Electronic Components Sales Market Analysis and Forecast (February 2024)

Table Of Contents

Prologue

1 Macroeconomics in February

1.1 Global Manufacturing Industry Remains Volatile

1.2 The Decline in Electronic Information Manufacturing Industry

1.3 Semiconductor Sales Rebounded Strongly

2 Chip Delivery Trend in February

2.1 The Overall Chip Delivery Trend

2.2 List of Delivery Cycles of Key Chip Suppliers

3 Orders and Inventory in February

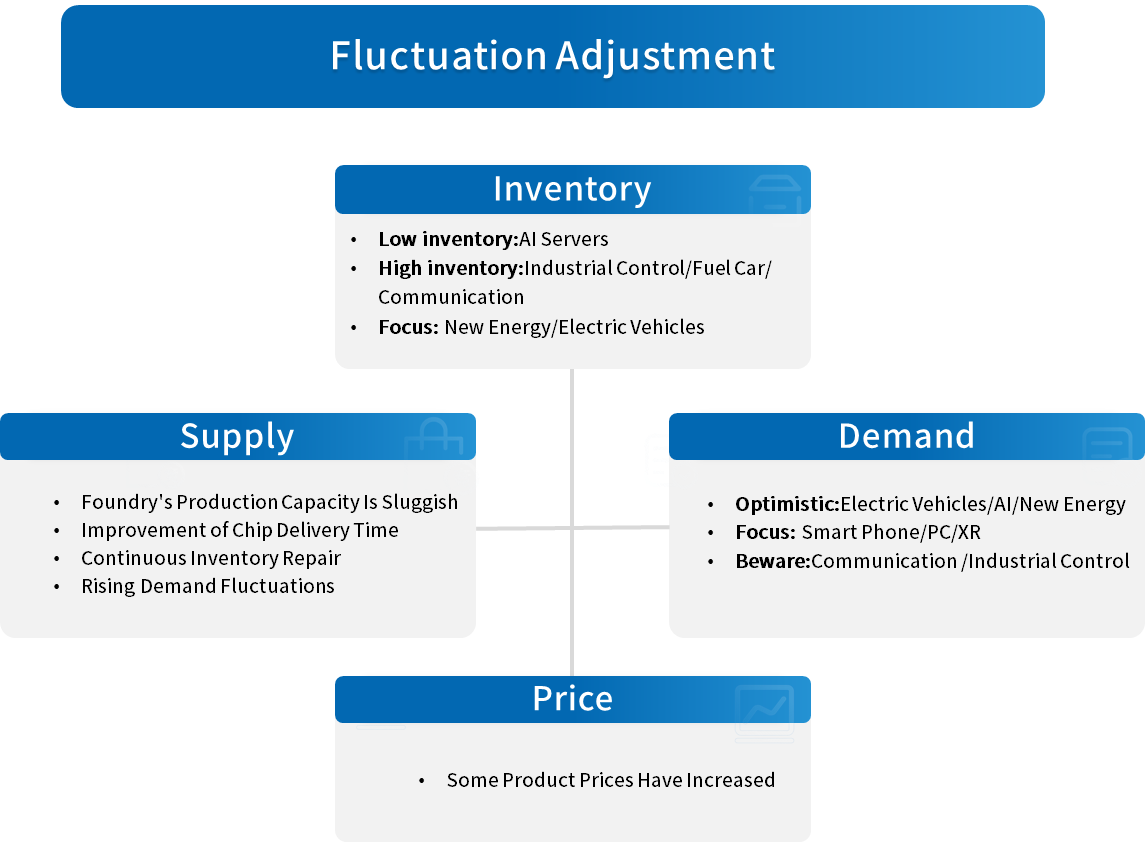

4 Semiconductor Supply Chain in February

4.1 Semiconductor Upstream Manufacturers

(1)Silicon Wafer/Equipment

(2)Fabless/IDM

(3)Foundry

(4)OSAT

4.2 Distributor

4.3 System Integration

4.4 Terminal Application

(1)Consumer Electronics

(2)New Energy Vehicles

(3)Industrial Control

(4)Photovoltaic

(5)Energy Storage

(6)Service Machine

(7)Communication

5 Distribution and Sourcing Opportunities and Risks

5.1 Opportunities

5.2 Risk

6 Summarize

Disclaimer

Prologue

1 Macroeconomics in February

1.1 Global Manufacturing Industry Remains Volatile

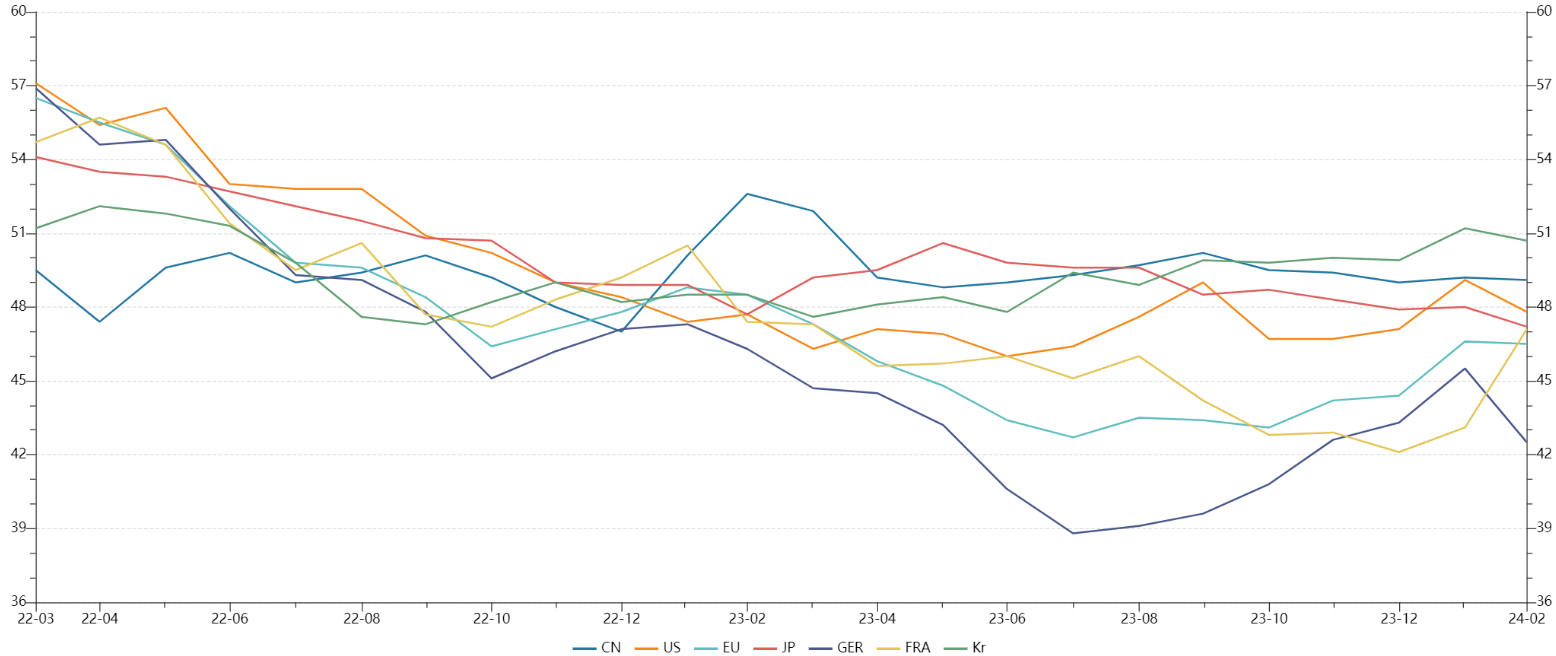

In February, the global economic index showed a marked rise, and the momentum of economic recovery has picked up. However, major economies including China, the United States, the European Union, Japan, France, and Germany remain below the warning line, with uncertainties persisting.

Chart 1: Manufacturing PMI of the world's major economies in February

Source: NBSPRC

The latest IMF forecast shows that the global economy will continue to maintain resilience in 2024, with an economic growth rate of 3.1%.

1.2 The Decline in Electronic Information Manufacturing Industry

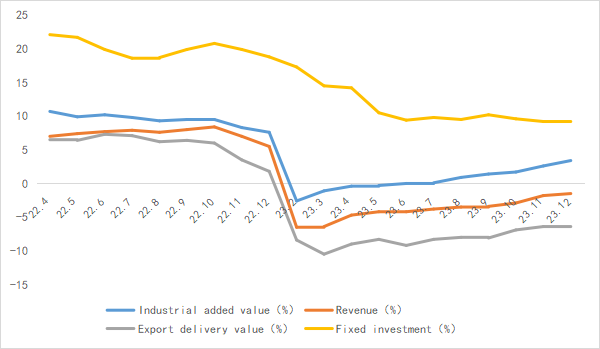

In 2023, China's electronic information manufacturing industry saw production recovery, export decline narrowing, benefits gradual recovery, investment steady growth, and revenue decline narrowing in multiple regions.

Chart 2: Latest Operation of Electronic Information Manufacturing Industry in 2023

Source: MIIT

1.3 Semiconductor Sales Rebounded Strongly

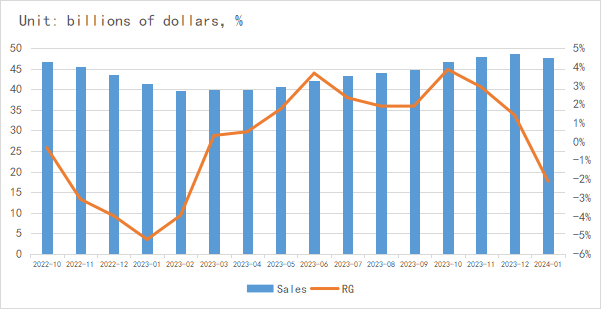

According to the latest data from SIA, global semiconductor industry sales in January 2024 were $47.63 billion, representing a year-over-year increase of 15.2% and a month-over-month decrease of 2.1%. From a regional perspective, China's sales increased by 26.6% year-over-year, performing the best, followed by the Americas, with sales increasing by 20.3% year-over-year. SIA predicts that global semiconductor sales will be strong at the beginning of 2024, with sales expected to continue to grow in the coming months. The global semiconductor industry sales for the whole year will increase by 13.1%.

Chart 3: Latest global semiconductor industry sales and growth rate in 2024

Source: SIA、Chip Insights

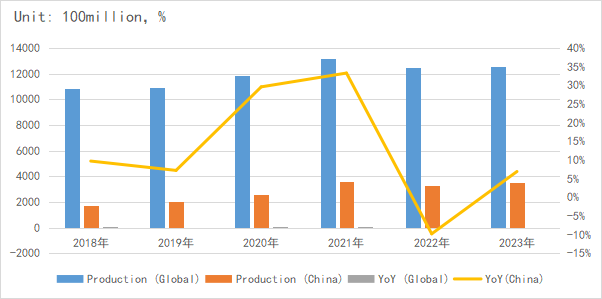

In terms of integrated circuit production, the global trend is set to rebound in 2023. China's production of integrated circuits reached 351.4 billion units, marking a year-over-year growth of 6.9%.

Chart 4: Global and Chinese Integrated Circuit Production from 2018 to 2023

Source: Wind

For more information, please refer to the attached report.