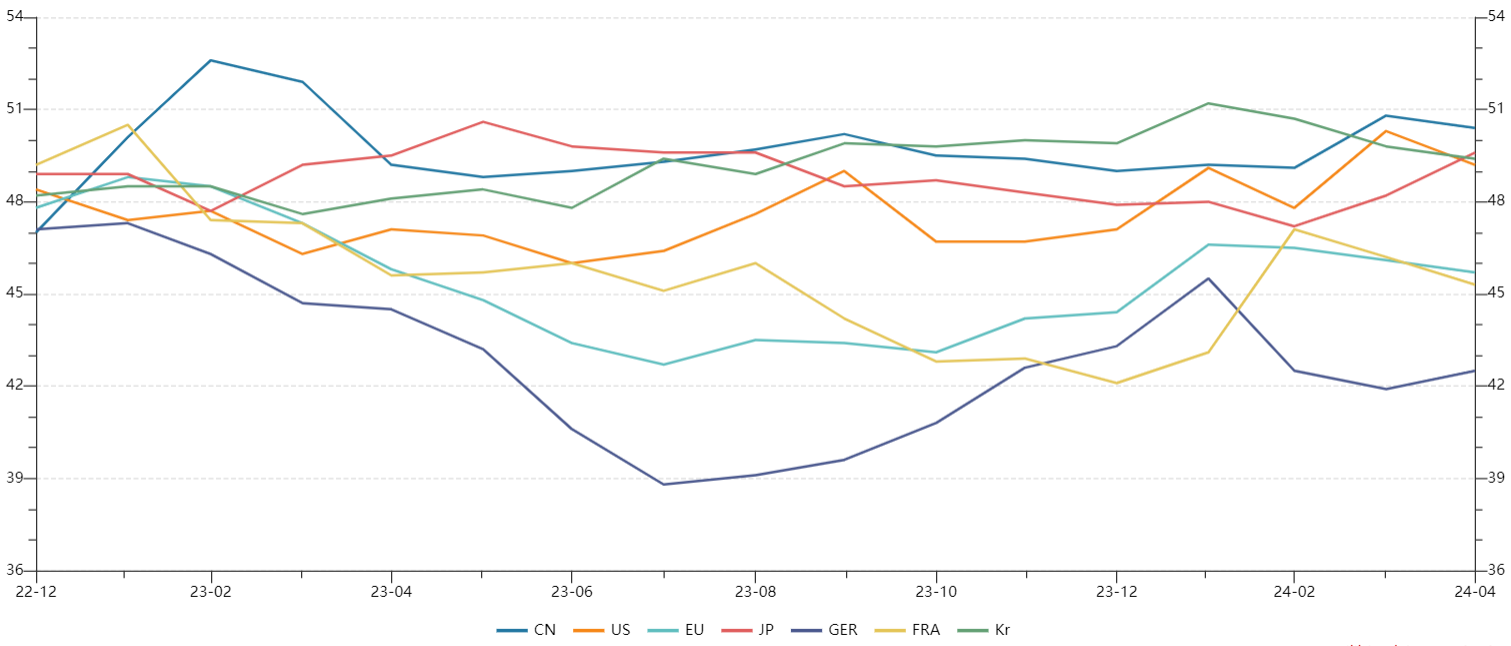

In April, the global economic index has slowed down year-on-year, and uncertainty still exists. Specifically, apart from China, major economies such as the United States, the European Union, Japan, and South Korea still face prominent contradictions in the uneven global economic recovery below the boom bust balance line.

Chart 1: Manufacturing PMI of the world's major economies in April

Source: NBSPRC

Since the beginning of this year, the mild recovery trend of the global economy has changed the expectations of major economic organizations for global economic growth. The IMF predicts a global economic growth rate of 3.2% in 2024, which is 0.1 percentage points higher than the forecast in January this year.

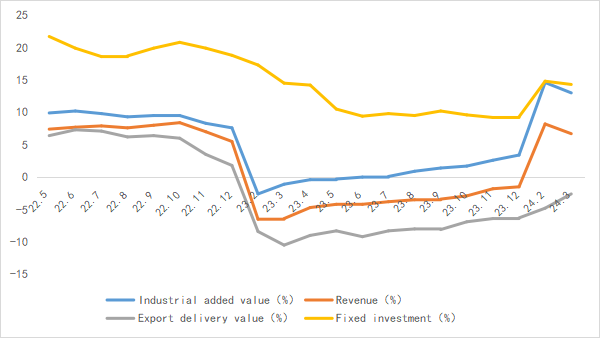

1.2 Improvement in the Electronic Information Manufacturing Industry

From January to March 2024, the production of China's electronic information manufacturing industry steadily increased, exports continued to rebound, efficiency continued to improve, investment maintained a high growth rate, and regional revenue differentiation was evident.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2024

Source: MIIT

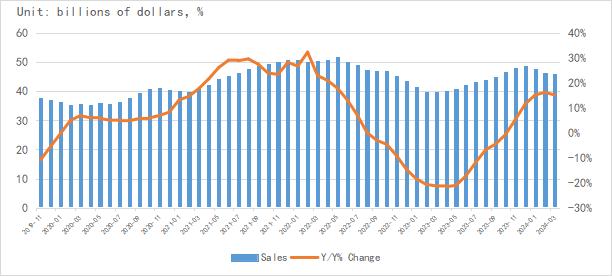

1.3 Semiconductor Sales Are on the Rise

According to the latest SIA data, global semiconductor industry sales in March were $45.91 billion, a year-on-year increase of 15.2%, and the month on month decline narrowed.The data shows that the cyclical recession of the semiconductor industry has bottomed out, and the improvement of final demand and the end of inventory normalization will support the gradual recovery of the industry.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA,SEMI,Chip Insights

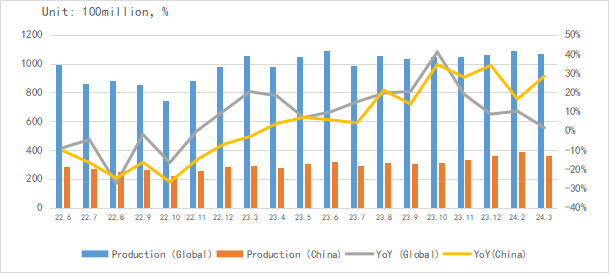

From the perspective of integrated circuit production, the global integrated circuit production in March was about 107.2 billion pieces, a year-on-year increase of 1.6%. China's production is about 36.2 billion yuan, a year-on-year increase of 28.4%. The domestic and international production growth is stable.

Chart 4: Latest global and Chinese integrated circuit production and growth rate in 2024

Source: MIIT,SIA,Chip Insights

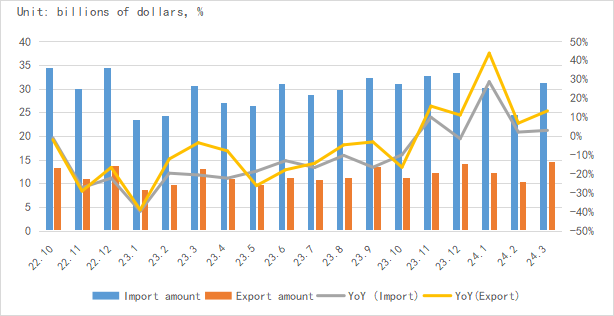

In terms of imports and exports, the year-on-year growth of China's integrated circuit imports and exports in March was stable, with a significant increase in export volume. With the continuous promotion of localization, the localization trend of China's integrated circuit industry is obvious.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA,Chip Insights

From the perspective of the capital market index, the SOX index decreased by 5.82% in April, while the China SW semiconductor index fell by 1.75%. Currently, domestic and foreign investors have certain fluctuations in market expectations.

Chart 6: Trend of SOX and SW Index in April

Source: Wind,Chip Insights

For more information, please refer to the attached report.