Electronic Components Sales Market Analysis and Forecast (March 2024)

Table Of Contents

Prologue

1 Macroeconomics in March

1.1 Global Manufacturing Continues to Rebound

1.2 The Electronic Information Manufacturing Industry Has Seen Significant Growth

1.3 Semiconductor Sales Are Steadily Rising

2 Chip Delivery Trend in March

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in March

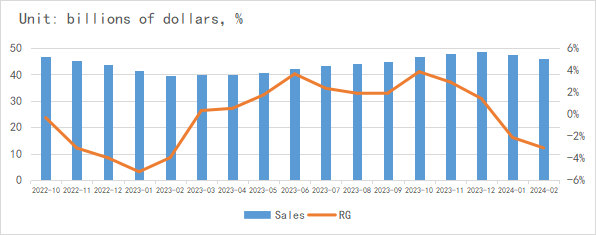

4 Semiconductor Supply Chain in March

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Server

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in March

1.1 Global Manufacturing Continues to Rebound

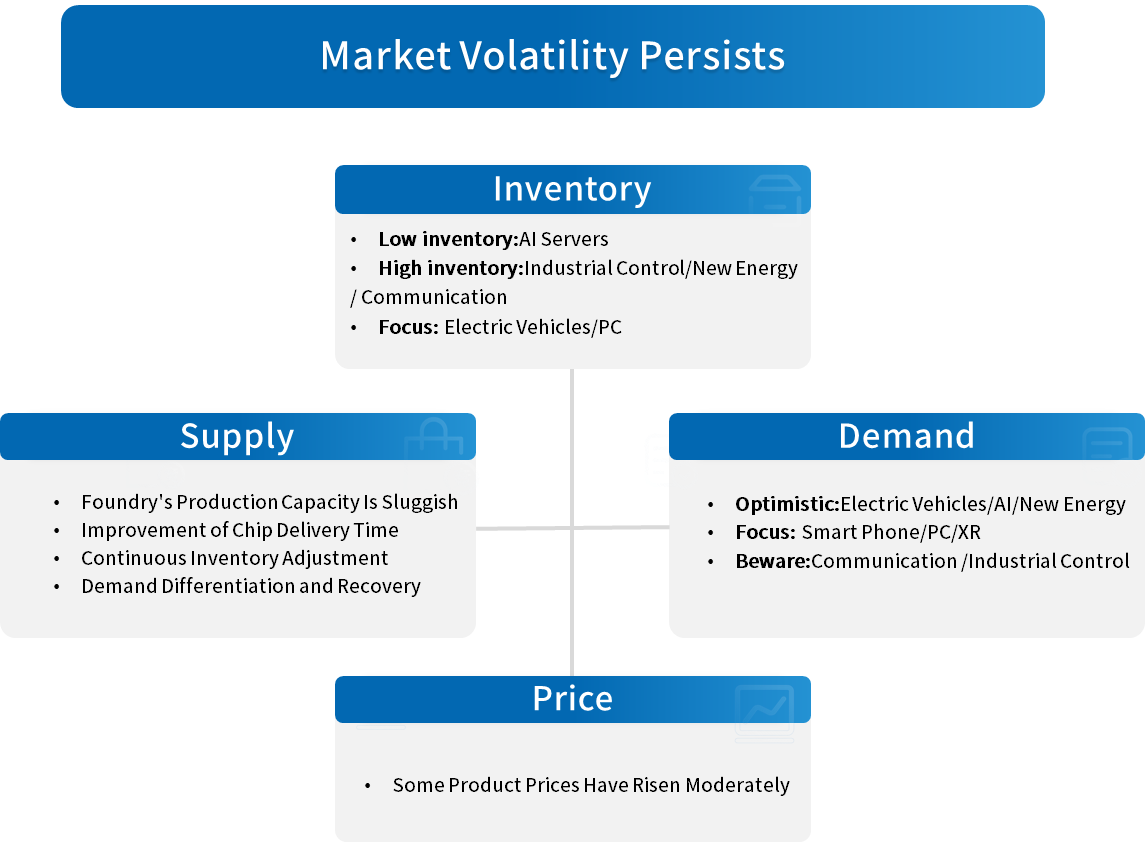

In March, the global economic index continued to rebound, with the economic situation remaining stable. Specifically, the core economies led by China and the United States have both returned to the balance line of prosperity and decline. Considering that China's manufacturing competitiveness continues to rise, its support for the Asian and even global economies remains very evident.

Chart 1: Manufacturing PMI of the world's major economies in March

Source: NBSPRC

From the perspective of global trade, with geopolitical conflicts no longer intensifying, the global trade growth rate in 2024 may be slightly higher than the global economic growth rate, and better than the same period last year.

1.2 The Electronic Information Manufacturing Industry Has Seen Significant Growth

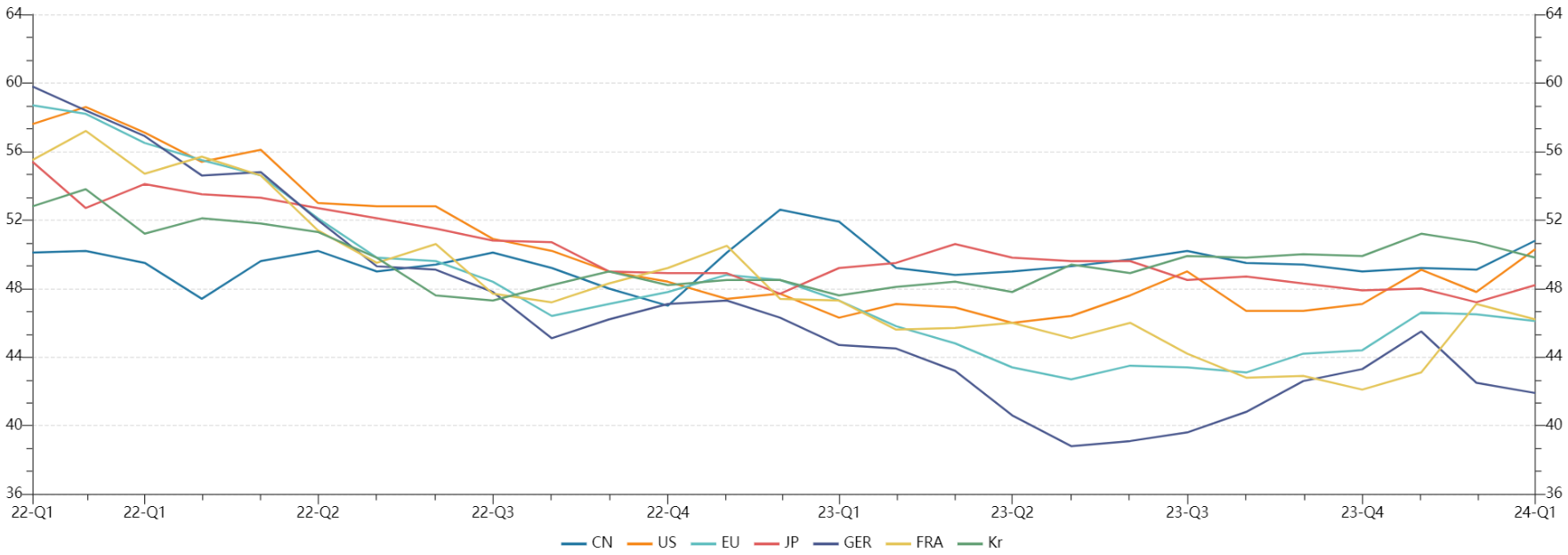

In the January-February 2024 period, China's electronic information manufacturing sector witnessed a substantial increase in production, ongoing enhancement in exports, steady progress in profitability, rapid growth in investment, and pronounced regional variations in revenue.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2023

Source: MIIT

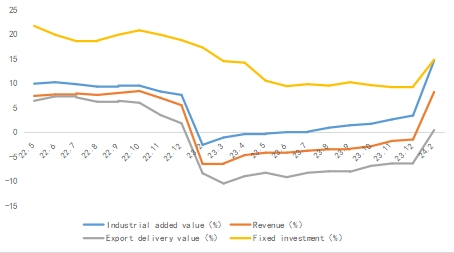

1.3 Semiconductor Sales Are Steadily Rising

According to the latest data from SIA, global semiconductor industry sales in February 2024 amounted to $46.17 billion, representing a year-over-year increase of 16.3% and a month-over-month decrease of 3.1%. The year-over-year market growth continues the robust trend observed since the middle of last year, and it is unlikely for the global semiconductor industry to rebound swiftly in the short to medium term. In 2024, it is likely to exhibit an overall steady recovery, with structural differentiation and adjustment evident in various sub-sectors.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA, Chip Insights

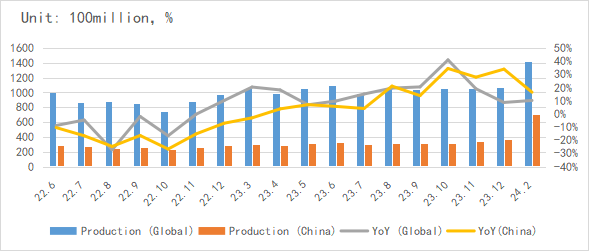

From the perspective of integrated circuit production, the global integrated circuit production in February was about 108.9 billion pieces, a year-on-year increase of 10.2%. China's production is about 38.8 billion yuan, a year-on-year increase of over 15%. From January to February, China's production rebounded significantly.

Chart 4: Latest global and Chinese integrated circuit production and growth rate in 2024

Source: MIIT,SIA,Chip Insights

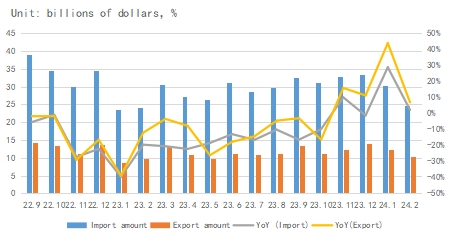

In terms of imports and exports, China's integrated circuit imports and exports continued to improve year-over-year in February, with quarterly factors slightly reducing the month-over-month growth. Looking at the overall trade deficit, the progress of domestic substitution has been positive.

Chart 5: Latest import and export amount and growth rate of integrated circuits in China in 2024

Source: MIIT,SIA,Chip Insights

From the perspective of the capital market index, the SOX decreased by 0.49% and the SW industry index decreased by 5.33% in March. The current market expectations of domestic and foreign investors are fluctuating.

Chart 6: Trend of SOX and SW Index in March

Source: Wind

For more information, please refer to the attached report.