Electronic Components Sales Market Analysis and Forecast (Q1 2024)

Table Of Contents

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Is Steadily Rising

(2)Benefits in the Electronic Information Manufacturing Sector Have Rebounded

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Are Steadily Rising

(2)China's Semiconductor Import and Export Have Been Improving

(3)The Semiconductor Index Exhibits Polarization

1.3 Chip Delivery Trend

(1)Chip Delivery Trend

(2)Supplier Delivery Cycle Summary

1.4 Orders and Inventory Situation

2 Semiconductor Supply Chain

2.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

2.2 Distributor

2.3 System Integration

2.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

3 Distribution and Sourcing Opportunities and Risks

3.1 Opportunities

3.2 Risk

4 Summarize

Disclaimer

Prologue

1 Macroeconomics and Semiconductor Trade

1.1 Macroeconomic Analysis

(1)Global Manufacturing Industry Is Steadily Rising

In Q1 2024, the global economy stabilized and tended to rise, and the PMI index ended its 17 month continuous trend of below 50% and returned to the expansion range of over 50%. Looking ahead to 2024, with a mild recovery in terminal demand and an improvement in trade conditions, the global economy is gradually emerging from a downturn.

Chart 1: Manufacturing PMIs of Major Global Economies in Q1

Source: NBSPRC

(2)Benefits in the Electronic Information Manufacturing Sector Have Rebounded

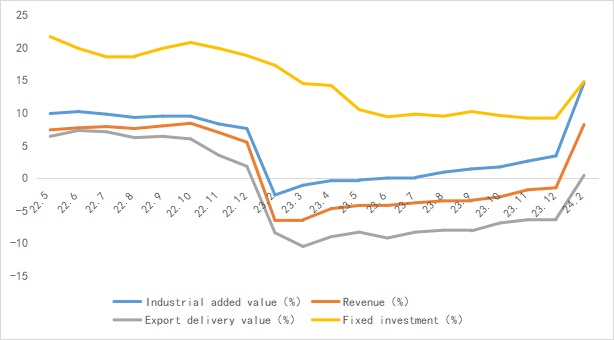

In the January-February 2024 period, China's electronic information manufacturing sector witnessed a substantial increase in production, ongoing enhancement in exports, steady progress in profitability, rapid growth in investment, and pronounced regional variations in revenue.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2024

Source: MIIT

1.2 Semiconductor Market Analysis

(1)The Production and Sales of Semiconductors Are Steadily Rising

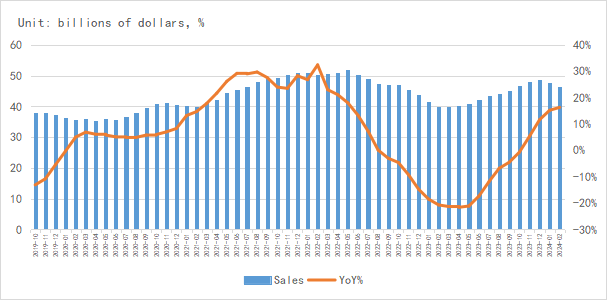

According to the latest data from SIA, global semiconductor industry sales in February 2024 were $46.17 billion, a year-on-year increase of 16.3% and a month-on-month decrease of 3.1%. The year-over-year market growth continues the strong trend since the middle of last year, and SIA predicts that the market growth will continue for the rest of this year, with clear signs of a rebound in the global semiconductor industry.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA, Chip Insights

From the perspective of integrated circuit production, the global integrated circuit production in February was about 108.9 billion pieces, a year-on-year increase of 10.2%. China's production is about 38.8 billion yuan, a year-on-year increase of over 15%. From January to February, China's production rebounded significantly.

Chart 4: Latest global and Chinese integrated circuit production and growth rate in 2024

Source: MIIT,SIA, Chip Insights

(2)China's Semiconductor Import and Export Have Been Improving

In terms of imports and exports, China's integrated circuit imports and exports continued to improve year-on-year in February, and the overall trade deficit showed good progress in terms of domestic substitution.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA, Chip Insights

(3)The Semiconductor Index Exhibits Polarization

Based on the capital market index, the SOX index surged by 21.93% in Q1 2024, whereas the China SW industry index experienced a decline of 11.29%, reflecting a continued resurgence in market transactions.

Chart 6: Trend of SOX and SW Index in Q1

Source: Wind

For more information, please refer to the attached report.