2023 Electronic Component Sales Market Analysis and 2024 Trend Outlook

Table Of Contents

Prologue

1 Semiconductor Industry Overview in 2023

1.1 Significant Improvement in Chip Delivery Cycle/Price

1.2 Semiconductor Sales Have Bottomed Out

1.3 Semiconductor Investment Has Rebounded Slightly

1.4 Geopolitical Disputes Trigger Industrial Transfer

2 Annual Review of Distribution Industry in 2023

2.1 Annual Supply Chain Events and Their Impact

2.2 Order and Inventory Situation of Top Manufacturers

2.3 Key Manufacturers' Delivery Cycles and Trends

2.4 Annual Fluctuations in Products and Manufacturers

3 Semiconductor Supply Chain Combing in 2023

3.1 Foundry Capacity Differentiation, Advanced Process Price Increase

3.2 Fables/IDM Inventory Bottomed out and Rebounded, With Continuous Improvement in Memory Prices

3.3 The Distribution Industry Has High Inventory and a Noticeable Rebound in Revenue

3.4 Different Changes in Demand, Optimistic About AI and Automotive Growth

4 Trend Foresight in 2024

4.1 Semiconductor Sales Recovery with Medium to High Growth Rate

4.2 Consumer Recovery, Pay Attention to XR Development Trends

4.3 Increased Concentration in the Distribution Industry

4.4 Accelerated Integration in the Distribution Industry

Disclaimer

Prologue

1 Semiconductor Industry Overview in 2023

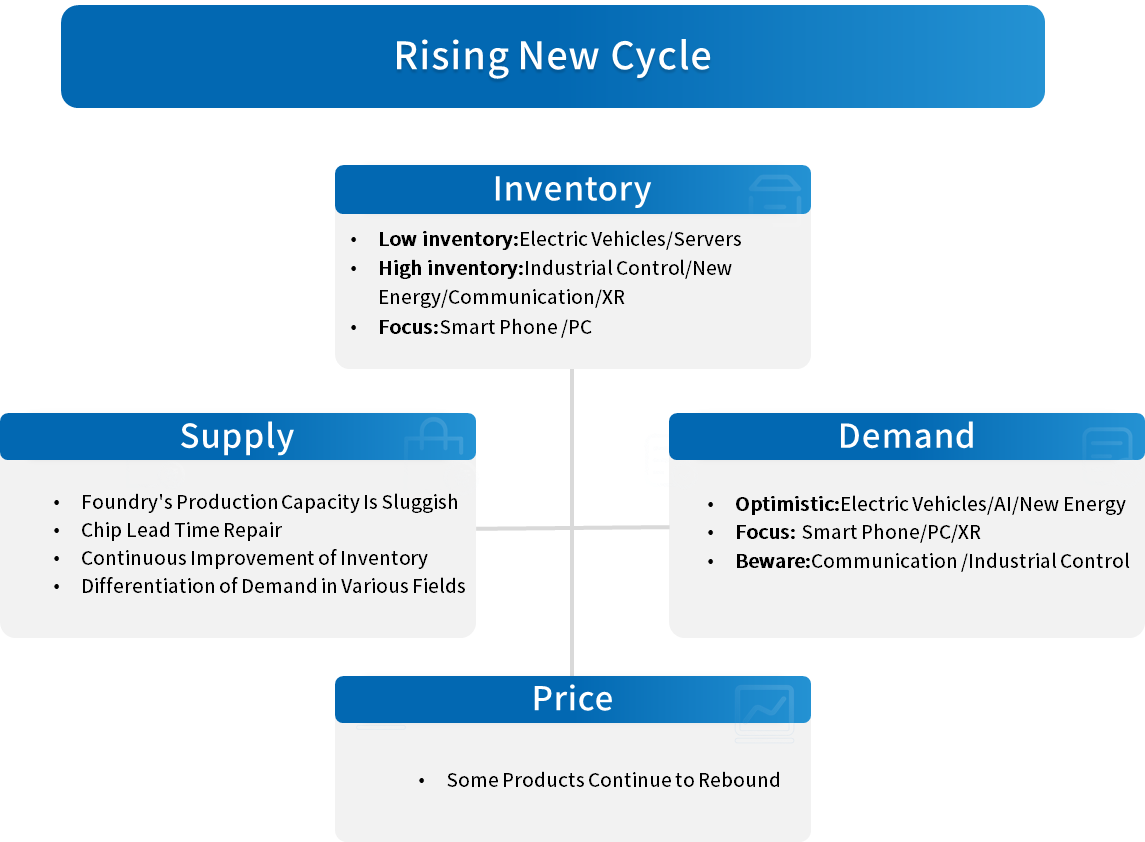

Looking back at 2023, issues such as weak macroeconomic performance, ongoing trade conflicts, and severe industrial fragmentation continue to persist. In the first half of the year, the global semiconductor industry was in a downward cycle. Since the second half of the year, with the mild recovery of terminal demand, the delivery times and prices of various types of chips have significantly repaired, downstream customers have resumed normal delivery rhythm, and the industry has gradually emerged from the bottom of the cycle. Currently, although there is still structural differentiation in the global semiconductor market, the overall market trend is improving in 2024 and is expected to return to an upward cycle.

1.1 Significant Improvement in Chip Delivery Cycle/Price

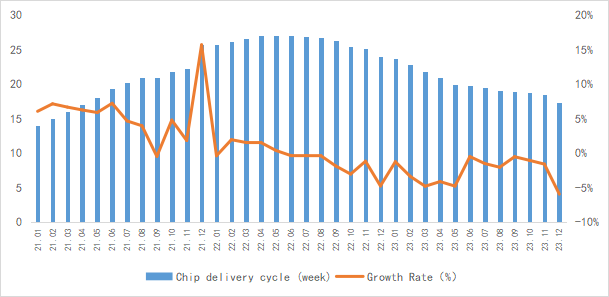

In 2023, global chip delivery times continue to decline, and the trend of chip inventory depletion is good. Chip Insights estimates that the current situation is basically at the bottom of this cycle. Overall, the industry's inventory adjustment cycle is nearing its end, and demand is becoming the key to future growth.

Chart 1: Chip Delivery Trends in 2023

Source: SFG, Chip Insights

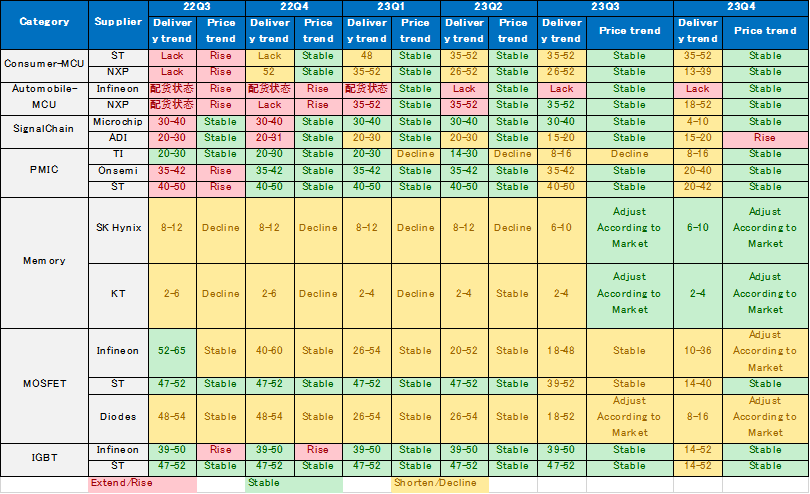

From the perspective of key chip suppliers, there has been a significant improvement in the delivery time and prices of various subcategories in 2023, but structural differentiation still exists. Among them, analog chips represented by TI and ADI have experienced significant declines and severe price inversion. The prices of DRAM chips such as Samsung Electronics and SK Hynix, as well as Memory chips such as NAND, continue to rise. Infineon, ST and other MOSFET/IGBT have significantly improved. The prices of consumer/industrial MCUs such as ST and NXP have entered a bottoming stage, and the market is stabilizing.

Chart 2: Review of Delivery Cycles and Prices of Major Manufacturers in 2023

Source: Future, Wind, Chip Insights

For more information, please refer to the attached report.